// 🍑 〰️

We like a lot for the long term but we need a better entry price based on their metrics and we would like to be closer to 2025 when profitability should be imminent.

// OUR TWO BITS

Obviously vinyl provides the best non-live sound quality, but streaming music has revolutionized music. Mostly for the better. There are growing pains, but the path seems to be heading in the right direction.

We all have a million songs at our mostly instant disposal. Or 80+ million last time we counted. Many more musicians than ever before can now make money from their craft. According to the BBC last March, 7,000 artists earned $50,000 to $99,999. (The royalties kick in after 30 seconds so try to wait that out before hittin‘ skip if they tune ain’t jivin’ with you.)

TBH we would give Spotify a 7 out of 10. Consumer-only perspective. We have no creator experience with the system.

There are probably a million things they could improve, from the app’s interface to the suggestion algorithms (giddy up, AI!), to the royalty distributions to the creator software to the … name your peeve. We think the sound of waves is more interesting than Joe Rogan but you probably totally disagree as he gets about 11 million listeners per episode and has the #1 podcast in the USA and UK. But that’s cool. There’s audio-a-plenty for all tastes.

The main thing is, “it’s getting better all the time,” to quote The Beatles. They have THE brand in music streaming, improving their existing software, systems, etc. is doable and they have a flywheel to further innovate around. They have withstood the onslaught of Apple, Amazon and Google. They have proven their ability to go toe-to-toe with them in the music streaming ring. Although that will be an ongoing battle.

But …

Spotify Profile:

“Spotify Technology S.A., together with its subsidiaries, provides audio streaming services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers. The Ad-Supported segment provides on-demand online access to its catalog of music and unlimited online access to the catalog of podcasts to its subscribers on their computers, tablets, and compatible mobile devices. The company also offers sales, distribution and marketing, contract research and development, and customer support services. Spotify Technology S.A. was incorporated in 2006 and is based in Luxembourg, Luxembourg.”

Some Stats:

- 30.5% of the global music stream market (Apple #2 at 13.7%)

- 515 million MAUs (monthly active users) in 184 countries and territories (Q1 2023)

- Adding ~250K per day over the past year.

- Europe 30%, NA+SA 41%, Rest of World 28%

- 210 million Premium Subscribers which account for 87% of revenue

- Annual streaming hours on Spotify; ~55B in 2018, ~132B in 2022, 24% CAGR

Latest Investor Presentation: https://s29.q4cdn.com/175625835/files/doc_financials/2023/Shareholder-Deck-Q1-2023-FINAL.pdf

Operating Expenses; this is probably the key to get them from the EPS redzone to the greenzone which will make investors sing their praises. Their Operating Margin is at -6%. For comparison Netflix at our last analysis was at 19%.

“Operating Expenses grew 36% Y/Y (or 34% constant currency), driven primarily by higher personnel costs related to the headcount expansion we undertook over the course of 2022.

…

Looking ahead, we continue to anticipate a meaningful improvement in our Operating Expense ratios and Operating Income/(Loss) in 2023 and beyond.”

Seeking Alpha, last 10 articles:

- Strong Buy: 2

- Buy: 4

- Hold: 3

- Sell: 1

// SOME NUMBERS

- 5 year CAGR = -2.7%

- Jun 23, 2018 to 2023 || $180.94 -> $157.49 || high of $387 in Feb 2021

- 127% above 52 week low of $69.29

- Future Growth Rate Estimate: {subscribe}

- Previous 5 year EPS = ($0.50) to ($2.39) for -378% growth

- Previous 5 year Revenue = $6B to $12.6B for 110% growth

- Next 5 year estimates EPS = ($2.52) to $5.51 for 319% growth

- Next 5 year estimates Revenue = $14.5B to $23.2B for 60% growth

- 5 year Price Target = {subscribe}

- Price to Sales Revenue multiple = {subscribe}

- Sector median P/S (ttm) = 1.2

- currently 2.34 with a 5 year average of 3.84

- Price to Free Cash Flow per Share = 543.1 🤔

- Operating Margin = -6% 😢

- Return on Invested Capital = -33.6% 😢

- Long Term Debt to Total Assets = 15% 🤔

- Cash & Equivalents to Total Operating Expense = 91% 🤔

// VALUATION

Spotify IPO’d in 2018 at $166 (for retail investors, institutions got a 25% head start at $132) which is the price it channeled at until the Covid frenzy launched it all the way up to $387.

