// TL;DR

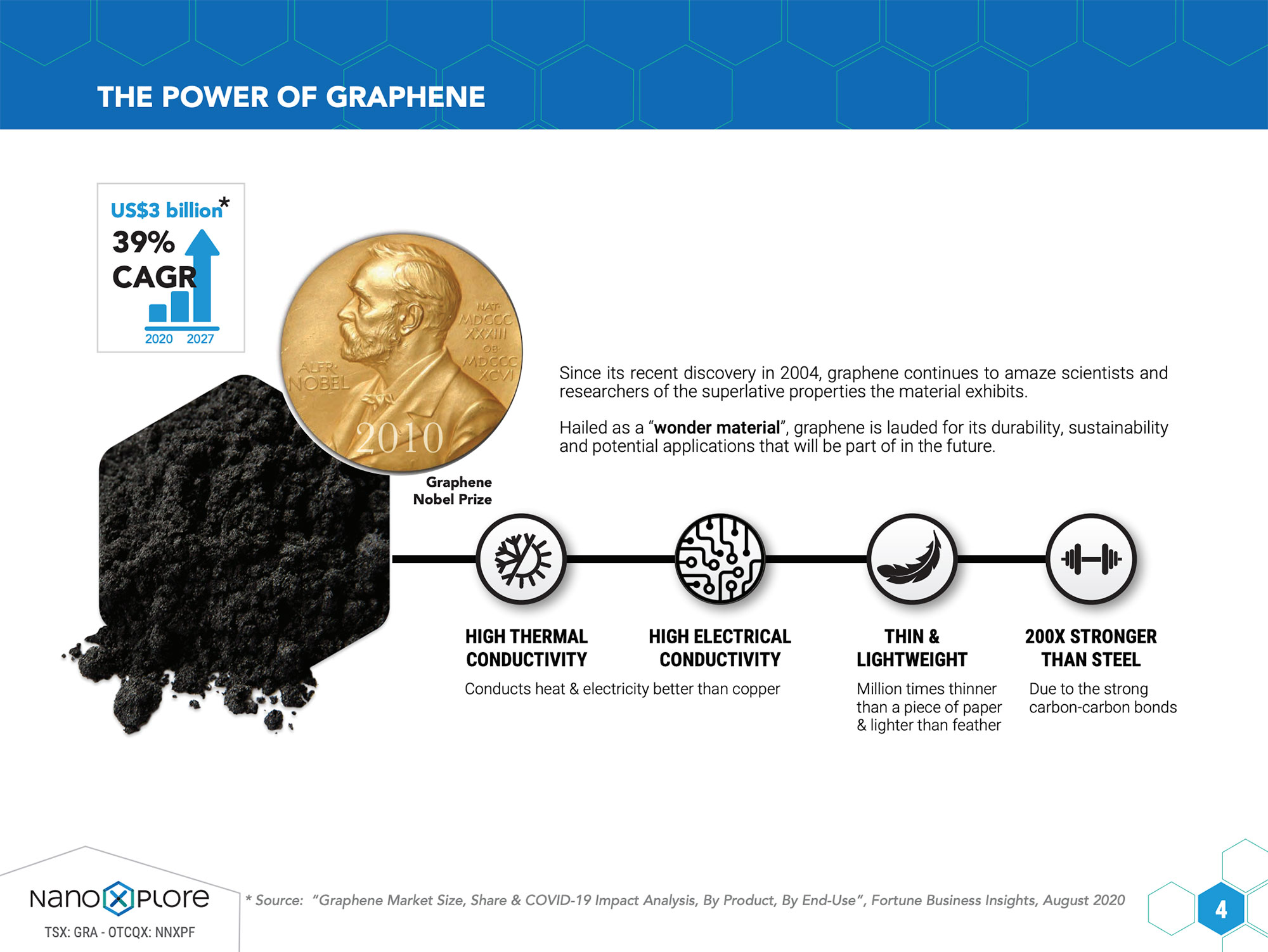

Graphene is 1-10 atomic layers of carbon. It is super strong, light and an excellent conductor of electricity and can be used in a myriad of ways from anodes for batteries to tires, paints and plastics, etc. As production scales and costs come down it will replace carbon black which is often made from coal.

NanoXplore makes graphene powder and pellets in the 6-10 layer quality. They claim to be the largest producer in the world of graphene powder with production of 4,000 tpa with plans to expand to 20,000 tpa by 2027. They make graphene for end-customers but are also acquiring companies that do the mixing and forming and then sell to large OEMs. Their VoltaXplore is building a battery gigafactory to make silicon/graphene anodes for EVs.

Very interesting but rather speculative. Excellent revenue growth, management appears to have executed well the past 5 years, but can operating margins and then EPS turn from red to green. The CEO is the founder and has +7% ownership so he should be aligned with fellow shareholders.

