You may have noticed value stocks, represented by The Dow, especially in the energy and finance sectors, burning up the charts (as best they can) in the past couple weeks as Wall St took its revenge on tech and growth stocks. Our portfolios took a beating but we held on because as long-term investors that’s what you should do (mostly) to get the big returns. And we feel this bull market, starting in 2009 isn’t over yet. The S&P has a ways to go yet. 33% higher, perhaps. But the crushing will happen at some point before we are finished with The Fourth Turning.

We love how Cathie Wood framed the recent rise of value stocks and fall of growth stocks. Basically she said, it’s great they get to share in the market going up, it bodes well for the entire market, but good luck to those investing in value (esp. energy and finance), because they are doing more investing in share buybacks than investing in R&D and future technologies and thus they are going to be disrupted this decade.

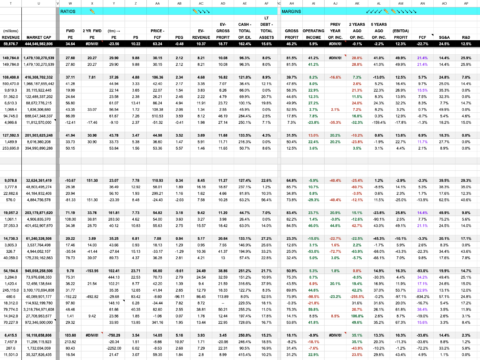

Or, this:

Or for a different take, try this article by Victor Dergunov:

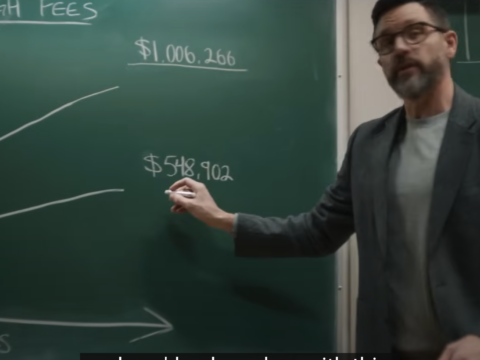

Some people may be saying, “but what if this is only the beginning?” To address this concern let’s examine why this correction occurred in the first place. Several primary reasons for the recent selloff include rising rates, frothy valuations in some sectors, an end to earnings season, passing of fiscal stimulus, and some good old profit taking. These appear to be transitory factors, and there doesn’t appear to be anything systemic threatening markets.