Tesla » TSLA // Consumer Discretionary Sector // Strike Price = $282 {subscribe: we are open sourcing this one}

The Tesla thesis is all about the plethora of catalysts they have and not what Elon does with Twitter/X or any other of his endeavours, or whether or not you think he is too right or left or alien or whatever. They are all virtually irrelevant to Team Tesla and their master plans 🔗

Catalysts:

- Model Y became the best selling car on the planet in Q1 2023 (taking over from Toyota Rav 4) with sales of 267,200. Expect that lead to continue and to grow.

- Cybertruck production starts ramping by Q4 2023. They have 1.8 million pre-orders. These trucks are going to blow people’s minds when they first see them in real life. Their specs will be superb and the starting price will likely be $50k. Expect them to become the best selling truck on the planet once the gigafactory in Austin is fully ramped up in a few years.

- The gigafactory in Berlin was at 5000 units per week earlier in 2023. Expect this to quadruple within a few years.

- Model 2 or whatever they call the smaller vehicle that will be built at the gigafactory in Mexico will enable many more people globally to afford a Tesla. Starting price will likely be around $25K. Launching in 2025.

- More gigafactories TBA in the near future.

- More semi trucks. The constraint is batteries. Demand is endless considering how many they can make annually–50k starting in 2024. There are 3 million semi trucks registered in the US spewing diesel fumes and costing way more to maintain and operate than the EV equivalent.

- Storage battery business (for residential and commercial/grid use) is taking off with YoY deployment growth of 222%. Q2 storage revenues increased 74% YoY to $1.5B (6.1% of their revenue).

- Full self-driving (FSD) and hence robotaxis: Tesla is gathering data at a 2M mile pace per day. Waymo is at 1M per month. Waymo, etc use lidar, radar, maps, vision and processing. They will remain geo-fenced for a while yet. Tesla uses vision and processing. Like a human. They are checking off edge-cases daily. Ultimately they will win this race. In the meantime, if you are lucky enough to have Tesla with the FSD package enjoy the near autonomous driving experience you already get.

- Car operating systems. There is likely to be only 2 or 3 primaries. Think iOS and Android. Other OEMs will be licensing the OS from Tesla. With FSD will likely come an app store. Tesla will get a cut of all the edutainment that runs through the vehicle’s OS.

- Charging network. This will replace most gas stations. Think food and entertainment along with charging.

- Lithium refining and who knows what else in the battery metals space. But perhaps this isn’t a catalyst, just business sense to make their battery supply chain more antifragile.

Did we miss anything?

Oh yeah. Humanoid robots. Optimus. Expected launch 2025 to 2027. Expect the former for Tesla to be utilizing them. Expect the latter for public use. Expect EVERYBODY to want to have one in their home. Vehicles sell in the millions, these will sell in the billions. Expect a price of $20k-ish.

Risks:

Eventually they do what they say but there can be delays. Expect some delays.

Is Tesla ready to forge ahead if Elon gets taken out by the proverbial bus. They are getting close but it would be nice to know who their Tim Cook is going to be.

The competition is coming. Not really. Tesla has a major head start, they innovate very quickly, attract the top notch engineering talent and barely even bother with patents because who cares if a competitor figures out 3 year old tech. Tesla makes money on each EV they sell. Ex-BYD, everyone else loses money on each EV sold. E.G. Ford loses about $60,000 for each EV they sell. Ouch. The legacy companies in this industry are going to experience bankruptcies and M&A.

That being said, not everyone wants to drive a Tesla and they can only build supply so fast so as far as hardware goes, they will have viable competitors, but on the software side, those competitors may well be licensing their software from Tesla.

Macroeconomics can take the stock for a ride to the dark side any time. But as they say, this too shall pass. The patient will be rewarded. (Buffett: “The stock market is a device for transferring money from the impatient to the patient.”)

Conclusion:

Is there a better opportunity in the stock market? (BTC may be, but it’s not in the stock market.) Volatility is not the same as risk but sometimes that aforementioned patience needs to be in the buying and not just the selling.

We recommend abiding by the strike price. Normally we aren’t the biggest fans of DCAing but this is an exception to the rule. If you are going to buy above the Strike Price make sure you are going to make more than one purchase, preferably so that your cost-basis is below the Strike Price. For long-term investors it makes it much easier to sleep at night when that volatility cuts deep. (Traders, you do you.)

// SOME FINANCIAL NUMBERS & ANALYSIS

- 10 year CAGR = 40.4%

- Jul 28, 2013 to 2023 || $9 -> $266 || high of $414 in Nov 2021

- 5 year CAGR = 30%

- 162% above 52 week low of $102

- Short Interest = 3.4%

- MoS Applied = 50%

Shockingly low amount of short interest considering how many people think this company is overvalued. Perhaps not as many people actually believe that enough to lay their cash on the line despite publicly bashing the valuation and the company/CEO.

