// This article is more about preserving wealth vs generating wealth than an analysis of TD as a specific investment. TD is more a proxy for wealth preservation investments.

Note: All prices in US$

TD // Purple 5 // Strike Price = $40

- 10 year CAGR = 4.7% (historical stock results Apr 19, 2013 to Apr 19, 2023)

- Future Growth Rate Estimate: 5% (based on our analysis of past financial results, qualitative research, and analyst estimates of future revenue and earnings)

- 5 year Price Target = $82

// WHY BUY

We don’t want to spend a lot of time analysing the investment thesis of TD. However, bank stocks, especially TD, seem to be a very popular investment for many retail investors so we would like to provide our perspective.

Note: We usually block our Strike Price but this time we are publishing it. Perhaps it will help show what we mean by ‘buying on sale’ when it comes to the other stocks on our Strike Price List. {subscribe}

TD’s growth by entering the US market appears to be a favourable strategy as opposed to BNS which has chosen to grow into Latin America. TD has a fair amount of short interest at the moment: 2.3% We think it is due to exposure to Charles Schwab and the US banking system which had a bit of an issue and may well have more yet, if interest rates continue to rise, etc.

Canadian banks are generally regarded as very safe, but before you invest in a bank make sure you understand its balance sheet, financial statements and the integrity of its management.

Note: We have not done our due diligence on all those factors for TD.

TD’s dividend CAGR for the past 10 years is 5.4%: $1.55 in 2013 to $2.61 in 2022.

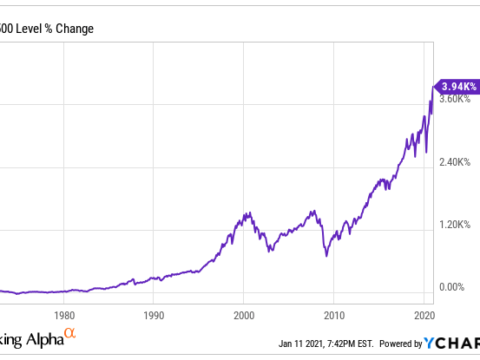

Presuming that 5.4% continues and the stock price continues to grow at 5% (the 10 year stock price CAGR is 4.7%) then the overall 10 year CAGR of a TD investment is 10.4%. Funny how this is the exact average annual return of the S&P 500 over the past 50 years. $1000 invested becomes $2690 at a 10.4% CAGR.

Note: We are ignoring the tax implications to keep it simple. Dividends are generally taxed at your marginal income tax rate unless in a tax free account and in your home currency. Discuss with your accountant. This is not our purview.

- $1000 at 10.4% in 10 years = $2,690

- $1000 at 10.4% in 20 years = $7,234

Note: This also ignores inflation which is devaluing your investment at 2% per year or perhaps 5% or more depending on macroeconomic factors, your location, etc.

If you are in preserving your wealth mode, 10.4% is respectable. However, we still highly recommend you buy index funds or dividend paying stocks like TD when they are at lower points in their valuation in order to maximize your returns. To do this requires a little extra knowledge, patience and effort, but can be worth it. If you score TD during a dip and can add 2% to your CAGR, your results are:

- $1000 at 12.4% in 10 years = $3,219

- $1000 at 12.4% in 20 years = $10,359

Note: We try to provide that extra knowledge and effort for our subscribers so they can simply use our Strike Price and carry on with their busy lives. Access to our Strike Price List starts at only CA$5 per month. { < 🍺 }

If you are in generating your wealth mode, 10.4% is inadequate. We want to outperform the market.

- $1000 at 15% in 10 years = $4,046

- $1000 at 15% in 20 years = $16,367

- $1000 at 20% in 10 years = $6,192

- $1000 at 20% in 20 years = $38,338

Over 20 years that can make a large difference in the amount of wealth you generate.

