American Manganese AMY.V

https://americanmanganeseinc.com

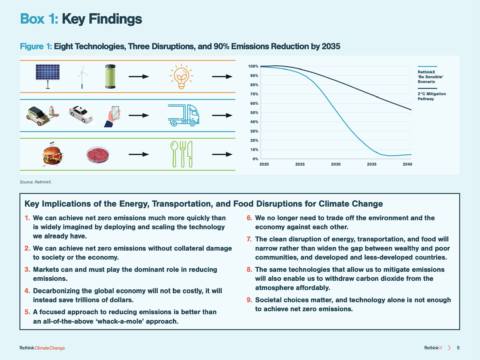

Key Insight: US gov stockpile of manganese in Arizona should be easy pickings but it is the battery recycling we are really interested in. Huge potential if they can build multiple commercial plants.

Management: They still got good ol’ Larry at the helm. Can he drive the bus across the battery recycling finish line? (He doesn’t even have to be first, just has to finish.)

Analysis Summary: They are starting to make cathodes, but mainly they have two aspects to the business; battery recycling and manganese ore processing. The patented battery recycling process uses hydrometallurgy that is cleaner than pyrometallurgy or chemical extraction. We expect first commercial production plant by 2023 and process 3 MT per day which gives a revenue of about $18M. The manganese ore processing of the US gov stock pile in Arizona we estimate to be about $32.5M (minus 25% for precaution) in revenue per year starting in 2022. $42.5M revenue times 15x equals a market cap of $637.5M. Current market cap is $190M.

Catalyst: Stockpile processing 2022, Commercial Recycling 2023

Recommendation: Battery recycling aspect likely to drive bigger stock price growth in 2023 and beyond.

- Hold time of 5 years.

- Risk profile of 7 out of 10.

- Strike price of $0.60.

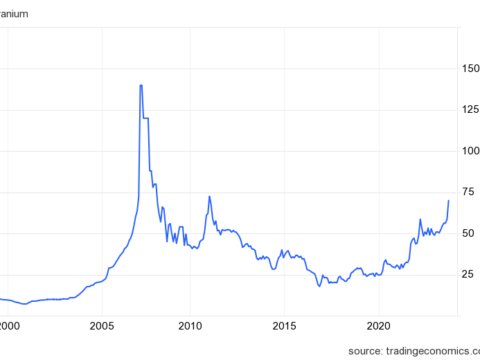

https://seekingalpha.com/article/4390266-look-manganese-sector-and-of-main-miners

“Artillery Peak represents one of the largest manganese reserves in the United States, with estimated reserves of 159 million tons of manganese ore graded 3.9% manganese metal.”

https://gosar.house.gov/news/documentsingle.aspx?DocumentID=4077

“The successful execution of this project could transform an unwanted stockpile of low-grade material, long ago paid for by the U.S. taxpayer, into a National Defense Stockpile stockpile material (EMM). The U.S. simply cannot remain dependent on Chinese supply chains — particularly when electrolytic manganese metal is a designated strategic defense mineral.”