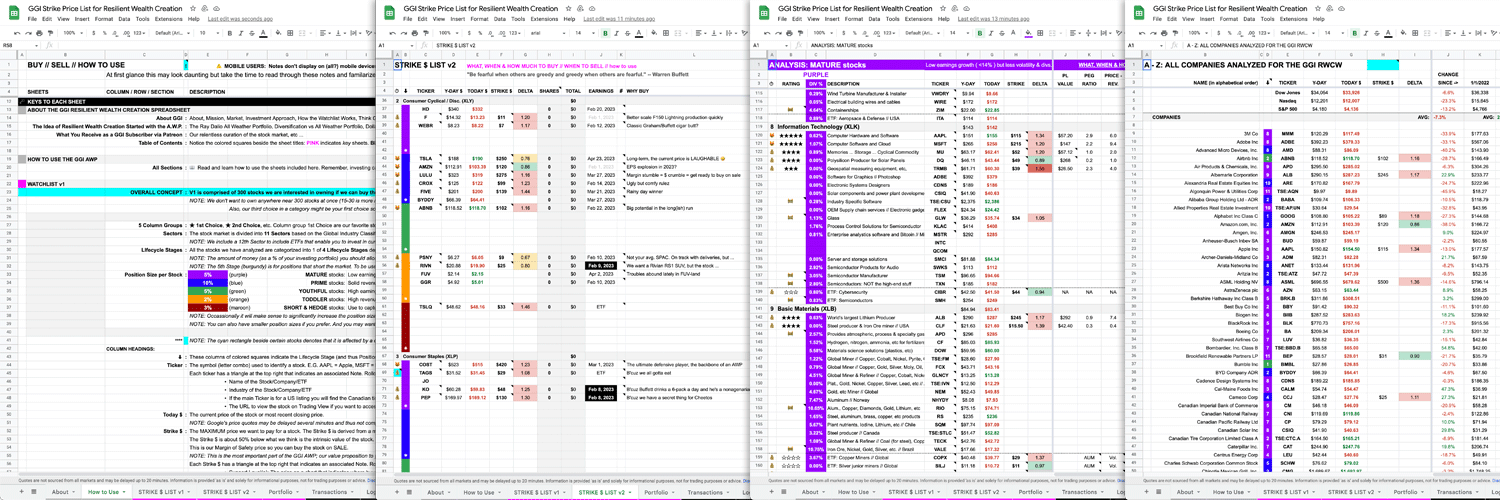

The Green Garage Investing Strike Price List

The Strike Price List contains up to 300 stocks (plus the odd bonus pick) and the strike (maximum) price we would pay for the stock. The list includes disruptive innovators to venerable stalwarts to ETFs for hedging, in all sectors of the stock market.

#StrikePriceList

Strike Price List // Abide the Strike Price // Generate Resilient Wealth // Think Green … Investing // Subscriber Benefits →

How the Strike Price List Works

- Subscribe at Patreon to be granted access to our Strike Price List.

- Our list of up to 300 stocks (plus the odd bonus pick) is divided into the 11 Sectors of the Stock Market plus 1 extra for ETFs of indices, bonds, currencies, resources, etc.

- Stocks are categorized into 4 Lifecycle Stages plus 1 for shorting (market going down). Each stage has a recommended portfolio allocation per stock: 6%, 10%, 4%, 2%, 3%.

- Each sector has up to 5 stocks that represent each of the 5 stages.

- Each stock has a Strike Price. This is the maximum price (or below) we would want to pay for the stock. Strike Price is a mix of art and science.

- You choose what to add to your portfolio and how much to invest per stock (at the trading platform of your choice) based on your personal goals, life situation and risk tolerance (gotta be able to sleep at night with what you own).

- You may want a lot of diversification across all sectors, more concentration, only dividenders, mostly disruptors or …

- You will likely want to own 15-30 stocks but that is up to the individual. Remember to #AbideTheStrike. There will often only be a selection of stocks that are at strike at any given time.

- We also include a fair amount of analysis and metrics (within this multi-page spreadsheet), for those interested in further investigation. (Also: Do Your Own Due Diligence)

- We frequently add news quotes and our comments to the stocks on the Strike Price List and post additions and updates to Patreon that get emailed to you.

How to Use the Strike Price List

Everything is defined and explained in the How to Use page. Look for the tabs at the bottom of the document. (The document is a Google Sheets spreadsheet.)

At first glance this may look daunting but take the time to read through the How To Use notes and familiarize yourself with the lingo and the user interface of the succeeding pages and it will all make sense. (Patreon subscribers can always ask questions and get help via the messaging system in the website or app.)

