Update: Jul 12, 2023

Aritzia is Having a Stock Sale

SA News: Aritzia Inc. (ATZAF) Q1 2024 Earnings Call Transcript

“To summarize, the investments made in the back half of fiscal 2023 and this year are to support our recent tremendous growth to help drive our future growth. While we are lowering our fiscal 2024 outlook due to our revised revenue expectations and resulting fixed cost deleverage, we expect sales growth to accelerate next year from the planned higher new store openings in fiscal 2025.

We also expect that the steps we’re taking will ensure that our margins begin to normalize in the second half of this year with further improvement in fiscal 2025. The expected revenue acceleration and margin expansion will drive significant earnings growth in the coming fiscal year.”

// GGI 💬

If you want specific numbers you can check out the transcript.

Basically $ATZ grew a lot so they’ve had to improve their systems to enable further growth, especially in the US. Systems improving costs money. Margins go down. Investors hate that. Stock gets sold off. Long term focused investors interested in Aritzia can use this stock sale to load up.

During trading today the stock dipped all the way down to pre-Covid highs. This is a major support level. So far the stock appears to have stuck the landing.

// 🍑 〰️

Aritzia doesn’t sell must-haves but they make and sell very nice to-haves for an age range etc of mostly women. Everyday luxury is their self-description. Not cheap or flashy, but quality, durable fashion. Having a few Aritzia pieces is attainable for many. They aspire to quality over quantity from store locations to materials, etc.

46 of their 114 boutiques are in the US (68 Canada). They plan to add 8-10 new boutiques in the US over the next several years. This will push their financials and management but it’s doable and EPS is expected to grow significantly as the company enters its prime. There are indications they have a brand moat but their grip on it still seems a little tenuous. Fashion is by design, fickle.

// OFFICIAL PROFILE

Aritzia Inc., together with its subsidiaries, designs and sells apparel and accessories for women in the United States and Canada. The company offers t-shirts and tops, sweaters, shirts and blouses, bodysuits, sweatshirts, blazers, jacket and coats, and dresses; pants, denim, leggings and bike shorts, sweatpants, skirts, shorts, sweatshorts, and jumpsuits and rompers; accessories, such as socks, hats, bags, scarves, belts, and intimates; swimwear; and shoes. It offers its products under the Wilfred, Wilfred Free, Babaton, The Group by Babaton, Babaton 101, Ten by Babaton, Tna, Little Moon, Sunday Best, Super World, TnAction, Denim Forum, Auxiliary, Talula, Tna x EMU, New Era, and Merrell brands. The company was formerly known as Aritzia Capital Corporation and changed its name to Aritzia Inc. in August 2016. Aritzia Inc. was founded in 1984 and is headquartered in Vancouver, Canada.

// OUR TWO BITS

Fashion isn’t fully our forte. It can be fickle and fad-filled, but for those who are aficionados, it can be a fine financial journey. The following are some facts and factors for your reflection. As always, we favour you understand the firm and the field and #AbideTheStrikePrice before becoming an Artizia owner.

Aspirational Environments: “Each Aritzia destination – physical or digital – is carefully considered. We pride ourselves on creating immersive, human and highly personal shopping experiences.”

Aritzia appear to be onto something in this department. They appeal to a wider age range than many of the fast fashion brands we might consider as their competition. We’ll let you judge the aesthetics of their fashion styles and the quality of their cut, fit-n-fabric, but it seems that people are willing to pay their higher prices in exchange for the quality. Artizia is where one goes for foundational items that can last for years. E.g. pay up for top-quality pants and jackets that can then be paired with a myriad of shirts, shoes and accessories. They call their style, “everyday luxury” which is a brand category somewhere between fast fashion and full-on luxury.

A Seeking Alpha author notes: “Another benefit of Mid-luxury is durability against macroeconomic factors like inflation and slowing consumer demand. McKinsey found that luxury brands are able to protect profitability as higher income customers rarely change spending habits, even in difficult economies. It would seem Mid-luxury companies, including Aritzia, are able to capture some of this macro durability. CEO Wong highlighted this fact in Aritzia’s most recent earnings call:

…what we’re seeing is, a tremendous amount of consistency between who’s shopping with us, what they’re buying, their average basket size have not changed, the average selling price has not changed, the number of units has not changed.

This mid-market strategy allows Aritzia to create considerable brand affinity and customer loyalty.”

Increased Brand Awareness: “We are driving brand awareness by expanding our boutique network, social media presence, influencer strategy, VIP program and digital marketing strategies. We plan to continue to build our social community, and we expect that our social community will continue to talk. When our clients talk, we plan to amplify their voices and augment through strategic marketing.”

