Projected to operate the largest graphite operation in the western world with best-in-class EBITDA margin per ton.

- Strike Price: $2.25 USD or $2.85 CDN

- Projected Price: $22 USD or $28 CDN

- Hold Time: 5 Years

- Risk Assessment: 7 out of 10

- Gain/Risk to Strike Price Ratio: 3.62 (we prefer over 3)

- Gain/Risk to Current Price Ratio: 5.73 (confers an excellent opportunity)

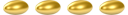

- Golden Egg Rating (out of 5):

- Portfolio Category: 🧨 🎲

- Catalyst: Full commercial production for Nouveau Monde, of anode quality graphite, starts in 2023. Global battery grade graphite demand to increase at a monstrous CAGR over the next decade with a supply shortage starting in 2023.

The Bottom Line

Yes, we’ve both started a position.

As this is a pre-revenue company it should be considered speculative, so we will limit our position to 1-2% of our portfolios.

We’ve rated the risk of Nouveau Monde at 7 out of 10 which is high but not too high for a speculative stock. This is because Nouveau Monde’s balance sheet appears solid and they have multiple attractive elements to their business. Considering the gain vs risk balance, we consider Nouveau Monde to be 4 golden eggs which you should strongly consider putting in your basket. We feel comfortable buying at the current price and up to $2.25 USD or $2.85 CDN.

More Info