NOTE: This report is a Quick Take. We have crunched the numbers to come up with a Strike Price. We do not have an in-depth understanding of the products, production capacity, capex, catalysts, risks, markets, competition, moat, management, etc. If you are interested in this stock, buying below our Strike Price could be a reasonable entry point for long-term investors to buy this on sale.

// QUICK TAKE

Hydrogen power has been an enigma for decades and Ballard is the poster child.

Unsure what the world record for longest to profitability is, but Ballard must be in contention. They IPO’d in Canada in 1993 (US in 1995) and 30 years later they have yet to record a positive EPS. Analysts still don’t expect it to happen until 2029.

Despite this lack of earnings, at last report they have $865.8M in cash & equivalents and $0 in long term debt. Total operating expense for 2022 was $137.8M so they should have at least 4 years of runway before needing to raise more equity. By then they will be on the cusp of profitability. To the chagrin of shareholders we presume they have done some significant stock dilution over the years, but for those looking to buy now, the clean balance sheet and large war chest is intriguing.

Ballard builds hydrogen powered fuel cells (engines) for big transportation vehicles, vessels, etc. They don’t deal with making hydrogen, distributing it or any of that stuff. Here is their official profile:

“Ballard Power Systems Inc. engages in the design, development, manufacture, sale, and service of proton exchange membrane (PEM) fuel cell products. The company offers its products for power product markets, consisting of heavy-duty motives, such as bus, truck, rail, and marine applications; material handling; and power generation. It also provides technology solutions, including engineering and technology transfer, as well as licenses and sells intellectual property portfolio and fundamental knowledge for various PEM fuel cell applications; and hydrogen fuel cell powertrain and vehicle systems integration solutions.”

Some oil & gas types think hydrogen is the fuel of the future. Battery-fans disagree. Elon has called fuel cells “fool cells” but also said that it makes sense to use hydrogen for industrial processes that require high temperatures and a lot of energy. Hydrogen may very well be suitable for ships and trains and planes but it isn’t assured.

There is blue, grey and green hydrogen. Only the green makes sense. Green means the hydrogen is made using renewable energy. Hydrogen is also rather flammable; even more than gas or natural gas. It also likes to escape and there is now science wondering if it is even worse than other greenhouse gases due to its commingling with methane. That said, the world needs a lot of energy and there will be room for many types of energy sources until the AGI figures out how to make pocket sized nuclear fusion reactors.

If you like the idea of hydrogen as an energy source then BLDP is an OG in the industry with a fine balance sheet and are, relatively speaking, on the cusp of profitability. Wall St often likes to reward that achievement. Analysts also expect them to go from $8M per month in revenue in 2023 to $45M in revenue in 5 years which will greatly improve their margins.

We are a little shocked by the price to revenue multiple they have been treated with given their unprofitability and negative EPS and revenue growth. It usually requires high growth to give unprofitability high multiples. It speaks well of management’s abilities. Or BLDP has the most hardcore HODLERs for owners. Insiders hold 15.6% of the shares outstanding and another 10.4% is held short. That has squeeze-ability but don’t expect current P/R multiple of over 20 to maintain despite growth that is expected to accelerate from past performance.

Latest Investor Presentation: https://www.ballard.com/docs/default-source/investors/bldp-cmd-deck_master_final_(06-13-2023).pdf?sfvrsn=2f8cde80_2

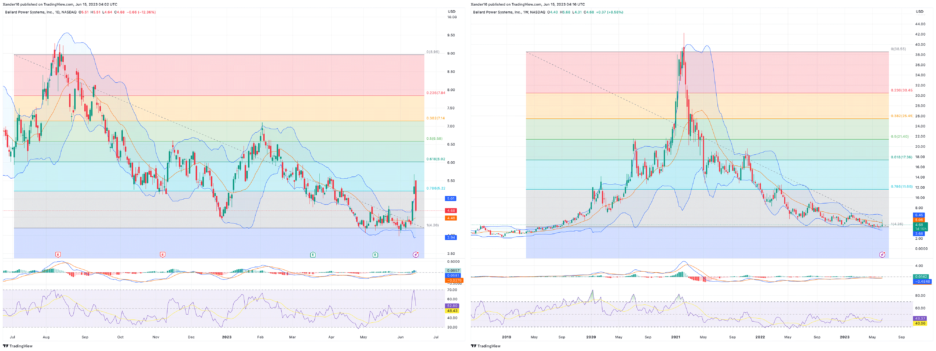

// THE CHART

The stock has had a ride the past few days. It looked like a breakout was happening but profits were quickly taken. There should be a lot of support at about $4. It hasn’t been below that since H2 2019. Since that time it peaked over $40 in early 2021. The downward trend since appears to be turning into a channel and given managements expected revenue and margin improvements, discussed in their investor presentation, a breakout and uptrend are likely imminent. The longer it channels the bigger the breakout.

// SOME NUMBERS

- 10 year CAGR = 9.5% (June 12, 2013 to 2023 || $1.99 -> $4.94)

- 5 year CAGR = 10.1%

- 24% above 52 week low of $3.98

- Future Growth Rate Estimate: {subscribe}

- 5 year EPS = ($0.15) to ($0.58) for -287% growth

- 5 year Revenue = $96.6M to $83.8M for -13% growth

- 5 year analyst estimates EPS = ($0.52) to ($0.17) for 67% growth

- 5 year analyst estimates Revenue = $93.4M to $537.6M for 476% growth

- 5 year Price Target = {subscribe} at a Price to Revenue multiple o {subscribe}

- Sector median P/R (ttm) = 1.37

- BLDP = 20.94 with a 5 year avg. of 27.31

- Price to Free Cash Flow per Share = -8.7 😢

- Operating Margin = -213% 😢

- Return on Invested Capital = -14.8% 😢

- Long Term Debt to Total Assets = 0% 😀

- Cash & Equivalents to Total Operating Expense = 602.9% 😀