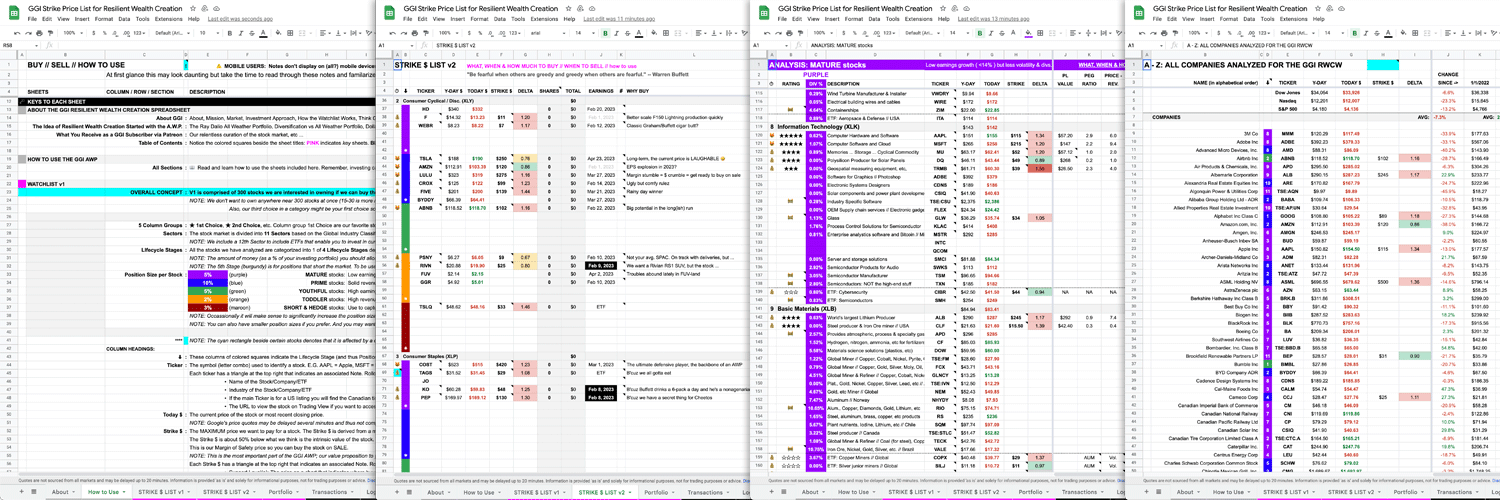

Do you want to know what, when and how much to buy and sell?

- What: Refer to the Strike Price List

- When: Refer to the Delta-to-Strike

- How Much: Refer to the Lifecycle Stages

(Don’t worry, this will easily make sense once you subscribe and see it in action.)

Subscribe to our Strike Price List (access via Patreon // starts at US$3.25 per month)

More info about Subscriber Benefits →

Strike Price List

Our Strike Price List contains up to 300 stocks (plus the odd bonus pick) and the strike (maximum) price we would pay for the stock. The list includes disruptive innovators to venerable stalwarts to ETFs for hedging, in all sectors of the stock market.

#StrikePriceList

More info about our Strike Price List →

Abide the Strike Price

We want to buy stocks on sale. Preferably at about a 50% discount from its intrinsic value. This reduces our downside risk and increases our upside potential. Warren Buffett referred to this as a Margin of Safety.

#AbideTheStrike

More info about Abiding the Strike Price →

Generate Resilient Wealth

💩 doth happen. If one is going to invest (a necessity for all who plan on living a long, full life), then resilience is crucial. Resilience requires being prepared for the black swan events that can crush a portfolio. On the flip side one doesn’t want to be in a low-growth-only portfolio when the bull charges.

#GenerateResilientWealth

More info about Generating Resilient Wealth →

Think Green … Investing

The Green Garage Investing goal is to make the GREEN for ourselves whilst we humans GREEN the world for our grandchildren and all:

🦋🧜♀️👽🤖🦄🌻👣

#ThinkGreenInvesting

More info about Think Green … Investing →

Why Subscribe & What You Get

Our mission 🚀 is to help retail investors buy great companies on sale (value vs price) and manage their portfolio (risk vs reward) to benefit from long-term investing in stocks. All in the galaxy are welcome. However, those with investment access to USA+CA stocks, busy with their career+family+passion, interest in a semi-DIY longer-term investing style, and creating a better future for all, will likely most enjoy our service.

