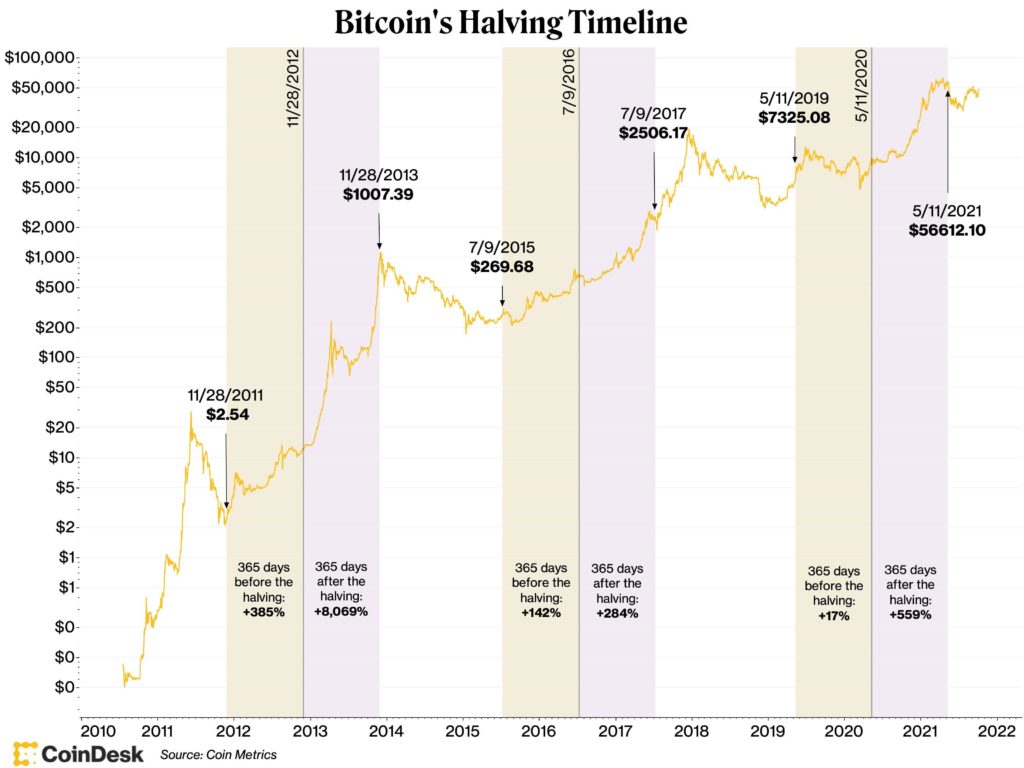

However, as an investor, it might be an idea to get in on this merge. According to RiskHedge Report:

When Ethereum gets its big upgrade, its daily supply will fall by 90%. That’s equivalent to squeezing three bitcoin halvings–which happened over 12 years–into a single day.

If one bitcoin halving produces 4X+ gains… what will a Triple Halving do for ETH’s price?

Below is the ETH-USD chart on Aug 21, 2022. Looks to me like the handle is forming for the teacup. This is “generally interpreted as a bullish signal by traders,” according to Investopedia. Also notice that the cyan coloured line, the 50 day moving average, is heading up to hopefully cross the purple 200 day moving average line. That also generally indicates significant price appreciation.

If ya’ll think it is go time for ETH and you can pick some up at your local/preferred crypto exchange or in Canada you can also buy the ETF ETHX.B ($CAD) or ETHX.U ($USD) in your TFSA; not having to pay tax on the potential gain of this Triple Halving could offset the ETF expense ratio nicely 🙂

ETH Train image credit: https://twitter.com/sassal0x/status/1364207094614749184