If the market is happy, one could benefit decently in the short term, but if one holds for 5 years and the company is able to execute mostly as expected, then the real rewards could kick in. That said, before investing, realize they are trying to be more than just a commodity producer where low cost of production wins. They are trying to also be in the commercial application production game and this adds more risk and more reward potential. Start with a small allocation and scale as the company executes.

// THE CHART

After the Covid euphoria the stock came crashing down throughout 2022 and has now been consolidating for seven months or so. The price is now attempting another breakout and has pushed past the highs of the previous two attempts to form a new uptrend. Market sentiment is now on its side for this third attempt.

// NUMBERS GAME

- 5 year CAGR = 12.1% (June 9, 2022 to 2023 || $1.90 -> $3.37)

- 5 year CAGR = 44.3%

- Future Growth Rate Estimate: {subscribe}

- Past 5 years EPS has been negative (from -$0.02 to -$0.11) and Revenue has grown at 135% from nada to $118.8M (TTM).

- 5 year analyst estimates for EPS and Revenue growth are 59% and 27.5%.

- 5 year Price Target = {subscribe} at a Price to Revenue multiple of {subscribe}

- The sector median is 1.1 and GRA is 4.9 with a 5 year avg. of 7.1

- Our multiple is high for the sector but conservative for the high growth and profitable players in it.

- Price to Revenue of some of their peers that are growing quickly: $MP 8.6

- Price to Free Cash Flow / Share = -53.3 😢

- Operating Margin = -9% 😢

- Return on Invested Capital = -11.5% 😢

- Long Term Debt to Total Assets = 2% 😀

- Cash & Equivalents to Total Operating Expense = 120.3% 😀

// LINKS

- Website

- Investor Presentation

- YouTube

- YouTube Search

- CEO on LinkedIn

- SeekingAlpha

- TradingView

- SEDAR

- Google News

// TWO BITS FROM THE BOTS

Why buy NanoXplore?

NanoXplore is a graphene company that provides standard and custom graphene-enhanced plastic and composite products to various customers in transportation, packaging, pipe, film, electronics, and other industrial sectors. … analysts have issued “buy” ratings for NanoXplore stock. The average twelve-month price prediction for NanoXplore is C$6.25 with a high price target of C$6.50 and a low price target of C$6.003.

What is graphene?

Graphene is an allotrope of carbon consisting of a single layer of atoms arranged in a hexagonal lattice nanostructure. Graphene is super-strong and stiff, amazingly thin, almost completely transparent, extremely light, and an amazing conductor of electricity and heat. It was first discovered in 2004.

What is carbon black?

Carbon black is a material produced by the incomplete combustion of coal and coal tar, vegetable matter, or petroleum products. It is used as a reinforcing agent in automobile tires and other rubber products but also as extremely black pigments of high hiding power in printing ink, paint, and carbon paper.

Will graphene replace carbon black?

Graphene is more expensive than carbon black, especially for dissipative applications. Graphene is not yet as widely produced as carbon black and because the industry is more accommodated to carbon black. However, graphene is a better suited material than carbon black if you look at their intrinsic properties. Graphene also provides the black color when added in bulk, and is both much stronger and more conductive than carbon black. Another source suggests that common benchmark materials in energy-related applications (graphite, carbon black and activated carbon) will only be replaced if graphene is proved to be superior in terms of both performance and cost.

Will graphene replace other electrical conductors?

Graphene has the potential to replace other electrical conductors in the future. It is already being used as a transparent electrical conductor in displays and can also replace conventional batteries used in cell phones, laptops and even cars because of its low weight, considerably less charging time and prolonged charge retaining capacity. However, it will be dependent on several different factors, including the willingness of end-users to adopt graphene over the status quo (and, in turn, change all their manufacturing methods).

How does NanoXplore make graphene?

They produce graphene through a mechano-chemical process that involves natural flake graphite, water, and hydroelectricity. The process is environmentally friendly and sustainable. NanoXplore’s patented mechanochemical (liquid exfoliation) production process is low cost, large volume, and highly scalable

// TWO BITS FROM THE COMPANY

NanoXplore is a graphene company. A manufacturer and supplier of high-volume graphene powder for use in industrial markets. We provide standard and custom graphene-enhanced plastic and composite products to various customers in transportation, packaging, pipe, film, electronics, and other industrial sectors.

We are headquartered in Montreal, Quebec with manufacturing facilities across North America and Europe.

We are the largest graphene powder producer in the world with a fully automated 4,000-metric ton per year facility in Montreal, Quebec.

We pride ourselves on the quality and consistency of our branded GrapheneBlack™ powder that has a predominate thickness of 6-10 atomic layers and purity of 96-98%.

We are a fully integrated graphene supplier, from graphene powder, to graphene-enhanced masterbatches, to graphene-enhanced plastic and composite products.

