Why Patience Matters

“The first rule of compounding: Never interrupt it unnecessarily.” – Charlie Munger (Warren Buffett’s investing partner)

Over the short term the stock market is a voting machine but over the long term it is a weighing machine. If you own quality companies with a moat (durable competitive advantage: E.G. brand, pricing, switching, toll, secrets, network) that are profitable and growing revenues, earnings and free cash flow, eventually the market will return to a bullish phase and reward your investment. As they say, “it’s not about timing the market, but about time in the market.”

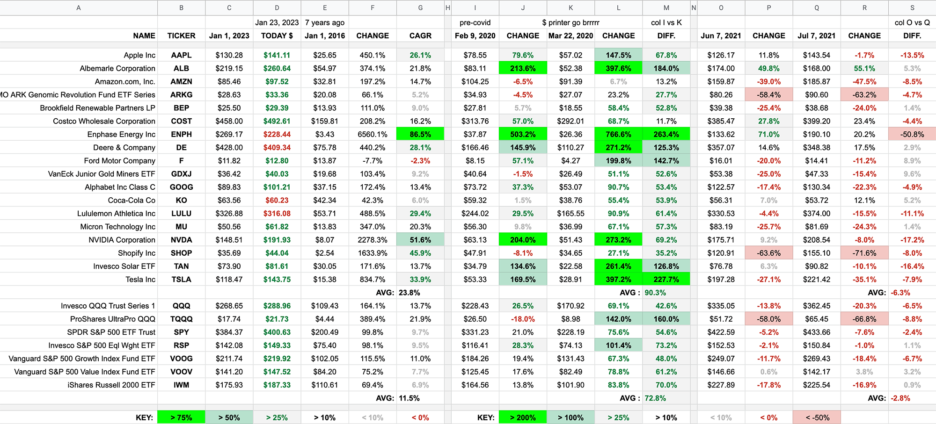

In Column G is the CAGR (compound annual growth rate) of the stock since the beginning of 2016 to the end of 2022. Some of the numbers are exceptional. You expect Tesla and Nvidia to be up there, but Deere ($DE) the maker of tractors, to be ahead of Amazon, Google and 2x the Nasdaq index ($QQQ) during this time period; that is a company with a strong moat. The company you would have wanted to avoid was Ford as they have debt, tight margins and a lot of competition and thus not a strong moat.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

Why Strike $ Matters

“The three most important words in investing are Margin of Safety.” “Just buy something for less than it’s worth.” — Warren Buffett

Our version of MoS is Abide the Strike $. We want to buy stocks on sale to minimize our downside risk and maximize our potential upside reward. Our Strike $ is based on a mix of art and science and is approximately 50% of what we think is the intrinsic value of the stock.

Patience is all fine and dandy but we want to buy quality at a discount and sleep comfortably with our investments as the Strike $ provides risk management so we don’t buy at the top of market cycles.

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.” – Warren Buffett

The chart doesn’t include our Strike $s but it does showcase how waiting for opportunistic prices minimizes your risk and increases your reward. Column M shows the difference of your returns from buying pre-Covid (Column I) to waiting for the market to be beaten down (Column K).

Covid is perhaps an extreme example as it was a black swan event but if you look at Column P and Column R, two random days in 2021 you will find your results could be quite different depending on the price you paid. E.G. if you had bought $AAPL on June 7th you would be up 11.8% but if you had bought on July 7th you would be down 1.7%. Or $NVDA, up 9.2% vs down 8%.

Also interesting is that $GOOG since 2016 has about the same CAGR as the Nasdaq $QQQ: 13.4% vs 13.7%. Still a decent return but Google likely hasn’t hit Strike $ very often during that time frame. But if you bought near the Covid low in March 2020 you could have doubled your money in 14 months and then sold some and had a low cost basis for the long term investment.

Dollar-Cost Averaging is fine but with a bit more effort utilizing our Strike $ system you increase your chance of significantly improving your results whether you are buying low volatility stalwarts for dividends or high volatility disruptors for growth.

“Be fearful when others are greedy and greedy when others are fearful.” — Warren Buffett

#AbideTheStrike$

This is what ChatGPT says about why patience matters in investing:

“Patience matters in investing because it allows an investor to ride out short-term market fluctuations and not make impulsive decisions based on fear or greed. It also allows an investor to take a long-term perspective and focus on their investment goals, rather than trying to time the market. Additionally, patience can help an investor avoid costly mistakes, such as buying high and selling low.”

When asked about why strike price matters it discussed options contracts which is a separate issue. However, our Strike $ can be used for selling puts and calls if one is so inclined.