#SubscriberBenefits

More info about Subscriber Benefits →

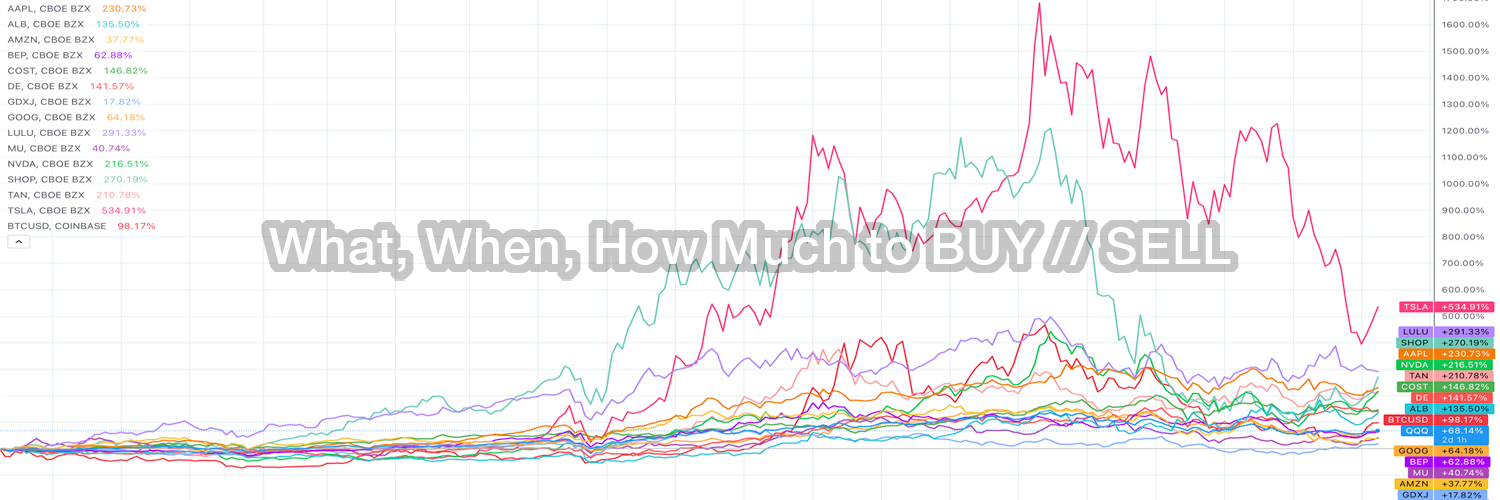

What, When, How Much to BUY // SELL

There is only one reason to buy a stock but many reasons to sell. Our Strike Price List categorizes stocks by sector and lifecycle. This enables diversification and portfolio allocation choice. We also rate stocks as 💰 (Take Some Profit When the Market Giveth) or 😻 (Love You Looooong Time) if they have 100+ Bagger potential. The Delta-to-Strike tells you when to buy and indicates when to sell. E.G. A stock 75% above Strike Price is nearing intrinsic value, thus taking some profit and awaiting a fresh opportunity could be prudent.

#PortfolioManagement

More info about What, When, How Much to BUY // SELL →

Fear & Greed

The stock market goes in cycles from there’s blood in the streets {FEAR} to irrational exuberance {GREED}. Every once in a while Efficient Market Hypothesis is correct and stocks trade at fair market value. When the market, industry or company experiences an event that causes fear then our Strike Prices light up green. FUD will be at its peak but if the stocks thesis is intact and the event is temporary (12 months or so) then this is the time to buy to maximize your CAGR. When your proverbial cab driver mentions an investment then greed is peaking.

#BuyLowSellHigh

More info about Fear & Greed →

HODL (aka patience)

Holding On for Dear Life may come from the Bitcoin community but it is also applicable in stock investing. Not to be conspiratorial, but Wall Street likes to take money from less savvy retail investors and have been known to create FUD to do so. (Tesla being a recent example: $300 in Sep 2022 to $100 in Jan 2023.) The antidote for that is patience; having a longer-term investment horizon (3+ years). 18 months seems to be about as far out as Wall Street is willing to look. Stock markets have a natural bias to go up. Ken Fisher taught us, “It’s not about timing the market, but about time in the market.”

#HODLtheRainforests (tweet reference)

Investing Can Be Daunting

Investing can be daunting. There are many thousands of stocks stocks to choose from and MUCH to know about this vast subject. We do the brunt of the curating the stock market work for you so you can focus on the quality stocks, forget the rest, and make your decisions accordingly. We take a 25,000 piece puzzle and turn it into a 500 piece puzzle.

#SolvingTheInvestingPuzzle

Team Green Garage

The garage door:

A * H – D = X // Chief Mechanic …

#TeamGreenGarage

Subscribe to our Strike Price List (access via Patreon // starts at US$3.25 per month)

More info about Subscriber Benefits →