Risk Reward Ratio = 35.6% // Overall Quality Score 70.0 out of 100

Strike Price = US$431 at 50% margin of safety or $577 at 33% MoS

NOTE: The strike price calculation include a 12.5% padding of the EPS (fwd) to compensate for R&D etc being part of OpEx and not CapEx where it would be depreciable. If I used a full 25% padding the 50% MoS strike price would be $478. The stock doesn’t feel that inexpensive after the run it has had going from about $320 in early December to $475 now in mid-Feb, but it is not as over-valued as some companies.

Trade Entry Price = $453 (subject to change at a whim due to market vicissitudes)

Stock Price at publication: $473.28

// STORY

Being V-Day I should have looked at $MTCH today but I decided to swipe left on it. $META has less hook-up but more future growth potential.

I regularly, but not frequently, use Facebook, Instagram and WhatsApp. My sister recently called WhatsApp the greatest app ever because it enables free communication in various forms all around the world. Important for her professorial work. I might argue the App Store is the greatest app ever, but some might call that pedantic or something.

I basically despise Mark Zuckerberg. I can listen to him on a podcast and he is tolerable, but the sight of him causes a visceral revulsion. E.g. His electric surfboarding July 4th video. So cringe.

His i’m an influencer, this isn’t an ad review of Apple’s VisionPro and its promotion of his Oculus Quest whatever brings forth in me, that feeling so eloquently explained by Valley girl talk, like, gag me with a spoon.

I once went to Zuck’s metaverse. It was neat being underwater with sharks. The restaurant game is the dumbest thing ever. I don’t need to go to that metaverse again. But I do kinda want the VisionPro (long-time Apple device user here). It could provide a lot of screen real estate for charts and things. Although I hope I don’t ever wear those ski goggles walking around in public — except on an airplane.

Anyway, here’s Meta’s company profile:

Meta Platforms, Inc. engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately. The Reality Labs segment provides augmented and virtual reality related products comprising consumer hardware, software, and content that help people feel connected, anytime, and anywhere. The company was formerly known as Facebook, Inc. and changed its name to Meta Platforms, Inc. in October 2021. The company was incorporated in 2004 and is headquartered in Menlo Park, California.

TL:DR

They sell ads after collecting and collating your data by providing for free a glorified address book, telephone and photo album that you populate with content on their behalf. You are their product. There is also the freedom of speech vs control debate.

The pro is this turns out to be a very lucrative business model. Amongst the cons are that social media can be as addictive as nicotine and as unhealthy as high-fructose corn syrup.

I am personally unlikely to invest in $META, but it is a high flying company and I understand if it is your kind of investment cup-o-tea. But like any investment it is worth understanding the intrinsic value and thus the amount of MoS you want to apply in order to try to maximize your CAGR.

One aspect of $META that I don’t fully grasp is what they are doing with AI and how is this an AI play. I doubt the stock price would be up 285% since Jan 2023 if investors didn’t consider this as part of the AI era.

According to ChattyG this is “how meta is utilizing ai”:

Meta, formerly known as Facebook, is utilizing AI in a variety of ways across its platforms:

- Content Moderation: Meta uses machine learning and natural language processing to screen for and remove offensive material such as sexual and violent content1.

- Virtual Reality: Meta uses computer vision algorithms to track user movement in real-time for its Oculus product1.

- Customized Product Experiences: Meta uses decentralized AI tooling to create customized product experiences in various domains, from video feed ranking to helping people discover new VR experiences in Meta Horizon Worlds2.

- Generative AI Experiences: Meta has introduced over 20 new ways it is tapping generative AI to enhance experiences on Facebook, Instagram, Messenger, and WhatsApp. This includes upgrades to its Meta AI assistant, more social and creative features, using AI to aid creators, and more3.

- AI Chatbot: The Meta AI chatbot, along with 28 specialized AI “characters,” is available across all Meta platforms, including Oculus VR and Ray-Ban Meta smart glasses4.

Please note that these are just a few examples of how Meta is utilizing AI. The company is continually exploring new applications of AI to enhance user experiences and improve its products5.

According to Meta themselves:

Meta’s generative AI investments are focused on helping marketers to do their best work, by allowing them to launch & test ad creatives faster and easily reach the audiences they care about.

Seriously. Thanks Mark. So visionary.