Financial Post notes: “Jennifer Lopez loves Aritzia. Meghan Markle digs the threads, too, as do legions of social-media influencers, plus heaps of teens and 20-somethings (just ask around) who can afford, or not, to shell out $98 for, say, a pair of shorts.”

We aren’t their target market, but how do you think they are doing in this regard?

Google Trends interest over time shows peaks each holiday season with higher highs and a slow but steady climb up and to the right over the past 5 years. The interest is half that of Lululemon and pales in comparison to Zara and H&M.

Their Net Promoter Score is 27. Lululemon is 43, Apple 47, Costco 79, Netflix 13 and Zara 3. All things considered their score is respectable but leaves room for improvement.

A year ago goodonyou.eco rated Aritzia Not Good Enough in terms of protecting workers and the environment and said they are “dabbling in sustainability but not doing enough.” We can’t vouch for the quality of their sessment. Aritzia appears to have lots to say about their social and environmental contributions here. 73% of their senior leadership is female, including the CEO.

Company founder Hill, says of the CEO, “I would argue that Jen is the most qualified fashion company executive in North America; she understands finance, logistics, fashion, retail, e-commerce, I.T., computerization — she has done it all.”

For three consecutive years Aritzia have “achieved carbon neutrality across our operations, which account for 100% of our Scope 1 and 2 emissions.” 64% of Spring/Summer 2023 styles “included organic and recycled cotton, recycled polyester and nylon.”

Aritzia recently acquired Reigning Champ, “a leading designer and manufacturer of premium athletic wear.” Now when we are dragged into an Aritzia store by our better halves, instead of finding a seat and thumbing our phones while trying to not ogle, we can also be shoppers. Our decrease in boredom and awkwardness should advance Aritzia’s top and bottom lines.

But … They want to grow their boutique count (and global ecommerce) especially in the US. This takes $. Do they have enough $ and does management have the skillz and do they have the brand power and fashion sense to not be just another passing fad in the field of fashion? When will they get the call up to the big leagues? (NYSE or Nasdaq; this could be a bonus catalyst for the stock price.)

// HIGHLIGHTS FROM THE LATEST INVESTOR PRESENTATION

https://s21.q4cdn.com/489771965/files/doc_financials/2023/q4/Aritzia-Inc-Q4-2023-Presentation.pdf

- Ecommerce growth in 2021-22 was 33% and 36% in 2022-23 with clients in 200+ countries and accounts for about 35% of their revenue.

- Revenue (in millions) grew from $874 in FY2019 to $2,196 in FY2023 for a 26% CAGR.

- Net Income (in millions) grew from $79 in FY2019 to $188 in FY2023 for a 24% CAGR. (During peak Covid net income dropped to $19 but was back on track at $157 the following year.)

- Currently at 114 boutiques in North America; 68 in Canada and 46 in the US.

- Planning to open 8 new boutiques in the US in FY 2024 and 4 expansions/repositionings.

- 100 US locations identified for expansion. Plan to open 8-10 new US boutiques annually through FY 2027 along with 3-5 expansions/repositionings.

- Payback period of a new boutique is 12-24 months.

- Expect ~150 total boutiques by the end of FY2027 with total retail square footage up by 60%.

