Hello Friends, Family, Acquaintances & Everyone Else

My first passion was hockey. In university it was history and then Photoshop and cascading style sheets. Now that website design is turning into an AI commodity and retirement is no-longer so far-fetched, my passion is for investing. There have been highs and lows the last few years while on this path, but I feel my conscious competence emerging in this fascinating field. I want to utilize this hard-won wisdom to enable my fellow retail investors to also enjoy the benefits of stockpiling and compounding.*

If you, or your bestie, are stock-curious, please continue reading.

3 – 2 – 1 Green Garage Investing 🚀

Green Garage Investing offers a semi-DIY subscription service to help retail investors compound and outperform the stock market index through long-term investing.

The subscription provides you with access to what I call a Strike Price List. It starts at only CA$5 per month. { < 🍺 }

My mission is to help those who are busy with their career+family+passion, to invest successfully, at minimal expense, in things they care about. The more subscribers I get, the more I can develop the business to improve the product (app vs spreadsheet) and service (better utilize the data I create) and better help retail investors (and myself :).

The Green Garage tagline is Abide the Strike Price to Solve the Investing Puzzle and Generate Resilient Wealth. It’s long-winded, but it sums up the problem, process and solution of the business.

Note: There are no online courses or other annoying upsells. I do the research, recommend a buy price and if/when the stock goes below the buy price, you decide whether or not you like the stock and want to add it to your own investment account.

Problem: Solve the Investing Puzzle

Investing can be daunting. Too many choices, too much to learn, too boring … no time. The game is rigged by Wall Street. So many companies and their management are untrustworthy. Yet it is important to be able to confidently put one’s money to work to maximize its compounding. Your retirement may depend upon it.

For those interested in a semi-DIY long-term investing approach, Green Garage enables you to stockpile (buy stocks on sale and hold ‘em) confidently so you can sleep soundly with your investments — Turning a 25,000 piece puzzle into a 500 piece puzzle.

Process: What is a Strike Price List?

My stock watchlist, comprising up to 300 stocks. These stocks are categorized according to sector, my rankings and company lifecycle stage (to help you with position sizing). The key is the Strike Price; the maximum price I would pay for a stock, even if I love the company. I only buy stocks on sale. This reduces downside risk and maximizes future compounding potential. The Strike Price can also indicate when to take profit. I use a color-coded delta-to-strike metric to indicate how much the stock is above or below Strike Price. 🟪 🟦 🟩 ⬜️ 🟨 🟧 🟥

#AbideTheStrike 🎳

Solution: Generate Resilient Wealth

Isn’t that what we all want? (And health.) But 💩happens. Manage your portfolio accordingly. This is different for all, depending on your age, risk tolerance, knowledge, etc. The process I developed, by learning from many successful value investors, and personal experience, can help you generate resilient wealth and avoid some of the classic investing mistakes. FOMO and high risk and high returns are not always correlated, to name a couple.

* All About the Compounding (CAGR: compound annual growth rate)

$1000 invested at 10% (S&P 500 return avg.) grows into $2593 in 10 years. However, many stocks have beaten that. A 20% CAGR on $1000 over 10 years turns into $6191. The key is knowing what to buy and for what price.

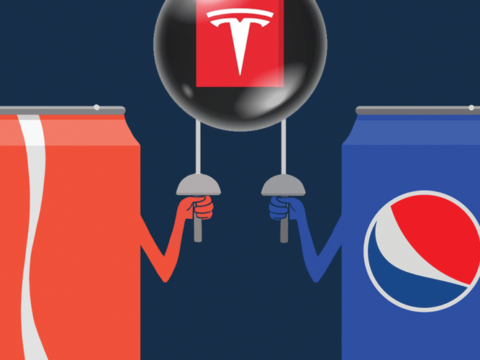

Tesla has a 10 year CAGR of 55% (2013 to 2023: March 16). I expect that to continue. Perhaps not repeat, but definitely rhyme. (My base case is 28%. Tesla has many positive future catalysts.)

If Tesla’s not your style, or you want a less volatile investment that still beats the market, let’s consider Costco. Their CAGR was 17% during the same time frame. But if you bought Costco in June 2017 for $175 per share, your CAGR would be ~19%, but if you bought in July 2017 for $150, your CAGR would be ~22%. $1000 invested in Costco in mid-2017 could equal $2839 or $3297 (a 16% difference). Over time, buying the right companies on sale maximizes the compounding of your money.

The Strike Price can also enable you to grab great opportunities when they present. Covid propelled Netflix stock to a peak of $700 in November 2021. If you bought it after its big fall in early 2022 for around $380, you would still be down. My Strike Price was $195 and in May to July 2022 you could have bought Netflix below that price. You would now be up over 55% in 9 months or even more if you had taken profits as it peaked around February 1, 2023.

Note: For profit taking, refer to my delta-to-strike metric, whether the stock is Love You Looooong Time 😻or Take Some Profit When the Market Giveth 💰and what your tax implications are (e.g. is it in a tax free account or not).

Growth Investing with a Value Mindset // Simplifying Stockpiling

A few of the investing-related quotes I like to keep in mind:

- “Be fearful when others are greedy and greedy when others are fearful.” — Warren Buffett

- “The first rule of compounding: Never interrupt it unnecessarily.” “The big money is not in buying or selling, but in waiting.” — Charlie Munger

- “Someone is sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

- “The key to success in investing is to identify the trends that are going to shape the future and then find the companies that are best positioned to benefit from those trends.” — Cathie Wood

Intrigued?

Subscribe to the Strike Price List: Patreon.com/GreenGarage

If you prefer to follow along for a while before paying, Green Garage is on Twitter @GreenGarageInv and you can sign up for the complimentary newsletter, Abide the Strike Price, from my website.

Note: The newsletter discusses stocks in the Strike Price List, and other investing-related news, but you need to subscribe at Patreon to get the actual Strike Prices.

If you would like more info about the Strike Price List, how to use it, my process, subscriber benefits, etc: www.GreenGarageInvesting.com

Thank you for reading!!

Cheers and best of luck to us all,

Alec

@ A * H – D = X // Chief Mechanic // “Investing in a sustainable future, one garage at a time.” (slogan by AI … goofy, but I kinda like it 🙂

P.S. If you’re not stock-curious, please consider re-posting or forwarding this message to your friends and family who you think may be interested.

P.P.S. If anyone reading this is also passionate about investing and interested in contributing, let’s talk.