By now you are likely aware of this tweet from Elon that put Tesla and Bitcoin into a collision and has caused an existential crises in the Green Garage as two our favourite things are not supposed to do that to each other.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

For the most part Elon’s message was crypto-positive except the part about not accepting bitcoin for payment for a Tesla car. But who cares, bitcoin purchases were likely a fraction of a percent of vehicles sold lately. As Russell Okung stated, “I wouldn’t buy a Tesla with Bitcoin anyway.”

However, we think there was an ulterior motive for Elon dropping this. He needs to distance Tesla from bitcoin a bit to get in on the transportation fuel credits that are being proposed in order to continue to close the transportation/energy loop and have all aspects of the biz covered. Charging networks need clean and reliable energy. Credits and Tesla engineering know-how can make this happen.

Tesla needs clean/reliable⚡️for charging stations (CS) esp. as 🚛rolls out. Next to CS they take🗑💩, turn into ⚡️, charge 🚗🚛, collect credits (see article). Bonus, they crypto-mine at CS with excess ⚡️ Doesn’t explain dumping on $BTC; does appearing squeaky clean get credits? https://t.co/2YWRMudAmk

— Green Garage Investing Ltd. (@GreenGarageInv) May 13, 2021

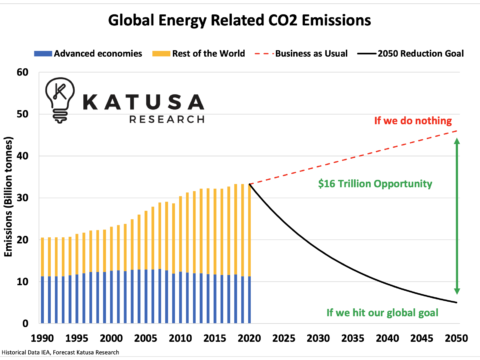

The problem is the EPA who control the credits have likely been buying the bitcoin energy FUD. It appears that big finance are now attacking cryptos like big oil attacked green energy and set us back for years if not decades in our fight for a clean environment and a minimally globally warmed planet.

Yes bitcoin uses its fair share of energy and its nature makes it very easily quantifiable. But how much energy does the existing banking and financial system use for its millions of people, computers, servers buildings? We wish we could give you an answer to that but it is really hard to calculate. Hopefully somebody does attempt to crunch all that myriad of number. We would love to see a comparison and to better understand the true costs of creating, maintaining and protecting a dollar. Twitter is currently awash with tons of bitcoin energy FUD debunking. Here are a few sources to get you started in learning about this if you’re interested: @MichaelSaylor @NicCarter @DanHeld @YassineElmandjra

Square and ARK Invest even co-authored a white paper to argue that bitcoin is a key driver of renewable energy’s future:

If bitcoin needs anything, it’s more white papers. In this one, @Square and @ARKInvest team up to argue for bitcoin as a key driver of renewable energy’s future: https://t.co/UmayxNtCFJ

Hate reading? Here’s the nutshell version:

— Square Crypto (@sqcrypto) April 21, 2021

As energy is crucial to crypto-mining, miners usually seek the lowest energy prices which are now wind, solar and legacy hydro-electric. What good capitalist doesn’t seek the lowest input price for this product? See Tony Seba for more info about energy prices:

My latest energy report, co-authored with @adam_dorr:

“#TheGreatStranding: How Inaccurate Mainstream LCOE Estimates are Creating a Trillion-Dollar Bubble in Conventional Energy Assets.”

Available now! Free download: https://t.co/iahiPrzCXm#RethinkingEnergy #CleanDisruption

— Tony Seba (@tonyseba) March 11, 2021

Crypto-miners also mine near natural gas rigs that have to use flaring to control the flow or something. You can look into that if you care, but basically it is the burning and thus wasting of natural gas as it doesn’t even make it into the grid to be utilized. By setting up shop near these natural gas producers the crypto-miners can capture the flare and at least do something productive with the energy before the hydrocarbons get released into the atmosphere. In the interim this is acceptable but going forward natural gas will be replaced by renewables.

ARK estimate that 76% of bitcoin mining is done with renewable energy. As far as we understand only in China is coal still being used for bitcoin mining. In the rainy season they move their mining rigs to hydroelectric facilities as that is their cheapest option. Apparently, “About 60% of all the world’s currently circulating bitcoins were mined in China.” That number appears to be shrinking.

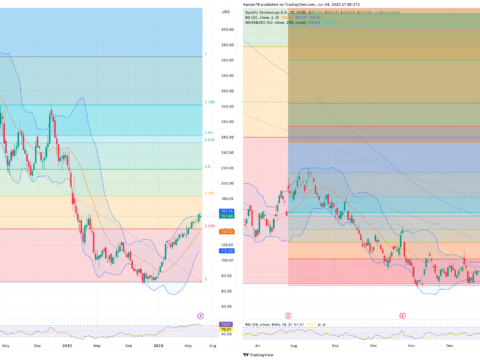

Anyway, it has been a tough couple days watching our favourite investments getting hammered, essentially because of each other. Seems like we have some very good buying prices for those so inclined. Just wish we knew how long the inflation fears that have been crushing growth stocks for the past couple months, will last? All that US federal stimulus and infrastructure spending was supposed to drive prices higher not kill the interesting part of the market.

Sometimes HODLing isn’t easy … $TSLA and $BTC are still two of the most important investments for this decade.

Image Source: The BakeKing

Update

Raoul Pal pretty much agrees …