But here’s a Meta is a Strong Buy author on Seeking Alpha:

As heard in the most recent earnings call, Mark Zuckerberg has begun shifting his focus towards increasing user engagement time and I think this is key. The open-sourcing of Llama 2, Meta’s Large Language Model, will help increase user interaction and facilitate better data collection, allowing for more personalized content. Heading into 2024, Meta has committed to invest up to $37 billion in digital infrastructure. Part of this investment will go towards purchasing technologies to program Llama 3.

Yeah, I’m biased. But the numbers aren’t …

// METRICS

Overall Growth Rates:

The past 5 years the stock has a 22.9% CAGR. Over 10 years it’s 21.2%. After crunching the past financial numbers, looking at future expectations and assessing valuations, I give them a 16% average growth rate over the next 5 years.

Revenue:

Over the previous 5 years revenue grew at a 13.8% CAGR. Revenue (ttm) is $134.9B. In 2024 it is expected to grow 17.4%. In 2025 expected growth is 12.2%.

Net Income & Earnings Per Share:

Over the previous 5 years net income grew at a 16.2% CAGR. EPS (fwd) is $19.94. In 2024 the EPS is expected to grow at 34.1%. In 2025 expected growth is 15.2%.

Free Cash Flow & Return on Invested Capital:

The FCF margin is 23.5% and the actual FCF/s (ttm) is $17.03 so they have a P/FCF ratio of 27.8. For comparison, $MSFT is not as good a value with a P/FCF of 43.8.

The ROIC is a solid 20.5%. $MSFT is 25.3%.

Gross Profit, Operating Income & R&D Margins:

GP (ttm) is a solid 80.7%. OpInc (ttm) is 36.3%. 2 years ago it was 28.8% and 5 years ago 41%. R&D margin is 27.4% versus 12.1% for $MSFT. That’s a lot of R&D for a company that tends to buy rather than create new products. Maybe the metaverse will be different.

Cash & Debt:

They have a cash to operating expense ratio of only 109.2%. Money to burn on R&D, share buybacks and now even dividends. Dividends are a sign of maturity and stability. Also an admission you don’t know how to utilize that money to grow it.

Long term debt to total asset ratio is a reasonable 8%.

Price to Sales (revenue) Ratio:

PS ratio (ttm) is 8.7. The sector average is 1.25. Meta’s 5 year average is 7.4. They are 17.9% above their average. Optimally I would want to buy their stock 25% below the average, but unless the market gets very grumpy and reprices everything I expect their average multiple to increase as investors are digging the quality of their revenue growth and sales efficiency.

$MSFT have a PS ratio of 13.2 and a 5 year average of 10.7. Multiples grow as moats expand. $META has brand and network moats and is working on switching and toll moats.

NOTE: Moats or durable competitive advantages include Brand, Switching, Secrets, Tolls, Price (low) and Networks.

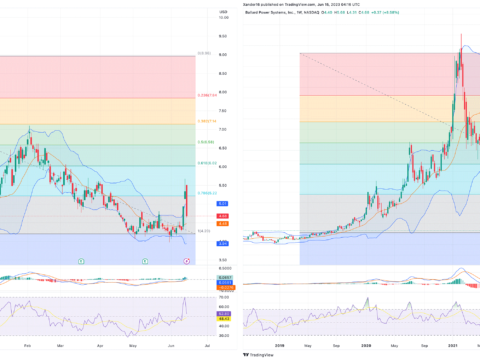

// CHART

https://www.tradingview.com/symbols/NASDAQ-META/

All the indicators need a cold shower. Not a long one but coming down to test strike price of $431 would be good. Strike is about 1/3 the way down from the 1.272 fibonacci.

Unless the macro heads south and the stock price retests support at the previous ATH (~$383), I would bet it first tests the 1.618 fibonacci at $560.

Then again, we are due for an S&P dip of 5-10%. Yesterday it looked like that might begin as inflation wasn’t quite what they expected, but the bulls battled back for a 1% gain.

// A Peak Behind the Scenes of the Green Garage Investing Process

Normally I publish these reports behind a paywall for my Patreon subscribers.

Anyone can look at a chart and see if a stock is expensive or cheap, but analyzing the financial statements, doing qualitative research and coming up with an intrinsic value of the company, and thus a strike price so one can gauge the amount of margin of safety they are getting if they buy the stock at the current price, is a much more involved process.

Please reach out if you have any questions.

Regards and good luck to us all,

Alec