NOTE: This report is a Quick Take. We crunched the numbers to come up with a Strike Price. We do not have an in-depth understanding of the products, production capacity, capex, catalysts, risks, markets, competition, moat, management, etc. Buying below our Strike Price could be a reasonable entry point for long-term investors to buy this on sale.

// 🍑 〰️

Who doesn’t love a trip to Home Depot? At least at the beginning of a project. By the fourth trip in your project it gets kinda tedious, but by then you probably know exactly which aisle to hit.

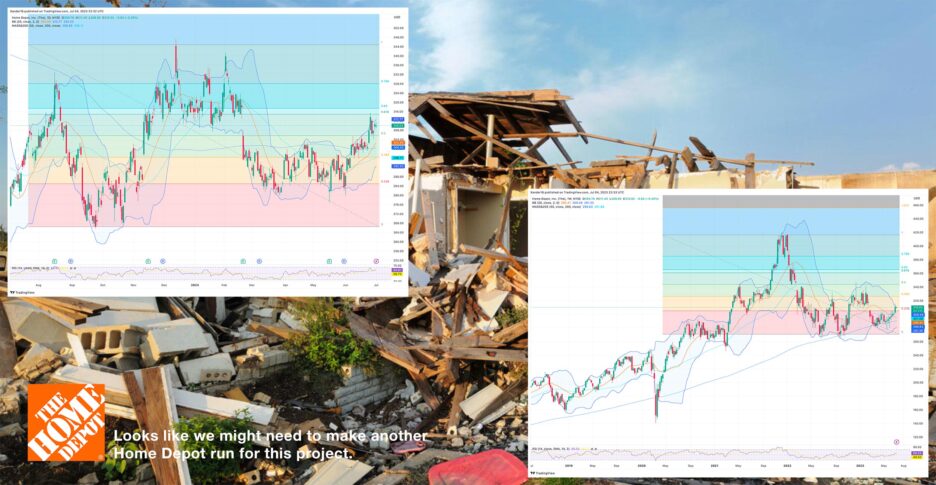

Home Depot is a solid blue chip company with a well established brand moat and pricing power. Management has been getting the job done for decades. The company has dividends and buybacks for shareholders, yellow tag sales for customers and if need be, it seems like a decent place to work at. The company is very much representative of the economy as a whole. Bathroom renos and outdoor living rooms are bought when times are good.

But occasionally that economy can burst its tech bubble (2000), collapse its housing and mortgage markets (2008), or go into chaos-mode from a pandemic (2020). The growth rate of $HD appears to be decreasing but at the right price and including the yield one could outperform the market with this stock. One doesn’t need a huge margin of safety with this stock, as its blue chip-ness should endure, but a margin of safety is still required to protect your downside risk and maximize your upside potential.