// TL;DR

Buy for the dividend and because you like Texas oil+gas, not for the growth rate. Management hell bent on dividends over the health of the overall business is odoriferous.

// WHY BUY

We clicked on a link in an email from Seeking Alpha with the title “Energy Transfer Will Reward Only The Most Patient Of Investors” thinking it was about how the transition to renewable energy would take a while, so be patient as an investor.

Apparently there is an oil+gas company in Texas that goes by the name Energy Transfer, that owns about 31,500 miles of pipelines and 5 natural gas storage facilities and offers other industry-related services, which gives them a market cap of about $40B.

Apparently they have also gotten a lot of love on Seeking Alpha lately with 7 articles by 6 different authors all giving a Buy rating in the past month.

We have not read any of those articles, or anything else about the company, but here are some of the numbers:

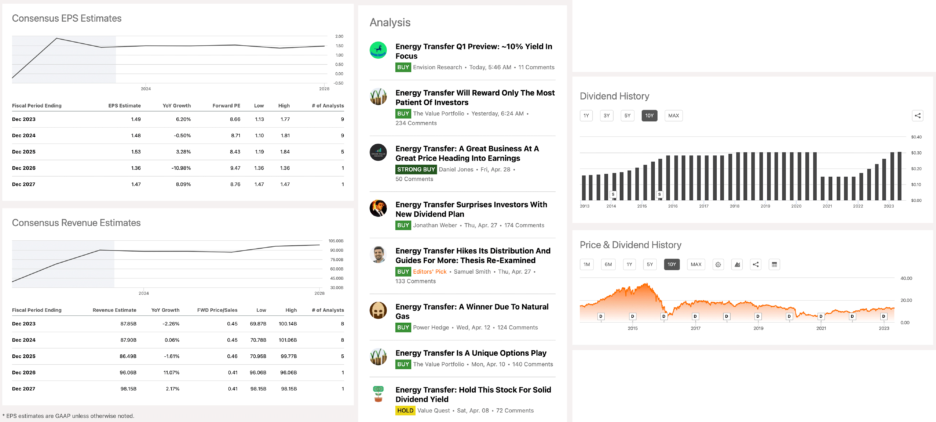

- PE (fwd) is 8.66 which is almost exactly inline with the sector median of 8.65.

- Price/Sales (ttm) is 0.44 which is -65.88% below the sector median of 1.16 but is on target for their 5 year average of 0.45.

- From 4 years and further back the Free Cash Flow per share was negative and turned positive 4 years ago so that has yet to move the needle on their Price/Sales ratio.

- Their Long Term Debt has grown at a 10 year CAGR of 7.9%, $22.6B to $48.3B.

- Their Cash & Equivalents has grown at a 10 year CAGR of -7.97%, $590M to $257M.

- Their Cash Flow from Operations to Total Debt Issued ratio of 0.32 ($9.1B / $28.9B) implies that it will take 3.125 years to pay off the debt.