- Revenue in FY2027 estimated to be $3,500 to $3,800 for a 15-17% CAGR

- $175M available revolving credit facility

- $86.5M in cash and equivalents

- Capital Cash Expenditures in FY2024 of ~$220 million

- Gross Profit Margin expected to decrease by 2% in FY 2024

- EBITDA expected to grow to ~19% in FY2027

- Expect a cash balance of $1 billion+ by FY2027

// SOME FINANCIAL NUMBERS, STATS & THOUGHTS

- 6 year CAGR = 16.1%

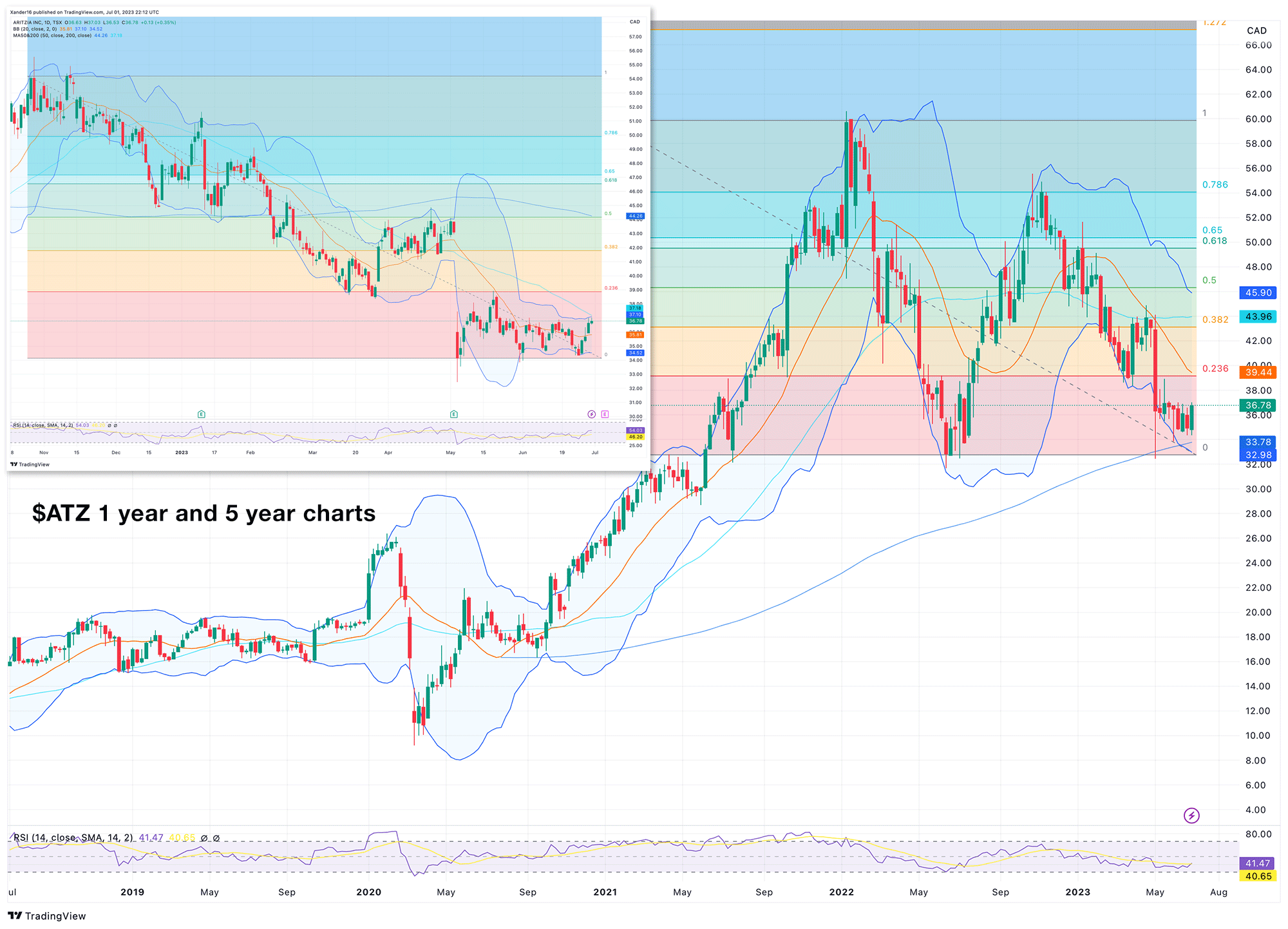

- Jun 30, 2017 to 2023 || $15.02 -> $36.78 || high of $60.64 in Jan 2022

- 5 year CAGR = 10.1%

- 13.3% above 52 week low of $32.45

The stock took a nose dive on May 3rd after an earnings call despite a slight beat of revenue and EPS. Short term margin pressures appeared on the horizon. The stock dropped to $32.45 and has mostly channeled since in the mid-30s. It’s now 13.3% above the 52 week low and looks ready to regain its upward trajectory.

- Future Growth Rate Estimate: xx% {subscribe}

- Previous 5 year EPS = $0.70 to $1.70 for 143% growth

- Previous 5 year Revenue = $875M to $2.2B for 151% growth

- Next 5 year estimates EPS = $1.46 to $4.82 for 230% growth

- Next 5 year estimates Revenue = $2.5B to $4.33B for 73% growth

The interesting aspect of the future growth rate is the EPS is expected to grow significantly faster than revenue. The revenue growth is decent but hardly spectacular but more of that money making it to the bottom line than in the past is usually appreciated by the market as it is a sign of a business that is performing well.

NOTE: the benchmark for stocks is 10% annual growth. The goal is to outperform that but not necessarily crush it. Sometimes one can crush it, but the risk factor makes that a more difficult situation to discern and manage.

- 5 year Price Target = $xx {subscribe}

- Price to Sales Revenue multiple = xx {subscribe}

- Sector median P/S (ttm) = 0.9

- currently 1.9 with a 5 year average of 3.1

For comparison, the premier fashion-related company is Lululemon. Their P/S is 5.6 with a 5 year average of 7.8. Aritzia is not the next $LULU. They are unlikely to revolutionize how people dress, but they can become a solid international fashion designer and retailer. Just don’t expect excessive P/S ratios.

