ARK Genomic Revolution ETF » ARKG // Healthcare Sector // Strike Price = $xx {subscribe}

SPDR S&P Biotech ETF » XBI // Healthcare Sector // Strike Price = $xx {subscribe}

// 🍑 〰️

Biotech is a difficult field for many investors, but it’s also enticing to have exposure to the vanguard of companies in the biotech/genomic revolution. These two ETFs, in their individual ways, give you diversified exposure to this nascent industry without having to sort through science journals, clinical trial data, etc.

According to the Golden Crosses forming in both ETF charts, it’s almost time for the next biotech boomtown. XBI is the safer play with a more diversified approach, but if you want the real gains ARKG are the more adept navigators; their Covid-induced trough-to-peak was 327% versus 177% for XBI.

If you prefer exposure to the entire Healthcare sector, large caps as well as the small and mid caps in these two ETFs, check out $XLV.

// SOME NUMBERS & STATS: $ARKG || $XBI

- Dividend Yield: 0% || 0%

- Expense Ratio: 0.75% || 0.35%

- Assets Under Management: $2.04B || $6.61B

- Average Volume: 1.5M || 7.8M

- Total Holdings (as of June 25, 2023): 46 || 145

- Top 10 Holdings:

- Exact Sciences 11.99% || Catalyst Pharmaceuticals 1.22%

- Schrodinger || Natera

- Pacific Biosciences || Blueprint Medicines

- Ionis Pharmaceuticals || Exact Sciences

- Teladoc Health || Alkermes

- CRISPR Therapeutics || Vaxcyte

- Ginkgo Bioworks || Amgen

- Intellia Therapeutics || Neurocrine Biosciences

- Adaptive Biotechnologies || Biomarin Pharmaceutical

- Accolade || Regeneron Pharmaceuticals

- Prospectus: ARKG overview || XBI overview

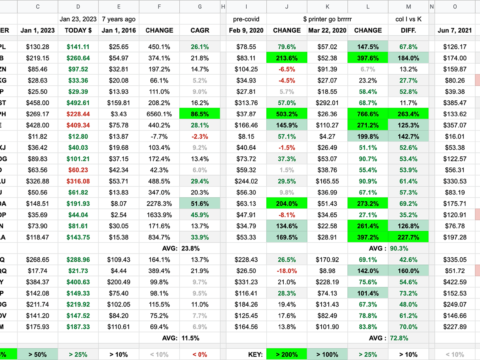

- CAGR:

- 8 years / 4.3% || 10 years / 9.2%

- Covid bubble, March 18, 2020 to Feb 9, 2021

- 327.6% || 177.7%

- Future Growth Rate: xx% || xx% {subscribe}

- 5 Year Projected Price: $xx || $xx {subscribe}

// OFFICIAL PROFILE

ARK Genomic Revolution ETF

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business. ARKG will be concentrated in issuers in any industry or group of industries in the health care sector, including issuers having their principal business activities in the biotechnology industry. The companies held in ARKG may be leaders, enablers, or beneficiaries of technologies including:

- CRISPR

- Targeted Therapeutics

- Bioinformatics

- Molecular Diagnostics

- Stem Cells

- Agricultural Biology

SPDR S&P Biotech ETF

- The SPDR® S&P® Biotech ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Biotechnology Select IndustryTM Index (the “Index”)

- Seeks to provide exposure to the Biotechnology segment of the S&P TMI, which comprises the following sub-industries: Biotechnology

- Seeks to track a modified equal weighted index which provides the potential for unconcentrated industry exposure across large, mid and small cap stocks

- Allows investors to take strategic or tactical positions at a more targeted level than traditional sector based investing

// OUR TWO BITS

ARKG has more concentrated holdings and is very actively managed by their trading team and specialist research crew. XBI is actively managed but is more of a tracker of the industry. XBI has 145 holdings and ARKG is about a third, with 46, as of this writing.

We generally prefer choosing our own stocks to using ETFs, even those curated by experts such as the crew at ARK Invest. They tend to be a little too disruptive tech focused, where revenue growth and understanding the technology is more important than margins and earnings. In a way their ETFS are like venture funds. Most of the companies they invest in need 5+ years for the thesis to play out. For many, this can be a long time to await positive results. For those who can afford to be patient the results can be extraordinary. We could go on about their funds, but the focus is on ARKG.