Recently the time to buy it was Sep 2022 to Jan 2023 for sub-$100. But that was then. At this point it needs another dip or time to grow its metrics in order to up its Strike Price. If you bought it here and it reached our 5 year price target you would be very happy with the results but you would be buying it with very little margin of safety. Fine for traders, but not for those busy with life outside the markets who want to sleep well at night. Over the next 5 years the economy could go in the toilet, competition could swoop in, management could replace CEO-Founder Ek with the next Colonel Tom Parker (the guy who turned Elvis into a Vegas freak show), or who knows what.

The interesting thing about Spotify, other than the fact we all love music and music streaming, is mostly great, is the growth trajectory of this company. 2025 is expected to be a very profitable year for Spotify. Its first. Markets like this. But it is still a year away being on the real cusp of profitability.

The previous 5 year growth of the EPS was -378% and 110% for Revenue. Analyst estimates for the next 5 years have revenue slowing down to 60% but the EPS growing 320%. Markets love this high EPS growth. Money talks, BS walks, especially if inflation and interest rates are an issue.

The expectation is that beginning in 2025 the fruits of their labour since 2006 will begin paying off as revenues make it all the way into their savings account.

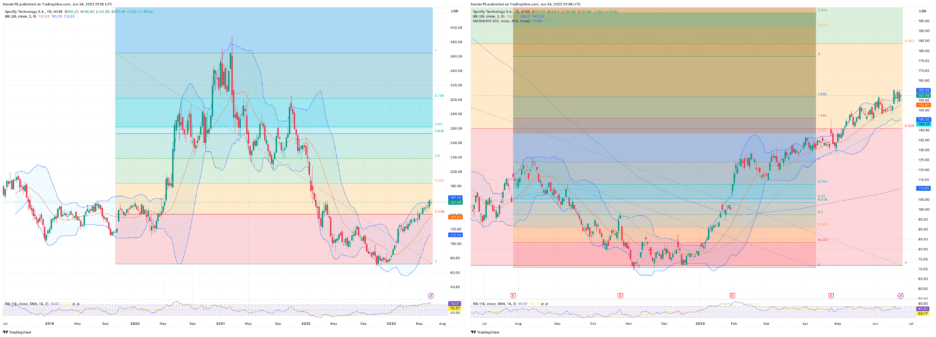

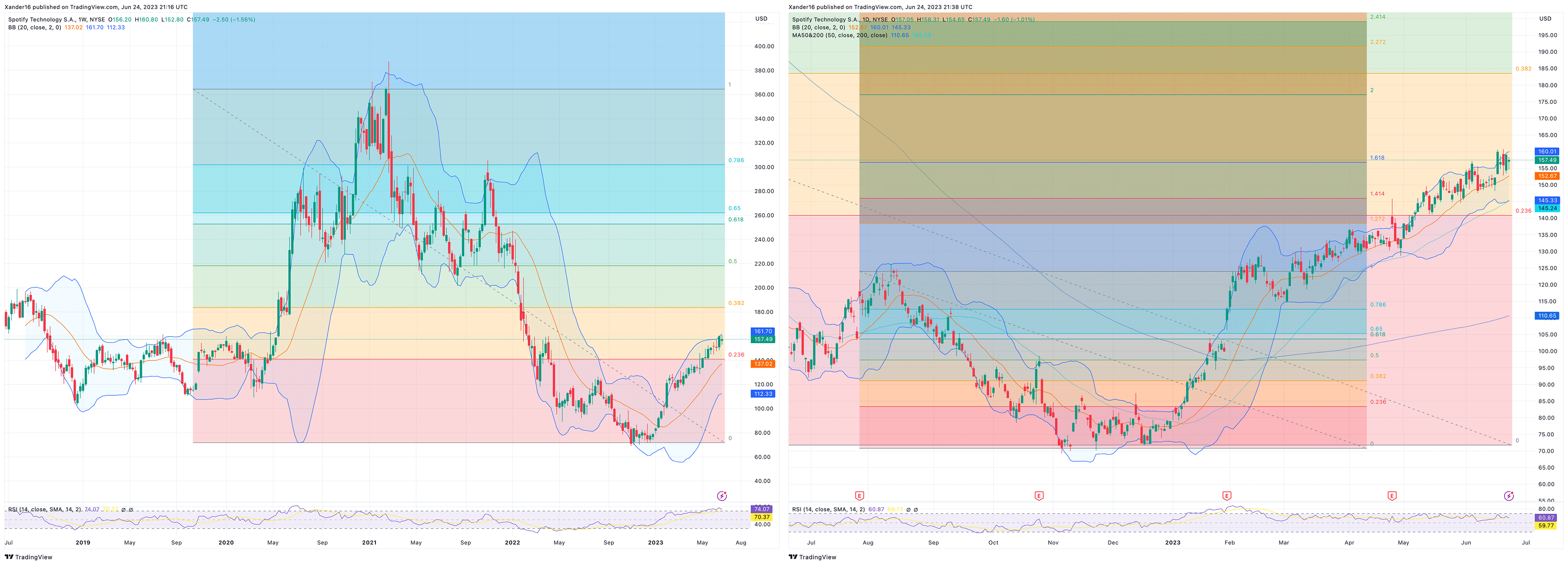

// THE CHART

It’s been a nice run for those who bought themselves a music streaming business for Xmas (etc). Spotify has an element of AI in it as the curator of your playlist (for those who are over 26 and can no longer be bothered to make their own ;), but it’s not in the business of making dancing robots or something.

