This morning my friend texted me, “you were right and I was wrong. With Tesla taking Bitcoin as payment it’s time for me to get on board.” I’m guessing there are a few people thinking like my friend. Bitcoin the network is about to get more secure. You might want to some quick studying and get on board too.

As Chamath says, “invest in markets that have de-risked but not yet scaled.” If Bitcoin wasn’t de-risked before today thanks to Michael Saylor and his putting Bitcoin on MicroStrategy’s balance sheet (not to mention the legions of bitcoin miners, developers, culturati, hodlers, etc.), it is now that Tesla has put $1.5 billion of its cash reserves into Bitcoin.:

In a nutshell, why to invest in Bitcoin: It has a finite amount of coins so its value can’t be decreased by more printing and inflating. It’s going from a speculation to a store of value to a medium of exchange to the global reserve currency. Right now it is a store of value and developers are rapidly turning it into a medium of exchange. It’s like the internet in 1997, to quote @woonomic.

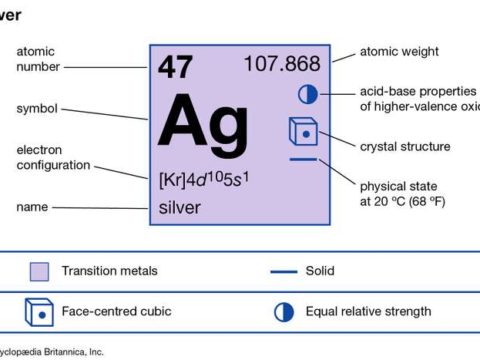

Bitcoin also works better than other currencies such as dollars or gold because it’s better tech. (The characteristics of money are durability, portability, divisibility, uniformity, limited supply and acceptability.) Bitcoin has network effects that are making it stronger all the time. It is code and therefore protected by the first amendment in the US. It gains value instead of loses it like fiat currency. E.G. According to @KingDavie24 an iPhone 2010 cost about 8556.3 Bitcoin than it does today. Or think about it as an iPhone costing about $750 in 2010 versus about$1500 in 2020. I don’t know about you, but my web design wages did not rise anywhere near 100%. In fact, they basically stagnated.

You can safely buy Bitcoin at various large coin exchanges: CoinSquare (Canada / referral code), CoinBase, BlockFi (referral code), Kraken, Binance, Cash App, etc. Stick with the large reputable exchanges if you are new to the game. Also if you are new, learn to HODL. You can be a day trader if you want to get fancy but for most buy and hold, and when you can, buy some more to hold. But remember the price will generally go down the day after you buy, but not to worry, that’s just the psychology of the market 🙂 You can play the halving cycle or you can hold for the decade and let the network scale. I don’t know how big the market cap for bitcoin is going to be in a decade but it could easily be 20x. If you don’t want to play the volatility game you could start with the Mayer Multiple.

We also own a bitcoin ETF called QBTC that trades in Canada. That way we can have bitcoin exposure in our TFSA (tax free savings account). In the US there is the GBTC. Look for the equivalents in your jurisdiction.

We recommend you do some of your own research so you understand what you are buying. It helps you sleep at night when the price is going down. Here are a few links:

- The Investor’s Podcast: Bitcoin Fundamentals (if you don’t have time to listen to all the podcasts at least listen to Episode 5 with the matter-of-fact Michael Saylor and perhaps Episode 1 as a primer)

- The Bullish Case For Bitcoin by Lyn Alden Schwartzer

- Bitcoin 1 Pager by Preston Pysh

- In Bitcoin We Trust by Sylvain Saurel

- What Bitcoin Did Podcast

- Real Vision

- ARK Invest White Paper: Bitcoin as an Investment

- Miller Value Partners: The Value Investor’s Case for … Bitcoin?!

- The Bitcoin Black Hole Effect | Hyperbitcoinization. The path to becoming the world’s dominant form of money

@JeffBooth The power of sound money 😍 pic.twitter.com/b7YKHfhNx2

— Michael Davis (@KingDavie24) February 5, 2021

In terms of adoption, Bitcoin has roughly the same users as the Internet had in 1997.

But Bitcoin’s growing faster. Next 4 years on current path will bring Bitcoin users to 1b people, that’s the equivalent of 2005 for the Internet. pic.twitter.com/Np9yTR3WkL

— Willy Woo (@woonomic) February 1, 2021