For the biotech industry an ETF makes sense as it is a complicated subject even for those with medical degrees and many of the companies are in nascent stages in which R&D budgets tend to outweigh revenues, let alone earnings. But it is also a very exciting industry and successes can be literally life-changing.

For example, Hunting Alpha writes: “Progress of R&D efforts is a key monitorable for ARKG. Given Exact Sciences’ large weight in ARKG, a key set of developments I am keeping an eye on is the commercialization of Cologuard 2.0, which is expected to lead to more accurate diagnoses of colorectal cancer, by reducing false positive rates by 30%, along with a 5-10% better unit profitability economics. Currently, Cologuard 2.0 is awaiting FDA submission and approval. It remains to be seen how long this will take. I anticipate these two events to be a key driver for the stock and, hence, ARKG”

The early stage nature of the companies in the biotech/genomics industry and thus these ETFs make them higher on the risk reward scale than many other investments. But look at the charts. Perhaps you will also conclude that an uptrend appears to be looming. Macroeconomics can still kill the party before it gets re-started but a lot of the downside risk appears to have been priced in with fairly solid support levels not too far below.

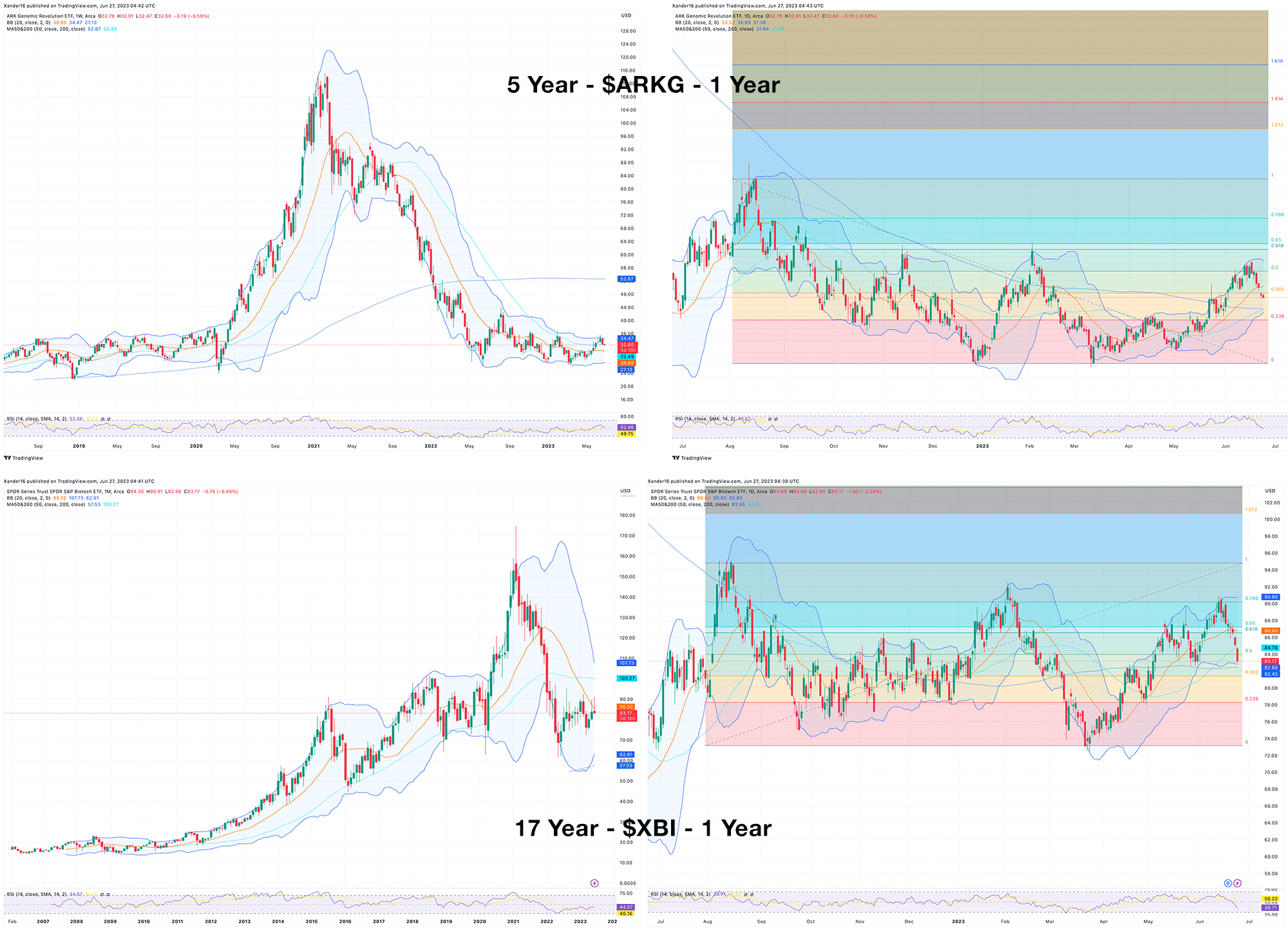

// THE CHART(S)

In the 5 year chart for ARKG you can see how the Covid-bubble made it soar but has also brought the price back to pre-Covid levels. In the 17 year chart for XBI you can see how the chart is up and to the right over time. Over the past 10 years, XBI has basically matched the S&P (~10%) but that doesn’t include that massive spike in 2020-21. The price is also now back below pre-Covid levels.

In the 1 year charts you will notice that XBI had a golden cross on June 8th and that ARKG will likely follow suit any day now.

Golden Cross: In technical analysis, a golden cross occurs when the 50-day moving average crosses above the 200-day moving average. It’s a bullish sign, indicating that the market may be heading toward a longer-term uptrend or bull market.

For those that like Fibonacci’s, ARKG has had two attempts at the Golden Pocket at 0.618. Third time’s a charm for that launch zone? ARKG has been channeling for a year and appears close to a break out.

// NEWS, REVIEWS & COMMENTS

April 21, 2023

SA // strong buy: XBI: Uncorrelated Growth Capitalizing On The M&A Tidal Wave In Pharma