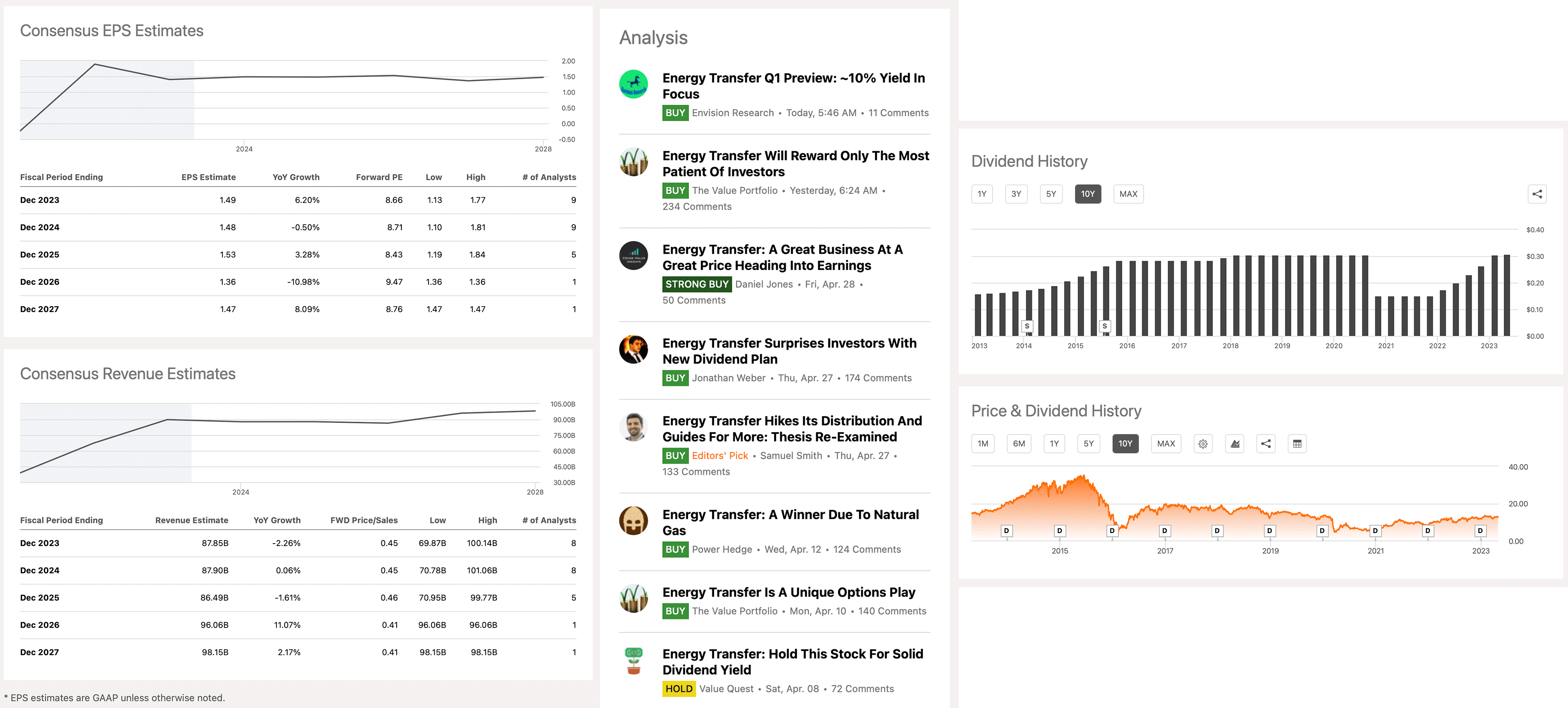

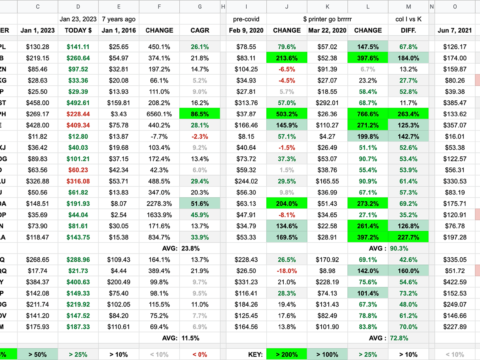

- The 10 year CAGR on their stock price is -1.3% ($12.91 today vs $14.71 on May 1, 2013).

- Analyst estimates for EPS growth over the next 5 years is 1.42%.

- Analyst estimates for Revenue growth over the next 5 years is 1.89%.

- We would say that at best you can expect the stock to grow at 2% a year.

- The one thing the company does have going for it a Dividend Yield of 9.55%.

However, judging by the dividend history in the chart below, they’re at peak dividend. It could go up but it could just as easily go down. That is basically a gamble on the future price of oil+gas. There could be some price spikes or supply issues but the secular trend on demand is downwards.

According to our Strike Price calculation we would want to buy this for a maximum of $13 and as luck would have it that is very close to where the stock price is sitting today.

Keep in mind that this stock basically keeps up with the S&P 500 thanks to its dividend but if the tax peeps take 25% you’re now that much behind the benchmark.

Other than the above, we know nothing about the company. We don’t recommend it because we prefer to support the development of other types of energy and invest to outperform the market, but if this is your kind of thing, fill y’er boots … up to 9.55% anyways.

- Mind the tax implications of collecting a US dividend.

- Due some further due diligence because we didn’t.

- Invest accordingly.

- Abide the Strike Price.

* Normally we don’t give away our Strike Price but this one is an exception to the rule and is sort of tongue-n-cheek promotional, didn’t take days, and is also sort of a study on why it is that people recommend these kinds of high dividend paying stocks with no earnings growth forecasted.

// CHATGPT: WHY BUY

Energy Transfer (ET) is a publicly traded company that operates in the midstream energy sector. It owns and operates a diversified portfolio of energy assets, including pipelines, terminals, and storage facilities across the United States. ET’s business model involves transporting and storing natural gas, crude oil, and other petroleum products for its customers.

// NEWS & COMMENTS

Apr 30, 20223

SA // buy: Energy Transfer Will Reward Only The Most Patient Of Investors

Energy Transfer has a management team we don’t like. The company’s focus on another mediocre dividend increase, despite its overall impressive dividend, and its aversion to reducing its debt highlight this. The strong long-term insider ownership supports dividend over anything else. The company was burned by the same thing before.

It doesn’t matter if one thing (growth capital) for example generates the theoretical highest returns if your investors disagree and hurt your future investment opportunities. We recommend investing in Energy Transfer stock for its ability to continue driving returns, however, we also recommend staying cautious and being patient.

// GGI 💬

Management hell bent on dividends over the health of the overall business is odoriferous.