Remember, investing can be interesting, fun and lucrative!! 💰😀

Subscribe to our Strike Price List (access via Patreon // starts at US$3.25 per month)

More info about Subscriber Benefits →

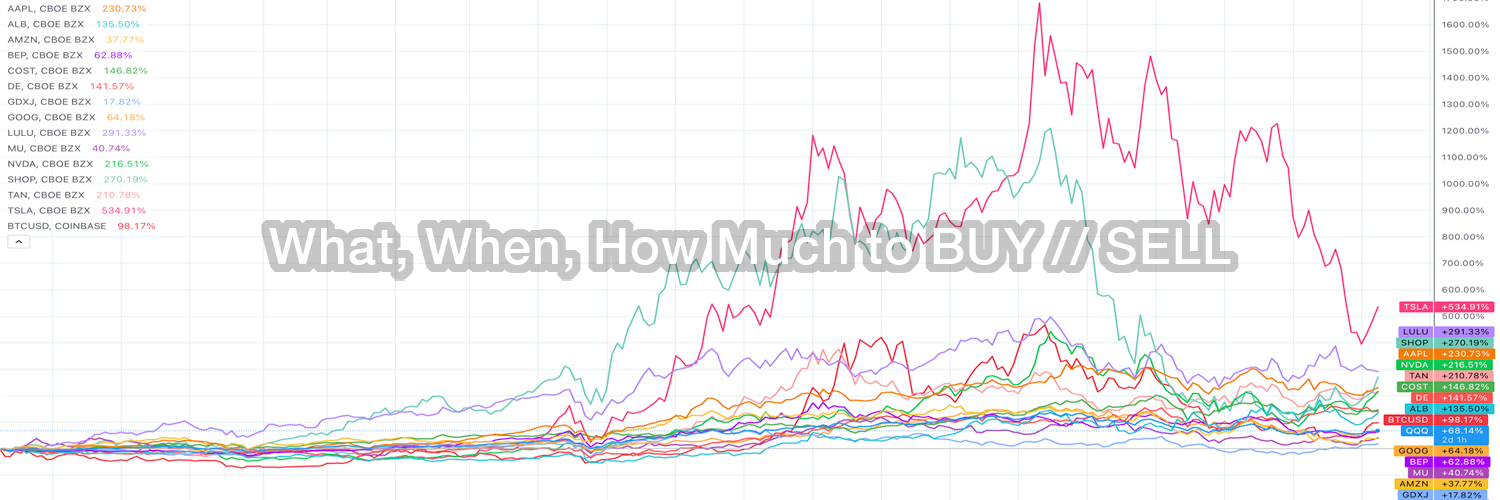

What, When, How Much to BUY // SELL

There is only one reason to buy a stock but many reasons to sell. Our Strike Price List categorizes stocks by sector and lifecycle. This enables diversification and portfolio allocation choice. We also rate stocks as 💰 (Take Some Profit When the Market Giveth) or 😻 (Love You Looooong Time) if they have 100+ Bagger potential. The Delta-to-Strike tells you when to buy and indicates when to sell. E.G. A stock 75% above Strike Price is nearing intrinsic value, thus taking some profit and awaiting a fresh opportunity could be prudent.

Simplifying stockpiling. Do you want to know what, when and how much to buy and sell?

- What: Refer to the Strike Price List

- When: Abide the Strike Price

- How Much: Refer to the Delta-to-Strike

#PortfolioManagement

In the Strike Price List you will find a column labelled Delta that indicates the amount a stock is above or below Strike Price: Delta-to-Strike. Amounts are color-coded:

- BLUE > 2X (double) above Strike Price = Take Profit Zone (unless it is a 😻 stock you and are going for a 100+ Bagger)

- RED > 1.5X above the Strike Price = Take Some Profit When the Market Giveth Zone (if it is a 💰 stock that you don’t want to hold for the long term)

- PINK > 1.05X above the Strike Price = Zone of Waiting to Buy or Take Profit

- GREY 1 – 1.05X of the Strike Price = Almost at Strike $ Zone

- GREEN 0.8 – 1X below the Strike Price = Buy Zone 🛍️

- YELLOW 0.5 – 0.8X below the Strike Price = Still a Buy Zone but also a Stop-Loss Zone: you may want to buy another tranche or two at these bargain prices or if you bought at Strike Price you may want to cut your losses (with a stop-loss order at your broker) to re-assess or wait for market sentiment to improve

- ORANGE < 0.5X below the Strike Price = Re-assess Zone: our Strike Price and thesis (reasons) for owning this stock … Is the company now a dud or is there a macroeconomic situation or temporary company/industry event causing the price to plummet?

There is only one reason to BUY a stock; you think it will go up in price.

What to Buy

The Strike Price List comprises the best stocks, to our current knowledge, in each Sector, based on Lifecycle Stages to indicate their level of risk vs reward potential. Generally only some will be below Strike Price at any given time. You can go off the board but we recommend choosing a selection of stocks from several of the Sectors. You can also choose any mix of Lifecycle Stages depending on your risk tolerance. Generally the older the less risk but potentially less growth. (Also with less exciting but more stable companies it is easier to sell them when an exciting opportunity comes along.)

