Upstart » UPST // Financials Sector // Strike Price = $xx {subscribe}

// 🍑 〰️

Upstart’s business is to use AI to augment traditional credit scoring methods to improve bank lending services and expand the availability of credit to a wider range of individuals at lower risk.

Some think the AI is lipstick on a marketing company but upon deliberation, we think it is legit, albeit, like most AI, a work in progress. Upstart is building an AI-powered platform that connects loan seekers and loan suppliers. They get a fee for the loan origination and the financial institution gets to collect the interest payments.

Perhaps a few folks have a personal relationship with a banker to discuss their next auto-loan, vacation or bathroom renovation, but the majority would prefer the anonymity of discussing this with a robot who can facilitate the transaction. Who wants to go around town figuring out which financial institution to connect with to get a loan instead of simply going online to the platform that has the household name in that industry. Upstart aren’t there yet, but they are working on building that brand moat.

Upstart is trying to upend the banking industry’s reliance on the FICO score. FICO has been licensing their credit score system since 1989. They have achieved high margins but their system isn’t as good at qualifying candidates and assessing the risk of defaults. Upstart can attack the price and the tech.

Upstart came flying out of the gates IPOing in Dec 2020. They had AI and profitability and the stock soared from $26 to $401. Then macro storms drove interest rates up very quickly and loan originations cratered and Upstart became unprofitable and the stock tanked.

Upstart worked on improving their existing products and some new products, increased their partners (loan suppliers) and secured more funding as cash was exiting their balance sheet.

It’s now time for cautious optimism as they expect to return to profitability in 2024. There are still risks as they need to move up the food chain in terms of partners and they need to make their platform a household name.

We’re not yet sure how much of a flywheel they can generate but despite essentially being middlemen, the business is more than just a feature to be consumed by a bigger fish.

The 35% short interest also makes for an interesting angle on this story. But at the end of the day investing for the long term is about building the business and having sustainable growth rates, margins and profitability. There is some momentum potential while the market is in an uptrend, but as always, we recommend one Abide The Strike Price.

// OFFICIAL PROFILE

Upstart Holdings, Inc., together with its subsidiaries, operates a cloud-based artificial intelligence (AI) lending platform in the United States. Its platform aggregates consumer demand for loans and connects it to its network of the company’s AI-enabled bank and credit union partners. The company was founded in 2012 and is headquartered in San Mateo, California.

// SOME BITS TO CONSIDER

Upstart’s business is essentially disrupting FICO scores which is what individual loans are based on. $FICO (Fair Isaac Corp. was started in 1956 and they currently have 40% operating margins on $1.43B in revenue. Those are phat margins and as Bezos said, your margin is my opportunity. Upstart have created robots to do a better job of assessing risk and thus increase the size of the addressable market or at least take market share from the incumbents. Their system was working well in a low interest rate environment.

But if the model works, why did the stock drop so much in 2022?

Upstart’s revenue comes from fees collected from loans they generate on their platform and given to banks and credit unions. Upstart also took some loans on their own balance sheet that financial institutions were not willing to buy. This gives them an interest bonus but also credit risk that investors were leery of.

Furthermore, as From Growth to Value explains in his insightful article:

“The company’s nosediving revenue was the second and more fundamental reason for the drop. And, sneak peek at the rest of the article here already, that didn’t change in Q1 2023. There is not enough demand from banks and other financial players who want to buy the loans Upstart generates. That’s not a problem specific to Upstart; it’s industry-wide and has to do with the rising interest rates.”

To put it in perspective, the YoY drop in originated loans on Upstart’s platform was 83%: 84,084 vs 465,537 in Q1 2022.

Employee numbers then got a 30% haircut. Wall St likes that decrease in expenses as more cash makes it to the bottom line. Efficiency.

Now guidance is looking up. Revenue of $135 million for Q2 2023, which is down 41% compared to Q2 2022, but it’s up 31% from Q1 2023.

Product expansion: about half of the loans on Upstart’s balance sheet come from car loan R&D. That means financial institutions will start to pay Upstart for those originations. Good for the balance sheet and for revenue growth.

According to Upstart, the market for US personal loan originations is about $84 billion and $635 billion for auto loans. Upstart are expected to generate a little over $1B in revenue in 2026.

Upstart is building a short term loan product for banks. CEO says this product has “the potential to eradicate more than 70% of payday loans in the next five years.” Presumably the fees will be much lower so this increases their addressable market and is useful for those who need that help.

They are also working on a HELOC product.

The Cross River Bank problem. Although it has gone from 46% down to 30% of Upstart’s revenue, they are actually a conduit in that CRB keeps some of the loans, sells some to institutional investors and gives some back to Upstart. Upstart’s CFO estimates they account for 10-15% of their revenue.

