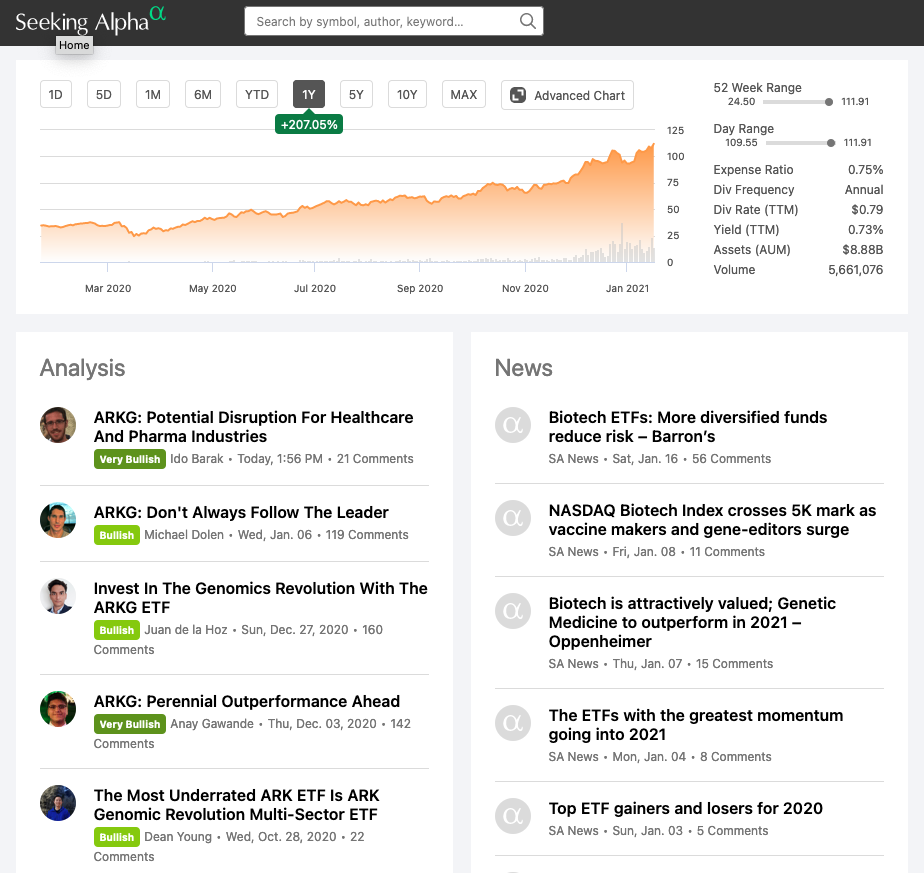

We first bought ARKG in July 2020 and it has pretty much already doubled. Normally we don’t buy ETFs as we figure we can do better with individual stock picks. ETFs are generally too much diversification, or diworsification as Peter Lynch called it. However, biotech is complicated stuff, scientifically speaking, and a drug can get to phase 3 trials and fail so it can be rather hit-or-miss with long periods of being pre-revenue. Also our area of expertise is green energy so adding biotech to our core competency would take much effort. In this case it makes sense to defer to an ETF.

One thing we can be sure of is that biotech and genomics in general are going to have a massive decade so we think it is important to have some exposure to it in your portfolio. Significant exposure even. The price of genome sequencing has gone from a million dollars about a decade ago to $1000 now. That is game changing stuff. That is like an EV battery going from $10,000 to $1. So for us, given ARK Invest and Cathie Woods best-in-class disruptive tech investing chops, their ARK Genomic Revolution ETF makes total sense. We get “exposure to CRISPR, gene editing, therapeutics, agricultural biology and health care innovation.”

And a bunch of Seeking Alpha authors seem to agree: https://seekingalpha.com/symbol/ARKG

As does Solving The Money Problem’s I-only-invest-in-Tesla, who has now recently allowed ARKG into his otherwise spotless Tesla portfolio: https://www.youtube.com/…

We can’t really give ARKG a strike price as it isn’t revenue or earnings constrained like an individual company. We recommend buying on red days. And don’t be afraid to have a significant position. But tranche in over time. And don’t plan on selling it for at least 5 years so it has time to really do its thing and battle past any serious market-wide dips that could happen along the way. Think of it as a store of value, like bitcoin or gold or a savings account.