Ehang, Chinese makers of autonomous aerial vehicles for urban transportation, today were hit by a short report from the charming Dan David of Wolfpack Research who claims to be a “Freedom of Speech activist in the global financial markets“, and thus is a short-biased activist researcher. I guess being a vocal proponent of free speech entitles one to print seemingly fake news bs. Happy reading and/or watching.

For some perspective you might also want to read the positive and neutral articles about Ehang on Seeking Alpha, go to the company website, read their white paper about Urban Air Mobility Systems, or watch what some YouTubers have to say about EHang.

We recommend that you look into GGV Capital the venture capital firm that helped launch EHang. We doubt they would be investing in EHang if it was a bs company

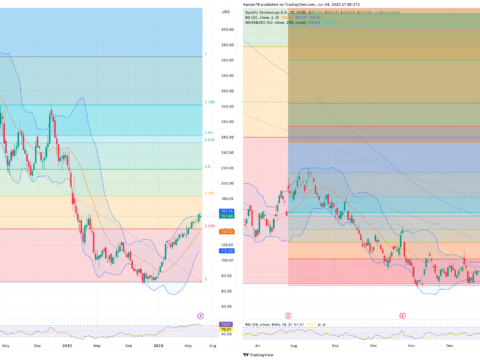

The EH stock price went from ~$20 in mid-December when we first analyzed the company and bought into it. Within a couple months it hit $120+ so it was an obvious target for a short attack. We didn’t expect to again be able to buy EH anywhere near our strike price of $42.50 without a major market correction, but thanks to the Wolfpack it looks like we will have a chance. But judging by the after-hours run up to $55, institutions might have already skimmed all the cream off the top of this deal. Will see what happens pre-market.

We haven’t yet posted our research about this company, but we did give it a 35% growth rate and a 🐛🐛🐛🐛1/2 rating. Strike price of $42.50.

Key Insight: Well-designed AAV (people-moving drone). Developing the first UAM (urban air mobility) network. UAM is more like buses than taxis. The taxi network comes later.

Management: CEO founder is a big engineer nerd with a passion for flying, education in computer science and work experience in communications-and-dispatch in Beijing. Jenny Lee of GGV Capital (see NIU) is a v.c. funder and on the board.

Analysis Summary: Ramping up production to 600 EH216 by 2022. Will need more capacity after that. Gross margin already at 59% and expected to increase as battery costs reduce. The key though is UAM and the command and control centre to make it a ride-hailing bus network. And because it is battery powered it is green and it will reduce ground transportation congestion. Expected travel cost of US$2.50 per Km according to their 2020 white paper. We like the design of their drones compared to the relevant competitors we could find. Appears to have redundant safety built in.