Abide the Strike Price

We want to buy stocks on sale. Preferably at about a 50% discount from its intrinsic value. This reduces our downside risk and increases our upside potential. Warren Buffett referred to this as a Margin of Safety.

Intrinsic value is the true value of a business; essentially the sum of the parts. Taking advantage of the difference between price and value is the name of the game. “Market price and intrinsic value often follow very different paths – sometimes for extended periods – but eventually they meet.” — Warren Buffett

#AbideTheStrike

Strike Price List // Abide the Strike Price // Generate Resilient Wealth // Think Green … Investing // Subscriber Benefits →

We have an affinity for growth stocks and disruptive innovation but we also know that value investing is the backbone to a successful investing approach. There are many resources you could and should study, but the master of value investing, Warren Buffett, sums it up: “The three most important words in investing are Margin of Safety.” “Just buy something for less than it’s worth.” Our Strike Price’s increase the chance you are buying a stock for less that it’s worth. (Note: No matter how much due diligence we do, an investment thesis can change in a hurry.)

- Margin of Safety means to buy stocks on sale; preferably about 50% off from its intrinsic value, or what “it’s worth.”

- Finding the intrinsic value is equal parts art and math. (Valuing a factory is math, valuing brand moats, addressable markets, secular trends, etc., is more art.)

- We analyze the qualitative aspects of the stock and crunch some quantitative aspects and come up with a Strike Price.

- Buying below Strike Price provides you with a MoS and increases your chance of long-term success by decreasing downside risk and increasing upside potential.

Two more Buffett-isms:

- “For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.”

- “Be fearful when others are greedy and greedy when others are fearful.”

The better buy price you can get the higher your CAGR (compounded annual growth rate), and if you can give compounding time to work, the returns can become outstanding.

Compound interest is the phenomenon of earning interest on interest. See it in action here. The catch is in maximizing the percentage that does the compounding. 1-5% for savings and bonds, 8-12% entire stock indexes, or certain stocks can double or even quadruple that rate. E.G. Apple’s 10 year CAGR has been 24.5% and Tesla’s 53.2%. Even the tractor maker John Deere is at 16.5%.

Note – Feb 15, 2023: Apple had a whale of a run during the past 10 years what with the iPhone and all but now that everybody has one and the next great invention hasn’t arrived {yet}, that growth rate might slow and thus buying new shares should be done with a forward looking growth rate under consideration. #AbideTheStrike We hope Apple comes up with another killer device (AR glasses perhaps {not VR}), but we can’t invest in hopium, that would be speculating not investing.

Compounding

- $1000 at 10% in 10 years = $2,594

- $1000 at 10% in 20 years = $6,728

- $1000 at 20% in 10 years = $6,192

- $1000 at 20% in 20 years = $38,338

Why it is worth Abiding the Strike Price. CAGR in action.

