// TL;DR

Robots are connoisseurs of electronics. They take seriously the components used to power their integrated circuits. One robot said: “GaN technology has the potential to revolutionize the power electronics industry and improve the performance and efficiency of electronic devices.”

Humans say about their electronic devices: “@#$%ing hurry up and charge.”

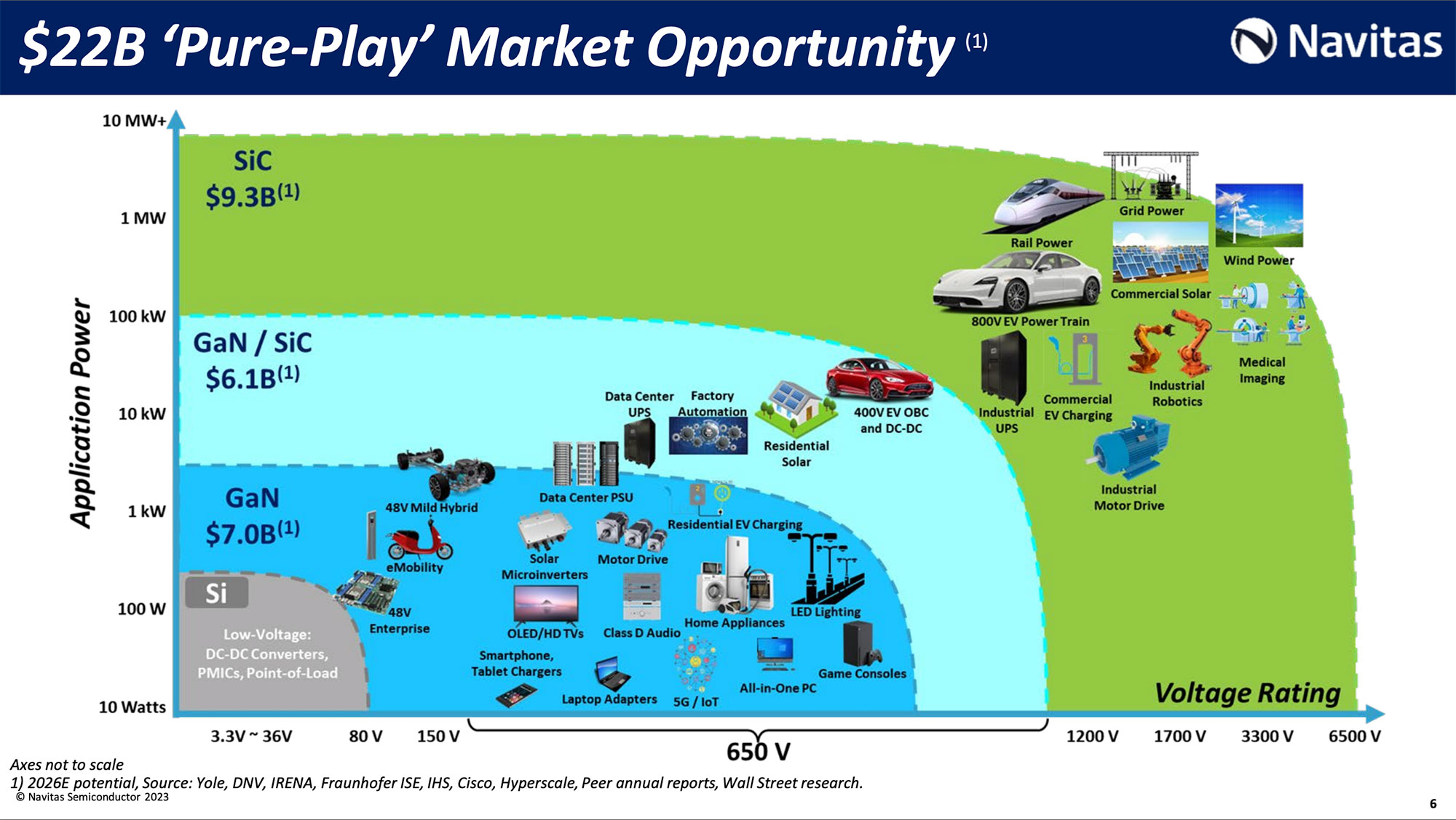

Gallium nitride and silicon carbide to the rescue. Small stuff wants GaN, midsize GaN/SiC and big stuff SiC. They provide higher efficiency, smaller sizes and higher power density. Less energy usage = green cred. But like LED lights, we’ll just use a helluva lot more of ‘em.

Crucial but unsexy product. Current market is $23B. NVTS could achieve 10% of that TAM. If they can go from $76M in revenue in 2023 to $577M in 2028 that would get them about 2.5% of the TAM.

Future growth rates like this are rare, and even though profitability is expected in 2025, sometimes the vicissitudes of life get in the way. Give this one 5 years and you don’t have to go all in at once, but the bold and patient could be handsomely rewarded for speculating on Navitas.

// DIAGNOSTICS

- 1 year CAGR = 8.4% (June 2, 2022 to 2023 || $8.25 -> $8.94)

- 5 year CAGR = 44.3%

- Future Growth Rate Estimate: {subscribe}

- For the next few years this growth rate could be low, but analyst expectations over the next 4 years of 110% for EPS and 85% for Revenue are unlikely to be maintained over a longer time frame.

