“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

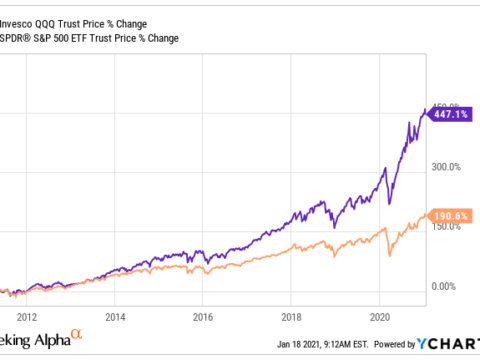

Bond yields, inflation, QE, stimulus, interest rates, The Fed, earnings calls, innovation, tech wreck, Dr Copper, Covid, cryptos, real estate, GDP, Shiller PE, GameStonk, etc. So many factors. Some are predicting doom, some are saying let the bulls run. But the reality is that except for a couple green days the last couple weeks has been rather difficult. We can’t help but wonder if this bond yield increase sell-off is Wall St taking profits to teach the retailers a lesson for causing a short squeeze on GameStop and other crappy businesses and for all the SPAC-happiness that is detracting from their cash-cow IPO business.

How low can this dip go? Hopefully this is about it as we are just under resistance at about 3780S&P and we stop worrying about bond yields and things and follow the direction of positive earnings calls, commodity prices rising, stimulus and vaccine dissemination. If the positive factors lose this debate then it looks like the next stop is 3500S&P That is going to ouch.

Take some profits for buying into the dip but don’t panic and remember the above quoted words of Buffett.