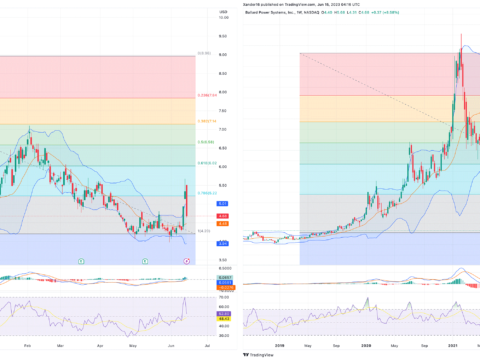

Avi Gilburt, The Market Pinball Wizard and black magic guru of Elliot Wave Theory expects the S&P500 to get to about 4250. It is starting the year at about 3750. This would be about a 13% gain. The average S&P gain for the past 40 years is about 8% so don’t go to cash yet, hang on through the volatility, take profits when you must and enjoy the ride as Avi is “rather bullish for 2021.”

So, as we look towards 2021, I sincerely hope many have profited from our work, and have learned valuable lessons about yourselves and the market in the process.

For those that read my public articles, you would already know that my initial target for 2021 is the 4200/4300SPX region. And, the manner in which we get there will tell me if we will see a direct continuation to 4600SPX or if we see a larger pullback before we continue on to 4600+.

So, to put it quite simply, I am rather bullish for 2021 as long as we retain the current market structure as I see it right now. Ultimately, this same larger market structure seems to be pointing up towards the 5500SPX region as we look towards 2022, and potentially up towards the 6000 region by 2023 before the bull market off the 2009 lows comes to an end.

Source: https://seekingalpha.com/…

One of Avi’s crucial investing points is that market sentiment not news drives the direction of the market. It’s a bit counter-intuitive for most of us, but we recommend that you keep it in mind when investing. Avi has a rather good investing track record and some would say a strangely top spot on Seeking Alpha.

I am simply noting that there is a much stronger overriding factor, and that is market sentiment. When market sentiment is bullish, it imposes a bullish spin to any news, whether that news is bearish or bullish. And, when market sentiment is bearish, it imposes a bearish spin to any news, whether that news is bearish or bullish. So, again, understanding the underlying market sentiment perspective is the key to understanding market direction no matter what the news or event.