- 5 year Price Target = {subscribe} at a Price to Revenue multiple of {subscribe}

- The sector median is 2.9 and NVTS is 28.7

- Nvidia is currently 37 so for a high growth company in a happy market, our number seems reasonable.

- Price to Free Cash Flow / Share = -27.1 😢

- Operating Margin = -259% 😢

- Return on Invested Capital = -19.6% 😢

- Long Term Debt to Total Assets = 0% 😀

- Cash & Equivalents to Total Operating Expense = 76% 🤔

// TWO BITS FROM THE BOTS

Why buy NVTS?

Navitas Semiconductor is a company that specializes in creating power semiconductors, which are essential components in a wide range of electronic devices. The company has made impressive progress in developing new technology and expanding into new markets, which could be factors to consider when evaluating the company’s potential for growth.

How much better is gallium nitride than materials previously used to create power semiconductors?

Gallium nitride (GaN) is a promising material for creating power semiconductors due to its high electron mobility and breakdown voltage. Compared to traditional silicon-based semiconductors, GaN-based semiconductors have several advantages, including:

- Higher efficiency: GaN devices have lower power losses and can operate at higher frequencies, which results in higher efficiency and reduced energy consumption.

- Smaller size: GaN devices can be made smaller than silicon-based devices, which is important for applications where space is limited.

- Higher power density: GaN devices can handle higher power densities than silicon-based devices, which is important for applications that require high power output.

Overall, GaN technology has the potential to revolutionize the power electronics industry and improve the performance and efficiency of electronic devices. However, the exact improvement in performance depends on the specific application and the design of the device.

What’s better for power semiconductors, gallium nitride (GaN) or silicon carbide (SiC)?

Both gallium nitride (GaN) and silicon carbide (SiC) are promising materials for creating power semiconductors, and each has its own advantages and disadvantages.

GaN-based semiconductors have higher electron mobility and breakdown voltage than SiC-based semiconductors, which means they can operate at higher frequencies and handle higher power densities. This results in higher efficiency and reduced energy consumption, which is important for applications like electric vehicles and renewable energy systems.

SiC-based semiconductors, on the other hand, have higher thermal conductivity than GaN-based semiconductors, which means they can handle higher temperatures without degrading performance. This is important for applications like power converters and motor drives, which generate a lot of heat.

Ultimately, the choice between GaN and SiC depends on the specific application and the design of the device. Both materials have their own strengths and weaknesses, and the best choice depends on the trade-offs between performance, cost, and other factors.

What is the most common material currently used in power semiconductors?

Currently, the most common material used in power semiconductors is silicon. Silicon has been used for many years in power electronics due to its abundance, low cost, and good electrical properties. However, as electronic devices become more sophisticated and require higher performance, other materials like gallium nitride (GaN) and silicon carbide (SiC) are becoming more popular due to their superior electrical properties. While silicon still dominates the power electronics market, the use of GaN and SiC is expected to grow in the coming years as these materials continue to improve in performance and decrease in cost.

What companies are making power semiconductors using gallium nitride?

Several companies are making power semiconductors using gallium nitride (GaN) technology. Some of the most notable companies in this field include:

- Navitas Semiconductor

- Infineon Technologies

- Texas Instruments

- STMicroelectronics

- GaN Systems

- Panasonic Corporation

- Transphorm Inc.

These companies are investing in GaN technology to develop new power IC chips that can be used in a wide range of applications, from consumer electronics to electric vehicles. Each company has its own strengths and weaknesses, and the competition is dynamic and subject to change over time.

Where does Navitas Semiconductor do their manufacturing?

Navitas Semiconductor is a fabless semiconductor company, which means that they do not have their own manufacturing facilities. Instead, they outsource their manufacturing to third-party foundries, which specialize in producing integrated circuits based on Navitas’ designs.

Navitas Semiconductor has partnerships with several foundries around the world, including TSMC, GlobalFoundries, and SMIC. The specific foundry used for a particular product depends on factors such as the product’s performance requirements, cost, and availability of manufacturing capacity.

// TWO BITS FROM THE GREEN GARAGE MECHANICS

Named after the Latin word for energy and founded in 2014. “The Navitas goal is to ‘Electrify Our World™’ using next-generation power electronics and to enable and accelerate the transition to fast, efficient, clean forms of sustainable energy.”

According to the Navitas website: “Navitas is the industry leader in GaN with drive, control and protection in a single easy-to-use integrated circuit (IC). Navitas GaNFast ICs are easy-to-use ‘digital in, power out’ building blocks that enable up to one hundred times faster switching speeds while increasing energy savings by as much as 40%.” Their GanFast ICs ”enable the highest energy efficiency, highest integration and highest power density in applications ranging from fast chargers for smartphones, laptops and tablets to TVs, data centers, electric vehicles, eMobility and energy generation from renewables.”

Apparently their GanFast is “powering the world’s fastest-charging smartphone: 100% in 9 minutes 30 seconds.