- Price to Free Cash Flow per Share = -80 😢

- Operating Margin = 13%

- Return on Invested Capital = 27.4% 😀

- Long Term Debt to Total Assets = 0% 😀

- Cash & Equivalents to Total Operating Expense = 13.8% 😢

As of Feb 2022 FCF/S had gone up to $2.46 after being $0.10 in 2014. FCF/S plummeted to ($0.46) in Feb 2023. What happened and will that revert to normal soon? Given the expected EPS growth and the expected cash balance of $1B or more in 2027 the FCF should return. But that is a should. Especially as our command-F of the past few earnings call transcripts returned next to nada for free cash flow. Revenue dipped and net income had fallen off a cliff in 2020. FCF went from $1.61 down to $0.68 but then way up to $2.46 and now down to ($0.46). We don’t have a good explanation for that.

The operating margin is decent, but cash is a bit of a concern. At least they are entering this US expansion phase without debt. We added 10% stock dilution into our projected price just in case they use some equity to fund their CapEx. However, they have repurchased more shares than they’ve issued since their IPO in 2016.

Their ROIC of 27.4% is impressive. It’s up there with $LULU which we just calculated at 28.8%

// THE CHART

After the earnings call in early May the price quickly dipped to near the previous lows in October 2022. The dip was quickly bought and the stock has channeled since. The 50-day Moving Average has a ways to go to get above the 200-day MA and create a golden cross. That could happen if there is an ease of margin pressure at the next earnings call. But with significant support now established just below the current level, long term investors can look to establish their position for the next expected growth phase.

// NEWS, REVIEWS & COMMENTS

Seeking Alpha, last 10 articles:

- Strong Buy: 2

- Buy: 7

- Hold: 1

- Sell: 0

4 articles have been written in 2023 about Aritzia, 3 buys and 1 strong buy.

May 4, 2023

SA // buy: A 20% Drop After Earnings Makes This Retailer A Buy

“In summary, after a 20% drop in the share price on issues related to margin pressures, I believe the long-term thesis for the company still remains largely unchanged. Aritzia is still poised to grow in the double digits and has been making investments that should sustain its growth over the long-term. With a strong balance sheet and disciplined capital allocation, the company should continue to grow in the U.S. market and further grow its ecommerce and omnichannel presence. At 11.3x EV/EBITDA, trading at a discount to its peers, Aritzia’s shares look attractive today.”

// GGI 💬

Temporary (it appears) margin pressures create an entry opportunity for those that think Aritzia is on the verge of a brand moat.

Mar 16, 2023

SA // strong buy: Mid-Luxury Powerhouse With Huge Potential

“Aritzia (OTCPK:ATZAF) is a Canada-based women’s apparel retailer operating in the mid-luxury market. The company has spent nearly 40 years building a reputable brand around high-quality, fashionable products. Since the company’s IPO in 2016, ATZAF stock has returned investors over 200%. Still, Aritzia remains a small-cap company valued at $3.4 billion, with a long-runway for growth.

My long-term bullish investment thesis for ATZAF hinges on three main factors:

- A superior strategy and business model – driven in large part by an experienced management team.

- Strong and improving fundamentals vs peers.

- An attractive risk-return profile given the company’s current valuation and growth potential.”

// GGI 💬

In conclusion the author opines that this is an asymmetric risk-return profile with an MoS of 60%+ and a 10 year annual return of 17%+. We concur.

Mar 7, 2023

SA // buy: Undervalued Retail Fashion Powerhouse

“You may have noticed that Aritzia (TSX:ATZ:CA) boutique stores have been steadily showing up in your or your significant other’s favourite shopping destinations with fashionable interior design. Aritzia boutique stores seem to be drawing traffic from both fast fashion go-to places such as Zara and H&M or luxury go-to places like Nordstrom (JWN).

Aritzia stands as a solid fashion business with a virtuous flying wheel built on its fully integrated supply chain. It is valued relatively cheaper compared to other well-known names such as Lululemon and Canada Goose. The payment by Aritzia for a secondary offering is questionable and inventory built-up is fairly concerning if not addressed in the coming quarters.”

// GGI 💬

The author points out “the number of days that it takes Aritzia to move its inventory has increased from 81.4 days in Q2 2022 to 123.9 days in Q3 2023.” This is worth monitoring if you’re going to become an Aritzia owner.

Green Garage Investing offers a semi-DIY subscription service to help long term oriented investors outperform the stock market index.

- Strike Price List: https://www.patreon.com/greengarage ( < 🍺 per month )

- Newsletter: https://greengarageinvesting.com/newsletter/ ( free weekly )