We own a strong IP portfolio and know-how through years of R&D development in adding graphene to current Li-ion chemistries, with a focus on silicon-enabled Li-ion anodes that improves energy capacity and charging speeds for the EV, energy storage, and electric truck and bus markets.

// TWO BITS FROM THE GREEN GARAGE MECHANICS

How much graphene do they produce?

Current production of 4,000 tpa of graphene with a capacity expansion plan of 20,000 tpa by 2027. They make GrapheneBlack which is a powder that can be used as a replacement for Carbon Black. The more they scale the better their economies of scale. Many OEMs are slow to transition and the enviro aspect and the superior qualities are all fine and dandy, but until cost parity there will be reluctance.

It should be noted that NanoXplore focus on mid-level quality graphene with 6-10 atomic layers. This is suitable for most applications, but if you need the best graphene, pay up for the vFLG (1-3 layers of carbon). FLG is 2-5 layers, MLG, 2-10 layers.

How does NanoXplore earn revenue?

Two divisions; Carbon Technology and Composites.

Carbon Tech works with end-customers that use graphene powder such as mixing it with plastics. GrapheneBlack Powder, an additive for tires, paints, batteries, etc. GrapheneBlack Masterbatch Pellets for sports equipment, plastic pipes and other industrial uses.

Composites includes recent acquisitions that specialize in plastic forming within various sectors and have large OEM customers (automotive, industrial, packaging) that use precision injection molding and forming of large composite plastic parts.

// CATALYSTS

VoltaXplore 2GWh battery gigafactory by 2026 and newly patented SiG (silicon/graphene) anode additive solution. Production capacity is equivalent to 50,000 Evs annually.

// RISKS

The usual; recessions, competition and the vicissitudes of life. The specific; they need to fund their expansion plans. They have substantial gov grants but debt and equity dilution are possible. (We build dilution into our projected price model.)

// CONCLUSION

Huge secular tailwinds industry as graphene is way better than what it is trying to replace. The company is scaling fast and already a leader. Profitability expected in a couple years. The big question is will they just be a commodity producer (lowest cost of production wins) or will their battery and other forays into commercial application production pay off and make them a major playa in the materials and industrials sectors. The CEO is thinking big, but will his stars align? So far so good, but there is still a way to go. Will know much more in a couple years. Trade this if ya want, but hold for 5 years for big gain potential.

// NEWS, REVIEWS & COMMENTS

May 30, 2023

SA // buy: NanoXplore Is Poised For Exponential And Profitable Growth As EV Sales Expand

“In my opinion, NanoXplore’s management has effectively executed its business strategy from 2017 to 2022. They have successfully established the industry’s leading graphene plant, boasting a production capacity of 4,000 tpa. Furthermore, they have reduced the unit operating cost to below $10 per pound, thus encouraging widespread adoption of graphene among downstream customers. Through collaborations with these customers and strategic M&A, NanoXplore has fostered a burgeoning, blue-ocean downstream market, with a total addressable market exceeding 7,700 ktpa. It currently boasts an impressive roster of customers that includes Ford (F), Toyota (TTM), Paccar (PCAR), Volvo (OTCPK:VOLAF), General Electric (GE), and Caterpillar (CAT).”

“With management’s guidance indicating continued revenue growth in the coming quarters, we can expect further expansion of margins and, ultimately, the achievement of profitability. In simpler terms, NanoXplore appears to be at a turning point, poised for a period of hockey stick-shaped growth. … With a total investment of $170 million over the next 3-4 years, NanoXplore is poised to increase its production capacity by five times and nearly quadruple its annual revenue. … Once the company completes its ongoing phase of capital spending by 2026, I anticipate that it will be capable of generating free cash flow in the hundreds of millions.”

“Drawing from the previous investment spree, as illustrated in figures 6 and 7, it is likely that this new round of capital investment will be followed by significant appreciation in the share price. Therefore, I believe that now is an opportune moment for those with a 3-5 year investment horizon to consider investing in this stock.”

// GGI 💬

This author recently wrote this comprehensive article and another a couple years ago. Their noting of the effective execution by management over the past 5 years is critical to the investment thesis for a company still in the early innings. And we like the sounds of 5x capacity and 4x revenue increase in 4 years. Operating margins and EPS are expected to be positive well before, but that is no guarantee.

Mar 9, 2023

SA // buy: A Compelling Graphene Pure Play

“NanoXplore is a compelling graphene pure play with decisive advantages over the competition. Graphene is finally leaving the lab, albeit seems to be appearing in more straightforward applications as an additive first, with the higher tech possibilities like microchips and even battery anodes remaining longer term growth prospects. Fortunately, NanoXplore has cast a wide net in this sense and is pursuing both currently available applications and more speculative ones, creating a potentially huge TAM.

There are significant risks within the graphene industry as the most efficient production methods are not certain. However, with an experienced engineer style CEO and promising product test results, I think the company has a good chance at becoming a leader of what will eventually be a large industry.”

// GGI 💬

Yup.