Due to the volatile nature of this stock we normally prefer more MoS, but for long-term investors this price level will likely seem cheap. And with Cybertruck on the cusp of rolling out, the stock is likely to get re-rated to a higher level. There is a chance the Cybertruck gets further delayed or is a dud, but we expect this vehicle to be an absolute game changer. In 1999 one could all of a sudden buy all kinds of products with the new iMac aesthetic. The same will happen with the Cybertruck aesthetic.

- Future Growth Rate Estimate: 28%

- Previous 3 year EPS = $0.25 to $4.02 for 1508% growth (neg. #s pre 2020)

- Next 5 year estimates EPS = $3.45 to $8.5 for 146% growth

- Previous 5 year Revenue = $21.5B to $81.5B for 279% growth

- Next 5 year estimates Revenue = $100B to $325B for 225% growth

To have a company as large as Tesla ($850B market cap) growing at 28% is phenomenal. The thing is, we think that is actually a conservative estimate as it really only factors in vehicle production and not software or energy, let alone robots.

- 5 year Price Target = $911

- Price to Sales/Revenue multiple = 8

- Sector median P/S (ttm) = 0.9

- Current P/S = 9 with a 5 year average of 10.2

- Change in shares outstanding (dilution or buybacks) = -10%

If they grow like we expect, the multiple of 8 is conservative. If we use their 5 year average of 10 we get $1139. Even with the lower multiple that’s over a 3x in 5 years. Tough to beat.

- Price to Free Cash Flow per Share = 136.4 🤔

- Operating Margin = 13% 🤔(was 15% after Q1)

- Return on Invested Capital = 21% 😀

- Long Term Debt to Total Assets = 1% 😀

- Cash & Equivalents to Total Operating Expense = 306% 😀

Not enough revenue is making it all the way to FCF yet, but they have a lot of R&D and CapEx to do and that ROIC is rock solid. Virtually no debt and cash on hand for 3 years of operations is excellent. The margin slippage has been a big deal of late. It was an offensive move by Tesla to sacrifice some profit to capture market share. Short term pain, long term gain. Astute management decision. It also enabled many people to invest at a great entry point.

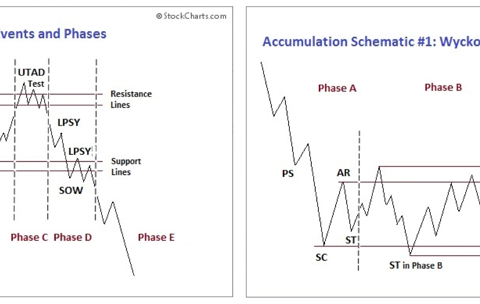

// THE CHART + 🍑 〰️

The golden cross by the 50 day MA was late June with a price in the $250s. The stock price quickly got to the Fibonacci golden pocket in the $290s but was rejected due to margin slippage and the temporary hit to earnings. If you don’t have your position in place, now is your opportunity, before the Cybtertruck catalyst kicks into gear. Chances are the stock price doesn’t get rejected at the golden pocket the next time it tests it.

// OFFICIAL PROFILE

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. It operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, retail merchandise, and vehicle insurance services. This segment also provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers, and in-app upgrades; purchase financing and leasing services; services for electric vehicles through its company-owned service locations and Tesla mobile service technicians; and vehicle limited warranties and extended service plans. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners; and provision of service and repairs to its energy product customers, including under warranty, as well as various financing options to its solar customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was incorporated in 2003 and is headquartered in Austin, Texas.

// NEWS, REVIEWS & COMMENTS

Seeking Alpha, last 10 articles:

- Strong Buy: 1

- Buy:3

- Hold: 5

- Sell: 1

- Strong Sell: 0

All 10 articles written since July 25, 2023.

Jul 29, 2023

Hold // Love Me Or Leave Me 🔗

- Despite the recent correction following the fiscal Q2 2023 earnings call, Tesla, Inc. stock still has managed to retain much of its premium and recovery from the January 2023 bottom.

- Elon Musk’s plan to flood the market with Tesla EVs appears to be working for now, with expanding Service gross margins despite the impacted Automotive gross margins.

- We have seen many tech giants turn to this subscription strategy, such as Amazon’s Prime membership and Nvidia Corporation’s GeForce Now/ Omniverse Cloud Service/ NeMo generative AI.

Combined with its overly fast and furious rally thus far, we are uncertain if it is smart to add here, due to the reduced upside potential to our price target of $303.98, based on its 1Y P/E mean of 48.56x and the market analysts’ FY2025 EPS projection of $6.26.

Then again, with TSLA’s P/E valuations wildly swinging between its 1Y high of 79.03x and 1Y low of 20.31x, it appears that Mr. Market is unable to make up its mind as well.

As a result of the potential volatility, we prefer to rate the TSLA stock as a Hold here. Anyone looking to add may consider doing so at its previous Q1’23 resistance levels of $200 for an improved margin of safety.