Here are some examples of well-known companies that have bested that 15% CAGR threshold over the past 10 years (dividends not included):

- Amazon – AMZN: 10 year CAGR = 23.1% x $1000 = $7,991

- Apple – AAPL: 10 year CAGR = 28.2% x $1000 = $11,992

- Costco – COST: 10 year CAGR = 16.9% x $1000 = $4,766

- John Deere – DE: 10 year CAGR = 16.8% x $1000 = $4,725

- MasterCard – MA: 10 year CAGR = 21.7% x $1000 = $7,127

- Microsoft – MSFT: 10 year CAGR = 25.5% x $1000 = $9,693

- Nvidia – NVDA: 10 year CAGR = 56.6% x $1000 = $88,699 🤣

- Steel Dynamics – STLD: 10 year CAGR = 22.1% x $1000 = $7,365

- Tesla – TSLA: 10 year CAGR = 49.7% x $1000 = $56,522

- TD Bank – TD: 10 year CAGR = 4.7% x $1000 = $1,583 😢

- Trex – TREX: 10 year CAGR = 24.7% x $1000 = $9,092

Tesla may have been a risky bet 10 years ago, but the other nine companies were middle to low risk. Our goal is to invest in the companies+stocks that will be market outperformers. Subscribe if you want to come along for the ride.

// ChatGPT: WHY BUY

TD Bank is one of the largest banks in Canada and has a strong presence in the United States. It has a reputation for being a well-managed and financially stable institution, which can be attractive to investors. Additionally, TD Bank has a history of paying dividends to shareholders, which may be appealing to those seeking income from their investments.

// CONCLUSION

If you are looking for wealth preservation, a bank like TD may suffice. We would rather pay under $40 for it (currently $62). This provides a Margin of Safety in case our thesis is incorrect. Speaking of the thesis, we do not have one for TD, our qualitative research is incomplete.

One thing we noticed doing our quantitative research was that TD’s FCF is a mess. Free cash flow is generally the backbone of the valuation of mature companies and thus of investing in them. … Just did a quick comparison of 3 US and 3 CDN banks. Generally over the past decade, US banks have positive FCF and Canadian banks have negative FCF. Not sure why, but if you want to invest in a bank you should know why. JPM stands out as the best in this metric. Will try to do an analysis on them shortly.

2022 FCF:

- BAC -$0.78

- JPM $36.12

- SCHW $0.31

- CM -$42.99

- RY – $46.72

- TD – $27.68

As for preservation vs generation of wealth, please refer to the Why Buy section above.

We prefer quality companies with secular tailwinds and market outperforming growth rates. Dividends tend to imply that management doesn’t know what else to do with the profits they are generating so they return them to the shareholders. That money is then taxed twice (company & shareholder) instead of being put towards growing the business and its ROIC. But, the reliable dividend income is nice if you are in wealth preservation mode. If you want to generate wealth you need to look to outperform the market. {subscribe}

// CATALYSTS

TBD

// RISKS

Balance sheet management. Management in general. Macro economic storms.

// NEWS & COMMENTS

Apr 6, 2023

SA // hold: Investors Smell Blood In The Water

Overall, I believe that TD Bank’s stock can see significant price deterioration in the following months. Investors have accumulated the largest short position in any bank since this banking crisis started, totaling $3.7 billion. Additionally, the problems surrounding regional banks today, coupled with a tight CET1 ratio once acquiring First Horizon’s assets, make the deal unappetizing for investors. Furthermore, rising interest rates continue to hurt the adjustable-rate mortgage environment in Canada, where TD is the second-largest lender. Lastly, TD Bank maintains a 10% interest in SCHW, which according to their latest SEC filing has $28 billion in unrealized losses as a result from increasing interest rates on their bond portfolio.

// GGI 💬

We may yet get our Strike Price … 😚🎵

Mar 9, 2023

SA // strong buy: Scotiabank And Toronto-Dominion: One Offers Buffett-Like Return Potential

TD’s long-term growth guidance is 7% to 10% EPS growth. And unlike BNS, they deliver.

// GGI 💬

The CAGR of the EPS for the past 10 years is 7.72% ($3.31 – $6.96). Analyst expectations for EPS growth is 6.2% in 2023, 9.5% in 2024 and -10.75% in 2025. The average is 1.65%. Perhaps they can achieve the lower end of their own guidance but the upper end is likely wishful thinking.