“We maintain a buy rating for XBI ETF. The accelerating M&A fervor in the biotech sector presents a prime opportunity for investors to profit from the increasing valuations of small and mid-cap biotechs. We believe by investing now; investors can leverage the capital and innovation influx stimulated by big pharma buyouts, ultimately reaping substantial rewards as their portfolio positions are procured at enticing premiums. However, investors must remain alert to potential regulatory hurdles posed by anti-trust authorities and the broader examination of drug pricing. Nevertheless, a surge in M&A undertakings in 2023 is projected to reinvigorate the industry, hasten innovation, and bolster the performance of biotech equities. For most investors, we believe XBI would be the safest way to get exposure in small- and mid-cap biotech with optimal diversification.”

// GGI 💬

Big players always need fresh blood, er patents and talent, so with startups at beaten down prices not is as good a time as any for them to go shopping.

Jan 3, 2023

SA // hold: ARKG: Market May Ridicule ARK, But You Shouldn’t Ignore Their Genomics ETF

“I have always maintained that Cathie Wood and ARK Investment Management LLC – perhaps best known for its ARK Innovation ETF (ARKK) – do excellent research that goes much deeper than the quarterly outlook myopia present in Wall Street. If one combines the very important temporal drivers with the strong fundamental assessment of specialist deep research firms such as Ark Invest, I suspect one can do quite well in their investments. Indeed, that is what I attempt to do here as we look at the burgeoning genomics sector:”

“Overall, I believe ARK Genomic Revolution ETF is bottoming out after a bubble pop decline. Yet, I will continue to wait for signs of a last trap for the sellers before being convinced to put on the buys for ARKG. This technical trigger may be accompanied with positive news on clinical trials of major constituents of ARKG. For now, although I would like to be bullish, to make sure I generate alpha, ARK Genomic Revolution ETF will have to be on my watchlist for a “hold” position.”

// GGI 💬

The title of this article explains our thoughts quite well.

Green Garage Investing offers a semi-DIY subscription service to help long term oriented investors outperform the stock market index.

- Strike Price List: https://www.patreon.com/greengarage ( < 🍺 per month )

- Newsletter: https://greengarageinvesting.com/newsletter/ ( free weekly )