Fill y’er boots with tech specs galore in their investor presentation.

Navitas Fundamentals from page 33:

- Industry’s only pure-play next-gen power semi company, $23B/yr market

- Founded 2014, 220+ employees

- Nasdaq: NVTS (IPO October 2021)

- Leading power GaN IC and power SiC technology, 185+ patents

- >70M GaN, >9M SiC Shipped

- 3x (GaN), 5x (SiC) capacity expansion starting in 2023

- Major diversification in markets, regions

- Mission to Electrify Our World™

- Industry leader in mobile fast, ultra-fast chargers

- Market expansion on track / accelerated into data center, solar, EV

If the TAM is $23B and they are 1 of 7 companies in the space according to the robots (let’s make it 10 in case they missed some competitors), then each company gets 10% of the market or $2.3B in revenue. Given the growth in devices that should easily increase at a 20% CAGR.

Navitas revenue is estimated to be $76M at year end. That’s only 3.3% of their baseline TAM.

Them thar’s a lot of potential growth.

Mind you it could take 8.5 years or more to get to their full TAM. And competitors may have something to say about it along the way. Revenue growth of 50%, after 2023, would get them to about $577M in 2028, about 2.5% of the TAM.

Here’s an image of many of the electronic devices that will be interested in using state-of-the-art power semiconductors. #ChargingSpeedMatters

// CATALYSTS

Industry transitioning from silicon to GaN and SiC; expect 30% market penetration by GaN and SiC by 2028.

// RISKS

Recessions. Better materials. Competition.

// CONCLUSION

Still risky, but a helluva opportunity if they succeed. Analysts current estimate is for profitability in 2025. Still a bit of a way out but not that far away. Once profitable, Wall St will pay them positive attention. As enticing as the growth rate is, they will be at the mercy of the recession this, inflation that talk.

An investment like this should be given 5 years to play out. And you don’t have to go all in at once. But growth rates like that don’t come along every day.

They are disrupting the legacy tech, but unlike with consumer facing products nobody gives a shit. NVTS customers just need the component they are providing to be superior and relatively similar in price.

// NEWS & COMMENTS

Apr 14, 2023

SA // buy: Impressive Progress

“The current estimated potential market for GaN and SiC power semiconductors is ~ $22 billion per year; 30% GaN, 40% SiC, and 30% overlapping GaN/SiC. The transition from legacy silicon to GaN and SiC is still in its early days; about 30% market penetration by GaN and SiC is projected by 2028. This provides a very long runway for growth.”

“As of March 2023, about 250 chargers with NVTS GaN components have entered mass production, with 250 more in development. All of the top 10 mobile OEMs have chargers with NVTS components in production or design. NVTS revenue is typically ~ $1 for each charger.”

“Diversified 2022 revenue by segment: ~ 30% in appliance and industrial, 12% in solar and storage, 5% in EV, and 40% in mobile and consumer.

Diversified 2022 revenue by region: ~ 44% Asia, 32% Europe, 24% North America.”

“NVTS made significant progress in 2022. The fundamental driver – the technical advantages of GaN and SiC – is intact. My subjective impression is that management is capable, energetic, and effective in commercializing this advantage.

The acquisition of GeneSiC in August 2022 appears successful, and has significantly expanded the potential market, accelerated growth, and improved diversification by market segment and region.”

// GGI 💬

If you want more ins and outs of the business, read this article.

We asked the author: “Their current TAM is $22B. Do you think they can capture 10% of that TAM in the next 5 years or so?”

Their response:

“Thanks for the comment. How much market share NVTS can capture is an interesting question. I did an article in August 2022 – The Race for Market Share – that briefly summarizes about a dozen competitors in the space.

Many are much larger than NVTS. On the other hand, NVTS has the advantage of focus and flexibility. The biggest long term revenue bucket is expected to be EVs, and I expect that to be highly contested. But one of the attractions here is that there is room for multiple successful companies.

If they make their $75 million in 2023, and keep up that 2x growth pace, $150 million in 2024, $300 million in 2025, $600 million in 2026, $1.2 billion in 2027, $2.4 billion in 2028. That’s what it would take to get to 10% share of TAM in ~ 5 years.

I think sustained 2x growth is very optimistic – it’s just hard to manage that on multiple fronts. I’d be very happy if they can manage 50% after 2023, which would leave them with $570 million in 2028, about 2.5% off TAM. I would guess that’s a more likely target.”

Mar 9, 2023

SA // hold: Strong Potential, But Fed Could Spoil The Party

“NVTS has a solid backlog that points to some predictable revenue streams in the future. I think it’s going to come, but will probably take longer than anticipated because of the current economic environment and shareholders taking profits after the recent doubling of the share price of the company.

The combination of those things with a projected level performance in the first quarter of 2023 underscores the strong probability of a correction in the stock; that would be the time to take a position for investors interested in NVTS, because once its backlog starts to kick in, its share price is probably not going to be at these relatively low levels for a long period of time.”

// GGI 💬

Volatility will likely be part of this stock’s story. That’s the nature of high revenue growth and pre-profitability.

AI image prompt: electronic devices with smiling faces on wireless charging pads in a heavenly setting