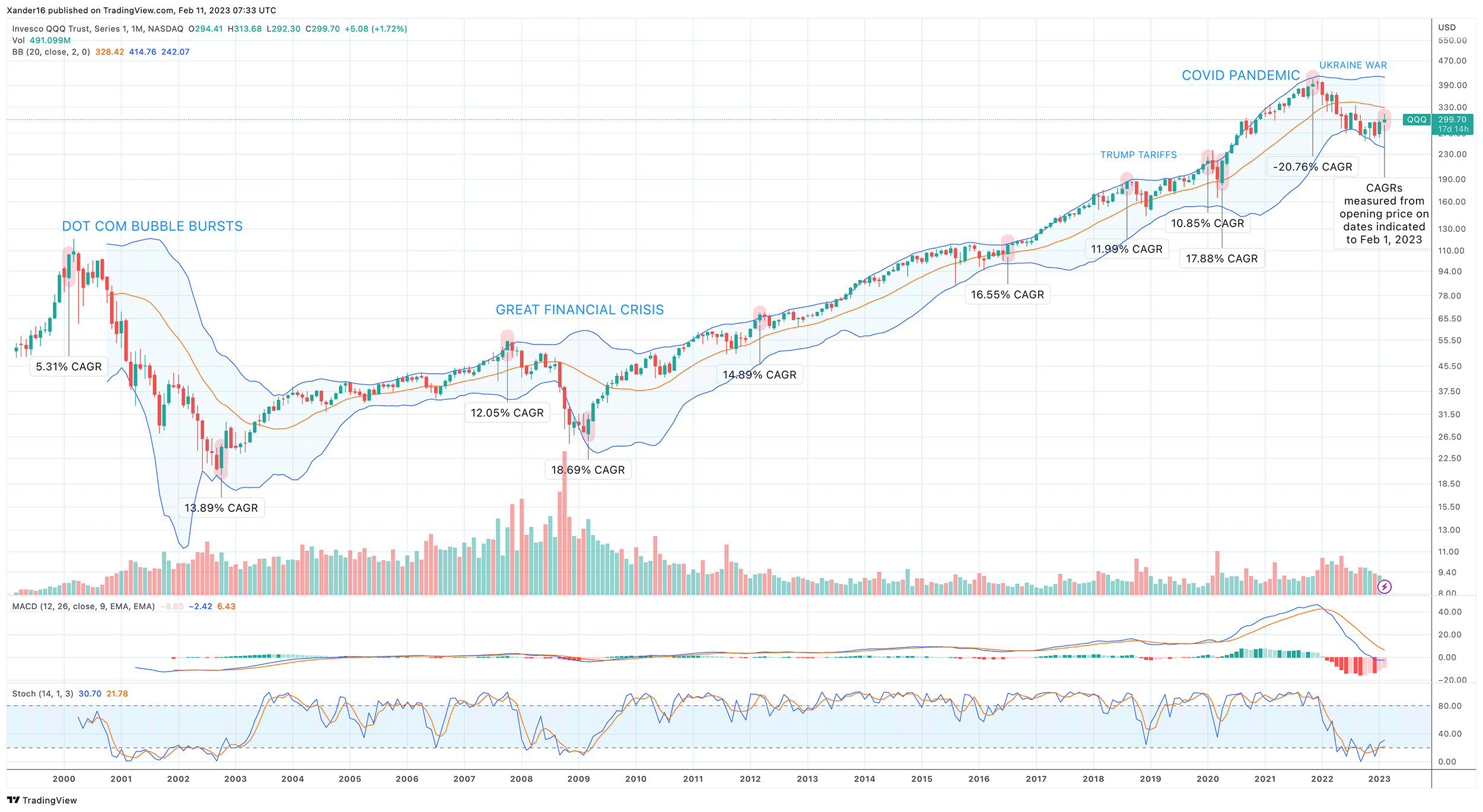

The QQQ is an ETF that tracks the Nasdaq. On Feb 1, 2023 it opened at $294.41:

- Feb 1, 2000 opening price of $89.53 = 5.31% CAGR ($1000 = $3,287 for a gain of 229% in 23 years)

- Oct 1, 2002 opening price of $20.91 = 13.89% CAGR ($1000 = $14,072 for a gain of 1307% in 20.33 years)

- Oct 1, 2007 opening price of $51.45 = 12.05% CAGR ($1000 = $5,721 for a gain of 472.% in 15.33 years)

- Mar 2, 2009 opening price of $27.12 = 18.69% CAGR ($1000 = $12,206 for a gain of 1121% in 13.92 years)

- Mar 1, 2012 opening price of $64.66 = 14.89% CAGR ($1000 = $4,553 for a gain of 355% in 10.92 years)

- Jul 1, 2016 opening price of $107.49 = 16.55% CAGR ($1000 = $2,739 for a gain of 174% in 6.58 years)

- Aug 1, 2018 opening price of $176.87 = 11.99% CAGR ($1000 = $1,665 for a gain of 66% in 4.5 years)

- Jan 2, 2020 opening price of $214.40 = 10.85% CAGR ($1000 = $1,373 for a gain of 37% in 3.08 years)

- Apr 1, 2020 opening price of $184.81 = 17.88% CAGR ($1000 = $1,593 for a gain of 59% in 2.83 years)

- Nov 1, 2021 opening price of $386.56 = -20.76% CAGR ($1000 = $762 for a loss of -24% in 1.17 years)

As a long term investor, patience, Abiding the Strike Price and maximizing your CAGR (and time) is the key to outstanding gains.

Key Takeaway

You don’t know when the event will occur that takes a stock down to Strike Price. Even though you identify a great business you still want to buy it on sale to maximize the CAGR. Abiding the Strike Price enables you to take advantage of events* that give you a great price to buy a great business.

* Events could be a company or industry event or macroeconomic. As long as the event doesn’t change your thesis on the business, then chaos = opportunity.

Subscribe to our Strike Price List (access via Patreon // starts at US$3.25 per month)

More info about Subscriber Benefits →