Wish we knew this 3 months ago. But beware of what you wish for. That means you too, Bitcoiners.

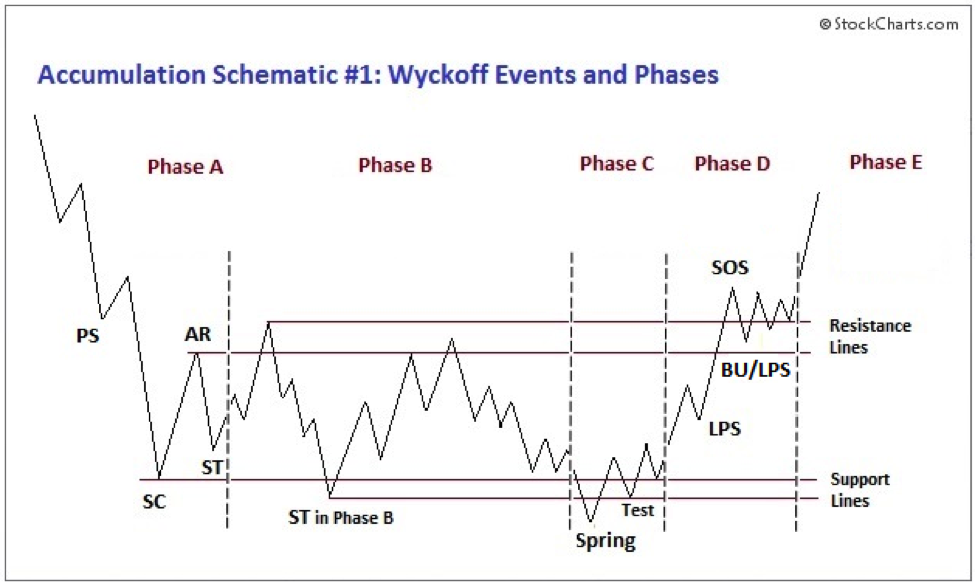

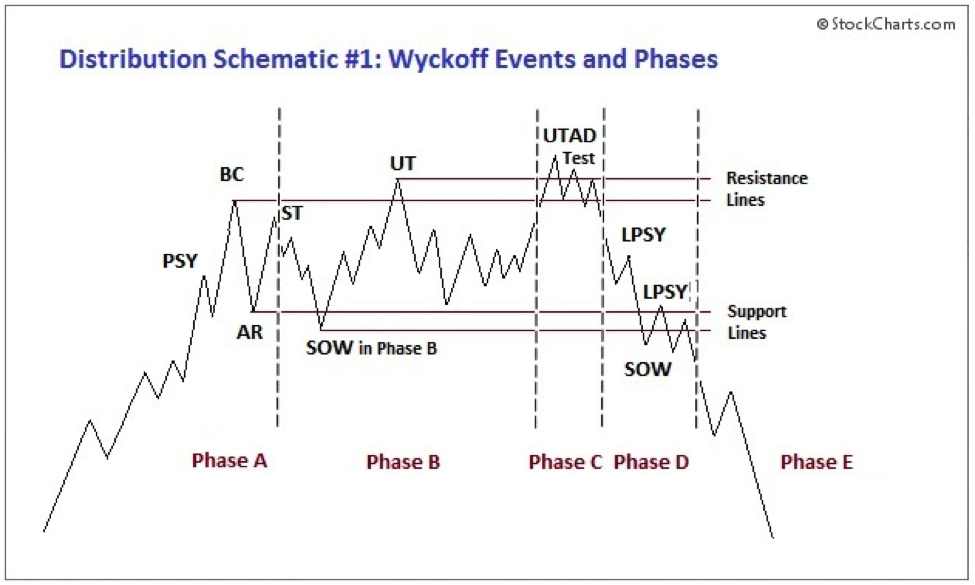

Yes we all applauded MicroStrategy getting into bitcoin and Michael Saylor showing off his playbook to his thousand favourite C-Suite friends, but that meant bitcoin was for more than retailers and the institutional fringe; that meant that the big players would also want in on that action. If you watch uncomplicated’s video (highly recommend – see below), it appears that we have proof that the large institutional investors are in on the game. The charts uncannily show their methods in action.

uncomplicated appears to have recognized a pattern in the bitcoin price action when it reached its all-time high in mid-April and then headed down until April 25th when he posted a video about it. As you may have noticed, the downward trajectory has continued since. And if the Wyckoff method is correct this could go on for a while yet as the big players test our resolve as low as $25K or even slightly less, to manipulate as much of your hard-earned crypto/money out of you as they can. They won’t go much below $25K as they don’t want to overdo the Fear Factor in the Fear and Greed Index or they will destroy the goose that is about to lay them some golden eggs.

Do not panic sell, retailers!! This too shall pass. Wyckoff has a way to pressure the price down and way to coax it up. And when the institutions are ready for it to go up, the fun will begin and we are liable to see the lofty numbers that PlanB and his stock to flow model predict. In the meantime HODL, accumulate if you can, don’t succumb to the pressure and the energy, etc. FUD and batten down the hatches if you are using leverage.

The Wyckoff Method:

This article provides an overview of Wyckoff’s theoretical and practical approaches to the markets, including guidelines for identifying trade candidates and entering long and short positions, analysis of accumulation and distribution trading ranges and an explanation of how to use Point and Figure charts to identify price targets. Although this article focuses exclusively on stocks, Wyckoff’s methods can be applied to any freely-traded market in which large institutional traders operate, including commodities, bonds and currencies.

→ https://school.stockcharts.com/doku.php?id=market_analysis:the_wyckoff_method

This is where they drive the price down and mess with your emotions. Buy in Phase C if you can.

This is where the fun is. Sell in Phase C if you can as the cycle is liable to repeat.

uncomplicated

Coin Bureau

Chicken Genius Singapore