When to Buy

The Delta to Strike Price ratio indicates a buying opportunity when it goes below 1.00. For mature companies, if they dip below 1.00 then generally it is go-time as they often don’t stay there for long. For mid-age companies, the price can be more volatile due to less Free Cash Flow and growth initiatives, so you may wait to see if they go down further to 0.80 or more. For young companies, depending on macro-market sentiment they can be valued at extremes so you may want to wait for them to go below 0.50 or wait for positive catalyst announcements before initiating a position.

How Much to Buy

The Lifecycle Stage provides a recommended portfolio allocation for each stock, of 6%, 10%, 4%, 2%, 3%. Each Sector could have 5-15%. Each Lifecycle Stage, all Sectors included, could have 24%, 40%, 16%, 8%, 12%. Generally you will want 15-30 companies in total. You may want to build a position over time by buying in tranches (slices). Your first tranche could be just below Strike Price and if it goes down another 20% and you are excited by that turn of events, then buy another tranche or three. These are all just recommendations; you can cater (what, when and how much) to your own risk tolerance, interests, goals, etc.

There are many reason to SELL a stock; you need the money, the valuation has hit your target, better opportunity elsewhere, the thesis has changed, macroeconomics, etc.

What to Sell

The Strike Price List rates stocks as Love You Looooong Time 😻 or Take Some Profit When the Market Giveth 💰. The former are upper echelon companies with huge secular tailwinds that need time to play out to become potential 100+ Baggers. Don’t time the market as time in the market is more important. Do you really want to stop the compounding and pay taxes before necessary? The latter have cyclicality issues or something that is likely to give you another chance to buy them at Strike Price in the foreseeable future whether there are macroeconomic issues or not. Companies that are at intrinsic value (approximately double Strike Price) are selling candidates. Sometimes the thesis for owning a stock changes and then it can be best to sell and cut losses if necessary. Or if your third choice in a sector hit the Strike Price before the first choice and you bought, but then your first choice hits Strike Price, then selling could be prudent.

When to Sell

The Delta to Strike Price indicates selling levels. If the ratio goes above 1.50 and the stock is a 💰then you might want to capture some of those gains. If the ratio goes to 2.00 (the intrinsic value of the stock) quite quickly then even if it is a 😻 you may want to capture some gains as you will likely be able to buy them again at a lower price, especially as the Strike Price would likely be raised. The younger the company the more likely you should Take Some Profit When the Market Giveth due to the volatility of the stock price. With more mature companies that are less volatile, you might consider not taking profits, especially if there are tax implications and if they pay dividends to offset a downturn. Even if the market dips they might not dip enough to give you another chance to buy at Strike Price. (E.G. Good luck getting Costco at Strike Price 🙁 You may also consider putting a Stop-Loss Order on your recent purchase, especially with younger companies. (15-20% below Strike Price or your buy price.) You might have been excited to see a disruptor go below Strike Price but if its earnings are negative and market sentiment is bearish then it could fall much further before finding a floor and resuming an uptrend.

How Much to Sell

You can sell in tranches as well as buy. E.G. If you bought 100 shares at $10 and they went to $15 and you sold 67 shares the cost basis for your remaining 33 shares would be $0. If those 100 shares doubled, you could sell only half to get to a $0 cost basis. There is never anything wrong with capturing your gains, especially if the company is near intrinsic value (double the Strike Price) and does not warrant a significant increase in Strike Price. However, if you have bought a high quality company at a great price then remember the words of Charlie Munger: “The first rule of compounding: Never interrupt it unnecessarily.” And, “The big money is not in buying or selling, but in waiting.” E.G. Over the past 10 years Apple has grown at 24.5%. $1000 would have become $8950. In another 10 years from now, that $1000 at that growth rate would turn into $80,000.

Strike Price List // Abide the Strike Price // Generate Resilient Wealth // Think Green … Investing // Subscriber Benefits →

Caveat Emptor

- There are no guarantees a stock price will increase even if you buy on sale at our Strike Price. Buying on sale is intended to minimize your downside risk (esp. longer term) and increase your upside potential when market sentiment returns to your favor.

- Remember that stocks in the earlier lifecycle stages are more volatile and more difficult to assign a Strike Price. With that risk comes greater reward potential especially with patience and given the business maintains its quality (especially its management’s integrity) while in a down phase.

- Some people like to set a stop-loss to sell if the stock goes down, others try to zoom out and focus on the big picture knowing that a quality company will eventually be rewarded when its earnings catch up to its revenues.

- Do Your Own Due Diligence

Subscribe to our Strike Price List (access via Patreon // starts at US$3.25 per month)

More info about Subscriber Benefits →