When Bitcoin Bull Market? With Rational Root

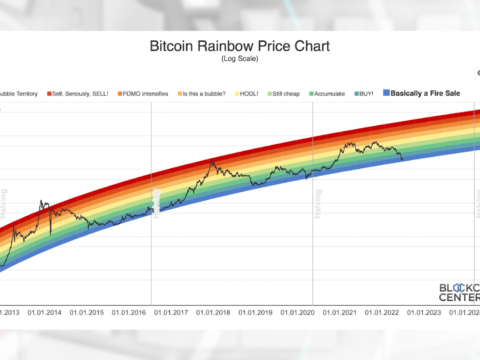

“If we keep on following the same pattern Bitcoin should reach between $100,000 and a million in the next cycle, and possibly higher after that. So that is quite bullish.” The Rational Root is a Bitcoin on-chain & cycle analyst. In this interview, 9 months on from our last interview, we look into the various Bitcoin price models Root has developed. We again review his Bitcoin Spiral Models, Bitcoin Hodl price models and Bitcoin halving & cycle charts. We discuss the growing evidence of Bitcoin scarcity, and bullish cases as we approach the next halving.

Video | Podcast | @therationalroot

// GGI 💬

Compelling case for Bitcoin from a technical analysis perspective, as opposed to fundamental or philosophical. (See the Saylor for fundamentals, Search Booth, Gladstein, Breedlove, etc for philosphicals.) The last halving was in May 2020. New supply gets cut in half every 210,000 blocks; about 4 years as the bitcoin code self-adjusts the mining difficulty depending on how the amount of hash power being used by the miners.

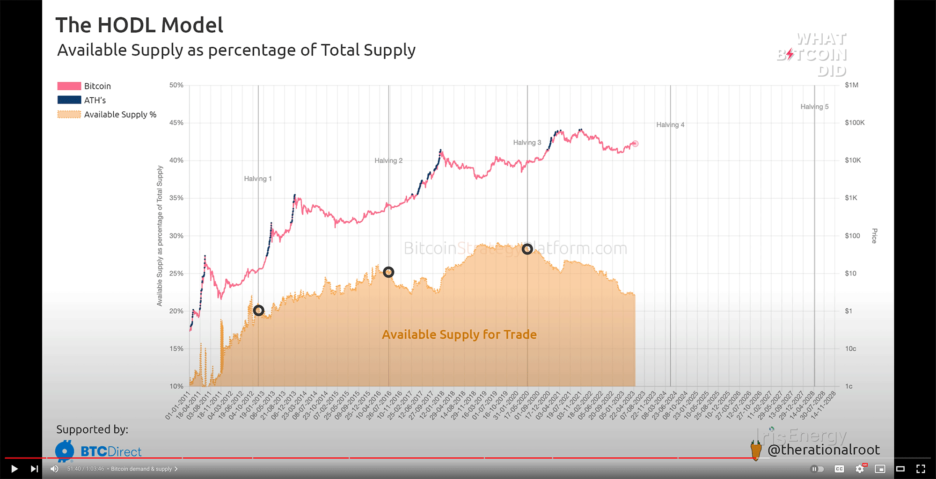

In 2019 and 2020, leading up to Halving 3, the Available Supply to Trade (orange area) was at a peak. Why? Likely because a lot of people wanted to get in on the Bitcoin action as everyone had heard of someone who had made a mint in crypto. But these people were in it for the number-go-up aspect, not the sound money, good for the globe reasons. Those folks were quick to take profits and thus Bitcoin’s bull cycle did not achieve the expected price action. Many of easy money folks have been whittled away in the bear part of the halving cycle the past couple years.

The Available Supply to Trade amount of coins is down at 2014-15 levels. Bitcoin is in cold storage owned by HODLers. The next halving in expected to be April 26, 2024. Supply goes, down, scarcity goes up. Network effects and functionality increasing. Price is very likely to increase as demand for a scarce resource increases.

The price likely bottomed in November 2022 for this cycle. There could still be some solid dips, but now is the time to do your homework and start making moves if you want to be part of this financial revolution. We added to our allocation. With the way news travels these days the tradable ratio may not stay this low for long. There’s a lot of buy the news sell the event types out there.

P.S. Bitcoin uses some energy, but nothing unreasonable considering its importance and what else we use energy for. Bitcoin is also facilitating the growth of renewable energy. https://bitcoin.energy (E.g. read articles by Lyn, Nic, etc.)