The stock may get to the next resistance level around $183 but at some point it needs to do some channeling and earnings call check ups to make sure the EPS is growing from its 2023 depths.

The 50 Day Moving Average after crossing the 200 in late Feb is now well above and the RSI is getting frothy at 74 as it is cruising the top of the Bollinger Band.

// NEWS, REVIEWS & COMMENTS

June 8, 2023

SA // hold: I Will Buy After The Dip

“Spotify (NYSE:SPOT) has been one of the best-performing stocks this year with a massive over 80% year-to-date rally. And this is the major reason I am not buying at current levels despite undervaluation. I think that there is a high probability of new selloffs this year because adverse catalysts in the macro environment are highly likely to happen. Moreover, many investors will realize their capital gains after such a massive rally. Therefore, I assign SPOT a “Hold” rating.”

// GGI 💬

Yup. Patience.

May 25, 2023

SA // strong buy: The Closer I Look, The More Bullish I Become

“While I used to think of streaming services as a commodity, I’ve become increasingly confident about Spotify’s (NYSE:SPOT) future. Spotify’s preeminence as a DSP (Digital Service Provider), as evidenced by its best-in-class product (design, exclusive content, personalization, etc.), ubiquity, per user engagement, and continued evolution as a business, has placed it in a position to demand a significantly higher share of the (ever-increasing) pie it helped create. The closer I look and the longer my timeframe, the more bullish I become.”

// GGI 💬

Yup. Patience for those holding and for those looking for a great long term entry point.

Green Garage Investing offers a semi-DIY subscription service to help long term oriented investors outperform the stock market index.

- Strike Price List: https://www.patreon.com/greengarage ( < 🍺 per month )

- Newsletter: https://greengarageinvesting.com/newsletter/ ( free weekly )