Well said, From Growth to Value:

There has been much talk about a tech bubble lately or even that ‘the market’ is overvalued as a whole. These statements might have been a reason of concern for you and that’s why I wanted to address them.

Humans are naturally attracted to pessimism because evolutionary, this had an advantage over optimism. Thinking that the source of that rustle could be a mountain lion and not prey could save your life.

But in investing, it’s the opposite. As Morgan Housel once put it: Pessimism makes you sound smart, optimism makes you money.

For years, I have been hearing that the market has been overvalued and the Potential Multibagger stocks have been called overvalued since I picked the very first stock, Shopify (SHOP), at $77.86 in May 2017.

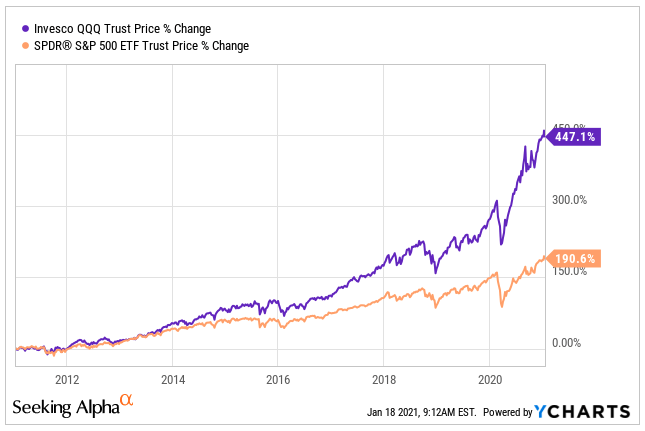

The tech sector has outpaced all other sectors, making many think that there is a new dotcom-like bubble brewing. While you won’t hear me claim that the best stocks are cheap, I don’t see a dotcom-like bubble, but a much more fundamental change that investors who call this a bubble might have missed.

Source: https://seekingalpha.com/…

Love the concept of growth to value and agree with his assessment of the importance of revenue growth. Ya’ll may want to read his articles so you can learn useful facts like “2010 is a tipping point. In that year, software spending overtook that of industrial equipment, and it keeps widening the gap.”