Remember last April and May and their was no toilet paper at the grocery store and people were losing their jobs and the pandemic was ramping up and we didn’t know how long it would last and so the Fed printed some money and the stock market roared and the recovery was more a swoosh than a V? And now the US has practically beaten Covid down and the party is about to get rolling again and the Q1 earnings calls of any tech-related company have been for the most part exceptional and yet it seems like the stock market is puking unless you are investing in oil or potash or steel or lumber or things that we don’t really care about unless they are trying to do it in a more efficient and environmentally sustainable way.

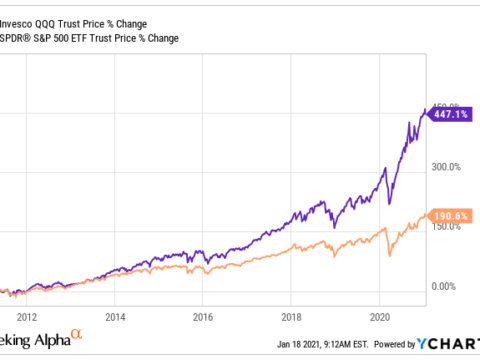

Technically we are still in a bull market that started back when Obama wasn’t grey-haired, but right now it feels like the bull is out back taking a dump. The bull will be back charging … 6000SPX?? … at least until the debt/inflation/fiat breakdown/social unrest/income inequality/fourth turning completion, etc. really takes hold and brings out Da Bears for a couple years (mid-decade perhaps) and we can really transition to the Seba-society we aspire for.

Value investing is our foundation, but it is tech-related and thus growth companies that are going to electrify our collective bus and drive it to where as a civilization we want. We are sure the bull will charge in our direction again in the near future but in the meantime we need to be patient while the value guys reap some of the benefit of this bull market too. It’s good to share the proceeds of this bull market all around as ARK’s Cathy Wood has explained. However, it is certainly getting a little frustrating watching our forward-looking companies stock prices circle the drain like this. But it is also certainly providing some great prices for those that want to get in on the future leading companies. See our recently analyzed list on the right column for some future leader examples.

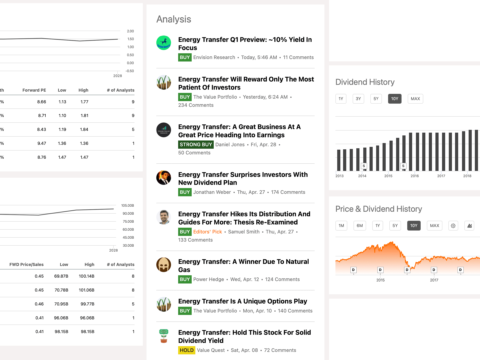

Speaking of patience, if you have holdings in the red, of companies that you like a lot and want to see succeed, then don’t despair and give in to Wall St tempting you to sell for a loss. Taking money from retailers is their definition of success. Allegedly! It feels like the Wall St algos are grinding the market caps of Tesla etc down as far as they can so they can start buying these future winners on sale. They too know what buying at a margin of safety means. And once they have their MoS prices for these forward-looking companies they will be buying hand over fist.