Forbes: “The CEO and cofounder is Dave Girouard, who built the billion-dollar apps business for Google. He had also served as a Product Manager at Apple and an associate in Booz Allen’s Information Technology practice.” Solid resume.

// SOME STATS

- Upstart claims: “FICO’s credit checks lead to 12 times more defaults among the highest-risk lenders, and about 4 times more defaults among low-risk lenders.”

- Upstart models train on over 100 billion cells of performance data with an average of 90,000 new loan repayments added each business day.

- Automated loans made a big jump in the first quarter, now totaling 84% of all loans, up 13.5% year-over-year.

- Net Promoter Score of 83

- CEO: “we secured multiple long-term funding agreements together expected to deliver more than $2 billion to the Upstart platform over the next 12 months.”

- CME Federal Credit Union recently became its 100th partner. Its partners are up 10x since IPO in December 2020.

// SOME FINANCIAL NUMBERS & ANALYSIS

- 2.5 year CAGR = -9.4%

- Jan 10, 2021 to Jul 10, 2023 || $52.73 -> $41.24 || high of $401 in Oct 2021

- 245.7% above 52 week low of $11.93

- Short Interest = 35%

This thing has been to Mt Everest and Marianas Trench in less than 3 years in the public market. IPOd at $26 and peaked, ridiculously, at $401. But if you investigate the financial statements, they went from great (FCF of $1.96 in 2021) to brutal (FCF of -$8.43 in 2022). But it appears they are going back to green next year in the earnings department and thus the stock has gone up 245% since it bottomed in early May 2023. Short interest is still 35%. Given that we believe the company is solid and able, that has juicy squeeze potential.

- Future Growth Rate Estimate: xx% {subscribe}

- Previous 5 year EPS = ($1.31) $1.73 $0.00 ($0.03) ($0.87)

- Previous 5 year Revenue = $125.8M to $853.3M for 578% growth

- Next 5 year estimates EPS = ($0.51) to $1.84 for 460% growth

- Next 5 year estimates Revenue = $548M to $1.25B for 128% growth

The revenue growth rate is expected to slow down from the torrid pace it had been on until macroeconomics brought interest rates up in a hurry and messed up their nascent business. However, EPS is expected to go back to the positive in 2024 and its growth rate is much higher. High revenue growth is fine and dandy, but investors love high EPS growth when (profitable).

- 5 year Price Target = $xx {subscribe}

- Price to Sales/Revenue multiple = xx {subscribe}

- Sector median P/S (ttm) = 2.3

- currently 4.6 with a 5 year average of 8.6

The growth rate is expected to be quite high for the short – mid term but then peters out, although the analyst coverage gets sparse. If growth rates can maintain the mid-term level than we could potentially increase the P/S Ratio and boost the price target, but even with our conservative outlook, the expectation is to outperform the market

- Price to Free Cash Flow per Share = -6.7 😢

- Operating Margin = -40% 😢

- Return on Invested Capital = -15.7% 😢

- Long Term Debt to Total Assets = 55% 😢

- Cash & Equivalents to Total Operating Expense = 52.6% 🤔

These numbers all suck but when your EPS goes from $1.73 in 2021 to ($1.31) in 2022 and an expected ($0.51) in 2023 this is to be expected. In 2021 they had more cash than debt and now debt is about 3x cash. That cash buffer enabled them to weather the interest rate hike storm but now it’s time to rebuild this buffer. The balance sheet isn’t a deal breaker based on expectations but it provides reason for caution in what otherwise looks like a set up for success.

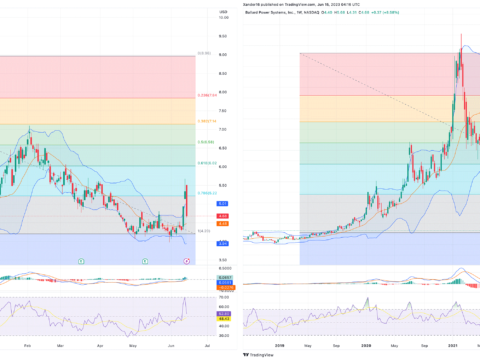

// THE CHART

The 50 day moving average crossed the 200 around June 9, 2023 after a sustained bear market. Super golden crossing.

(NOTE: “Going back to 1950, it [super golden crossing] has a 100% accuracy of predicting bear market endings and bull market beginnings. It is triggered only when a convincing golden cross happens after a long bear market. Specifically, the Super Golden Cross is triggered only when the 50-day crosses above the 200-day MA and stays above it for at least three days, after spending at least nine months below it. ”