// GGI 💬

They use a section title in the article, “Tesla Is Not An Investment That Is For The Faint-Hearted.” True. One has to be able to emotionally withstand the volatility in owning Tesla stock. Those that do will likely be rewarded. It can also require boldness to buy in. There is a chance we should be keeping our Strike Price at $222 or even $200 as the article suggests, but it seems like the puck is headed into the offensive zone and not retreating. It’s already did that. Go to where the puck is going.

Jul 28, 2023

Buy // Margin Flexibility Shows A Key Advantage 🔗

- Many analysts have pointed to the recent margin decline in Tesla, Inc. as a sign of future challenges.

- Tesla’s margin flexibility gives the company a significant advantage in the coming battle against traditional automakers.

- Wall Street has rewarded companies with higher revenue growth rates and modest margins compared to companies with modest revenue growth and high margins.

- Even at 25% YoY revenue growth, Tesla’s annualized revenue should hit $500 billion by 2030, giving the company more than 20% revenue share in annual auto sales.

The consensus estimate for 2 fiscal years ahead shows that all the traditional automakers would deliver modest single-digit growth while Tesla could show more than 30% YoY revenue growth. The higher revenue base and growth rate of Tesla could lead to a rapid decline in market share for these traditional automakers. Reuters has recently reported that seven major automakers are forming a company to build a national EV charging network that will rival Tesla’s supercharger network. This shows the threat felt by traditional players due to the growth of Tesla’s market share in total auto sales. Tesla stock is a bit pricey at a P/E multiple of 75, but the long-term revenue growth and future monetization options make it a good bet.

// GGI 💬

“20% revenue share in annual auto sales.” 1 in 5 new vehicles sold in 2030 will be Teslas. Let that sink in. It’s hard to believe, but that’s the conclusion many analysts have been coming to over the past couple years.

Jul 28, 2023

Strong Buy // The Common Sense Approach To Investing In Tesla 🔗

- Tesla, Inc. bears are not considering the long-term potential of the company, they do not understand Tesla’s strategy, nor do they have the patience and discipline to benefit from it.

- Concerns about Tesla’s falling margins and high valuation multiples are not what long-term investors should be focusing on. That is a short-sighted viewpoint on the company.

- Despite production delays and doubts about self-driving cars, the demand for Tesla’s products remains strong, with high revenue growth, and the company’s innovation should not be underestimated.

- Tesla is extremely financially strong, with over $23B in cash and investments with a 2.9% debt to equity ratio. They can afford to invest in capturing market share.

- Tesla is not just a car company, but also a sustainable energy company with the best visionary CEO and founder and talented employees, who are playing the long game.

If you have the time horizon, patience, and discipline to hold and follow Tesla Stock, just ask yourself these questions, Do I believe the following:

- Will Tesla innovate and create new vehicles that will break into new markets and gain more customers?

- Will Tesla find new ways to lower costs on the creation of vehicles and factories to improve margins and reduce time to production?

- Will Tesla find a way to get full self-driving cars scaled across the country, approved by regulators, and build a robotaxi business?

- When inflation and interest rates come down, will more people purchase Tesla vehicles?

- Could Tesla revolutionize how cars are built further leveraging AI robots and new manufacturing processes?

- Could Tesla integrate other products and create offerings from the other Elon Musk run companies?

- Will Tesla spend more efforts or add headcount to capture a market leading first mover advantage in energy storage globally?

- Can Tesla continue to operate with higher gross and operating margins than the competition? And ask yourself are they fiscally strong, to be able to focus on scale?

- Does Tesla have some of the best AI and manufacturing talent in the world?

- Could Tesla create a whole new AI product that we did not anticipate to generate revenues and margins?

// GGI 💬

If you are going to read one of these articles, make it this one.

Jul 27, 2023

Sell // 5 Key Concerns 🔗

- The stock of Tesla, Inc. has risen nearly 150% in 2023 after a massive 14-month decline.

- By many key valuation metrics, Tesla shares appear priced for perfection even as the company continues to ramp up production at an impressive pace.

- Five key concerns shareholders should have around Tesla after the massive rally in its stock year-to-date are highlighted below.

// GGI 💬

- Valuation

Great companies get high valuations. Apple and Microsoft rarely dip below their intrinsic value these days. - Consumer Demand/Interest Rates

Interest rates cause demand to suffer which is precisely the environment in which the strong thrive and the weak die. - The Law of Large Numbers

Great companies create flywheels so that each product builds on the previous so that as one market gets saturated the next hits growth. Apple made computers and then laptops, phones, tablets, watches and now AR/VR as well as adding services on top of all that hardware. - Declining Operating Margins

Sacrificing high margins in tough times to capture market share and put pressure on the competition seems like an astute strategy. Greater market share will lead to greater demand which will then improve margins. - Musk’s Many Distractions

Would there be anything different about Tesla today if Musk was solely focused on it? In 2017 when Tesla was ramping the Model 3 and on the verge of bankruptcy, Musk was 100% focused on Tesla, sleeping at the factory for months. Our guess is he would do it again if necessary but it’s unlikely to be necessary.