Investment funds run by some college students are taking on an extraordinary challenge: Picking stocks for the next 25 years and then never trading them

https://www.wsj.com/articles/picking-a-stock-for-the-year-2048-66d90e

// Article Highlights

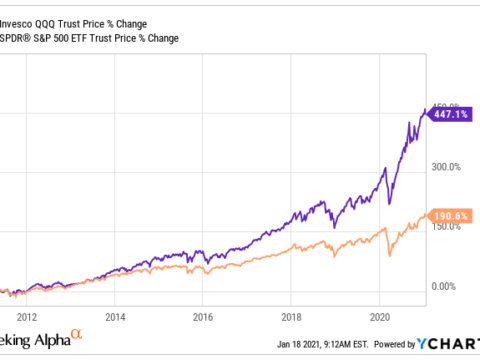

“One lesson from these new clubs is old: the astonishing power of letting your winners run for as long as possible. You can’t lose more than 100% on even your biggest losers (unless you bought them with borrowed money), but the potential gains on your biggest winners are boundless.

From the beginning of 1993 through this Feb. 28, for instance, 58 stocks gained more than 10,000% apiece, according to the Center for Research in Security Prices. Ten returned more than 25,000%.

These “superstocks” include now-familiar giants Apple Inc., Qualcomm Inc. and Monster Beverage Corp.—but also such minnows as air-conditioning firm AAONInc., tobacco-and-real-estate holding company Vector Group Ltd. and kitchen-equipment maker Middleby Corp.”

// GGI 💬

Love this idea. Unless you have the fast-twitch muscles and steely temperament of a day trader or the machine of Wall St at your beckon call, you are better off with a long term, maximize your CAGR mentality.

Imagining what the world will be like in 5 years and which companies will be thriving is doable. 10 years out and it starts to get quite fuzzy. Good luck with 25 unless you’re Nostradamus.

Let’s say you can’t pick an ETF, an index fund, bonds or just buy the whole market, it has to be companies. You need some diversity because you will have some failures. 15 – 25 seems about right.

But which ones?

This will require more thought and research. There are a bunch of companies that we have yet to do our due diligence on, but here’s our list on the spot today, in alphabetical order:

- AAPL – Apple: computing hardware and associated services

- ABNB – Airbnb: travel, always a fan fave

- AMZN – Amazon: shopping, delivery, cloud+AI compute

- ASML – ASML: they make the machine that makes the machines

- BYDDY – BYD: mass market EVs globally, the new Corolla or Civic

- COST – Costco: where else can you go for chicken and leave with a kayak

- DE – John Deere: food is good

- DM – Desktop Metals: 3D printing, aka, additive manufacturing, will work

- DNA – Ginkgo Bioworks: genetic engineering, precision fermentation

- ENPH – Enphase: brains behind solar+storage and new energy systems

- GOOG – Alphabet: AI, search and YouTube

- GVA – Granite Construction: infrastructure

- LICY – Li-Cycle: battery recycler and thus a miner and refiner

- MSFT – Microsoft: like an elephant, too damn big to push out the door

- NVDA – Nvidia: we need chips, chips and more chips

- PLTR – Palantir: enterprise software, AI

- RIVN – Rivian: people like trucks

- SOFI – SoFi: banking services are primed for disruption

- STLD – Steel Dynamics: can’t make much without metals

- TSLA – Tesla: EVs, AI+robotaxis, humanoid robots, energy storage systems

- WY – Weyerhaeuser: forests are awesome