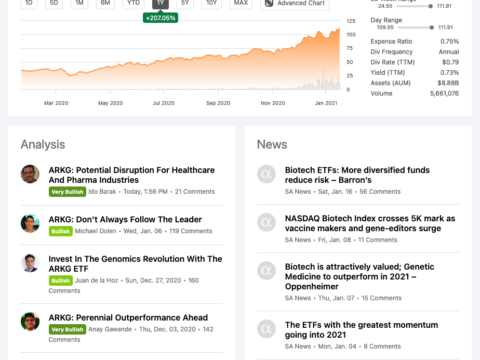

Brutal week or 8 … The market is acting like an angry drunk. But this too shall pass. Sharpen your pencils contrarians. Avi:

“I still think we may see a higher probability buying opportunity as we move through the first quarter of 2022. But, make no mistake about it. This pullback is a high probability buying opportunity as there’s a lot of support below the market, and our next higher target is 5500SPX which can be hit as early as the end of this year or by early next year.”

From the very learned but not humble Avi, the stock market whisperer:

Folks, I understand what you fundamentalists understand. But, until you understand what I do about market sentiment, how can you challenge me as to what is the more pervasive power in the market? How can you have an educated and meaningful debate with me if we are not working on the same plane of knowledge? How can I take your challenges or critique seriously if it’s not based upon the same knowledge that I have about sentiment? Would you walk into an operating room and tell the doctor that he’s “missing the point?”

Let me go into a bit more detail about my view on market drivers, and I’m going to be paraphrasing what I learned from the author of the book I challenged you all to read: The Socionomic Theory of Finance.

The main issue that we must address is that it is unworkable to apply analysis of economics in the forum of finance. In fact, it has been an abject failure at the times when it was most needed.

Whereas the law of “supply and demand operates among rational valuers to produce equilibrium in the marketplace for utilitarian goods and services . . . [i]n finance, uncertainty about valuations by other homogenous agents induces unconscious, non-rational herding, which follows endogenously regulated fluctuations in social mood, which in turn determine financial fluctuations. This dynamic produces non-mean reverting dynamism in financial markets, not equilibrium.”

From an empirical standpoint, consider that, within economic theory, rising prices result in dropping demand, whereas rising prices in a financial market leads to rising demand. Yet, most continue to incorrectly apply the same analysis paradigm to both environments.

More info about Socionomics:

Building upon scientific, empirical observations plus theories and findings from psychology and the social sciences, Mr. Prechter presents a comprehensive theory that is intended to displace the efficient market hypothesis and kindred economic models.

At the base of The Socionomic Theory of Finance is the thesis that financial markets, such as the Stock Exchange, are a manifestation of “Unconscious Herding Behavior.” Hence, financial market trends and patterns are a reflection of endogenous herding behavior. Changes in market trend direction occur because of changes in social mood. A swing in mood, say from optimism to pessimism radiates throughout the financial community to shape herd behavior. The price, volume, and sentiment measures of markets follow in an orderly, predictable fashion according to a hierarchy of fractals and the structure of the Elliott Wave Principle.

Etc:

Socionomics is a theory of human social behavior describing the causal relationship between social mood and social action. In finance theory, socionomics offers a new heterodox alternative to neoclassicism.

Socionomics posits that because contextual differences between economics and finance evoke different behavioral dynamics, the law of supply and demand, which is central to economics, is irrelevant in finance. In finance, uncertainty about valuations by other homogeneous agents serves as the context for unconscious, non-rational herding, which follows endogenously regulated fluctuations in social mood that in turn determine financial fluctuations.