Hut 8 Mining » HUT + TSE:HUT // Financials Sector // Strike Price = $xx {subscribe}

// 🍑 〰️

Hut 8 are miners of Bitcoin in Canada and have recently merged with a US based miner (USBTC).

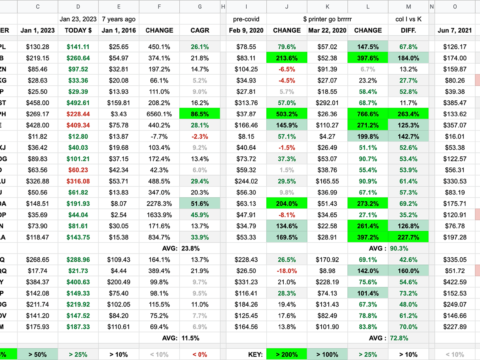

About two weeks before the Bitcoin halving on May 11, 2020, Hut 8 was at $0.59 and It peaked in November 2021 at $16.57 for a 2700% gain. By December 2022 it was back down to $0.78.

Bitcoin went up 673% during that time frame. Hut 8 was a 4x leveraged play on Bitcoin.

Will that repeat?

Not exactly, but directionally, quite possibly.

Since Q4 2022 Hut 8 has gone from $0.78 to $4.47 – a 473% gain. Bitcoin has gained 91% during that time. That’s a 5x return on actual Bitcoin. Not too shabby if you happened to scoop up some Hut 8 stock this past Xmas.

Is Hut 8 now a better company? Not really, they’re trying, but they’re kinda suspect.

They need the price of Bitcoin to double to be profitable (we think), and their 2023 capacity is 7.5 EH/s whereas competitors Riot is 12.5, Mara 23 and CleanSpark 16. But they have almost 9,300 BTC on their balance sheet (Mara is tops at almost 12,300) and they have very little debt and are known in the industry to be good HODLers. But besides the lack of debt, the financial statements are a bit of a mess.

There are no guarantees, but the price of Bitcoin is expected to be much higher in 2024 than in 2023. We estimate a US$200,000 peak this cycle. The next halving is expected April 26, 2024 when the reward a miner gets for solving a block goes from 6.25 down to 3.125.

If you like to roll the dice a little, Bitcoin mining can be fun. Don’t dilly dally at the party though. The volatility of the miners is even more than that of the underlying commodity. Hopefully the surviving miners have learned something about managing a business so their financial statements don’t go to total crap during the next bear part of the cycle, but don’t count on it.

// SOME FINANCIAL NUMBERS & ANALYSIS

- 5 year CAGR = 18.5%

- Jul 13, 2018 to 2023 || $1.91 -> $4.47 || high of $16.57 in Nov 2021

- 473% above 52 week low of $0.78

- Short Interest = 5%

Overall growth of the stock over the past 5 years is adequate but for the Bitcoin mining industry it’s all about the halving cycle and making as much money as possible when the bull runs and hanging on for dear life in the depths of the bear market.

- Future Growth Rate Estimate: xx% {subscribe}

- Previous 5 year EPS = 2022 -> ($0.96) ($0.42) $0.16 $0.02 ($1.78) -> 2018

- Previous 5 year Revenue = $36.2M to $111.3M for 207% growth

- Next 5 year estimates EPS = NA

- Next 5 year estimates Revenue = $111.3M to $339.7M for 205% growth

The revenue growth has and is expected to continue to truck along but can they at least figure out how to make the 4 year average EPS be above $0 so they are cyclically profitable and can start banking some profits?

- 5 year Price Target = $xx {subscribe}

- Price to Sales/Revenue multiple = xx {subscribe}

- Sector median P/S (ttm) = 2.9

- currently 8.7 with a 5 year average of 5.6

Yes that price target is decent but that’s not why we are out here on the risk-curve. Then again if they are a quality run organization and Bitcoin dutifully follows its protocols and thus the price adheres to its cycle then how risky is it? The chances of that P/S multiple doubling during the bull market is quite high so the 1-2 year price target may actually be higher than the 5 year. But also notice the 52 week low during this past bear market. With volatility like that you want this in a tax free account and don’t FOMO when the bull runs, get a head of the game, as the bull might not charge all the way to the finish line as happened in the previous bull market.

- Price to Free Cash Flow per Share = -10.6 😢

- Operating Margin = -77% 😢

- Return on Invested Capital = -36.6% 😢

- Long Term Debt to Total Assets = 2% 😀

- Cash & Equivalents to Total Operating Expense = 37.6% 🤔

Besides the lack of long term debt these numbers are gross. The only time in their history they had positive FCF was $0.05 in 2019. Firstly they need the price of Bitcoin to perform better this cycle than it did last cycle, but they also need to have their 💩together so they can be highly profitable during the bull market and not egregiously unprofitable during bear market. The merger with USBTC and the building out of high performance computing centres is expected to address some of their issues.

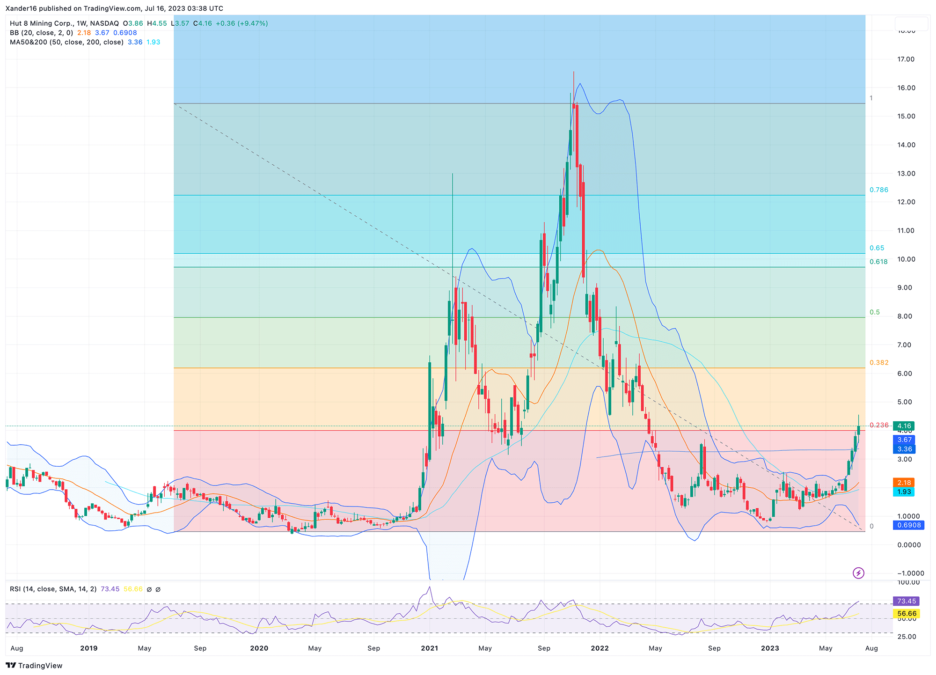

// THE CHART

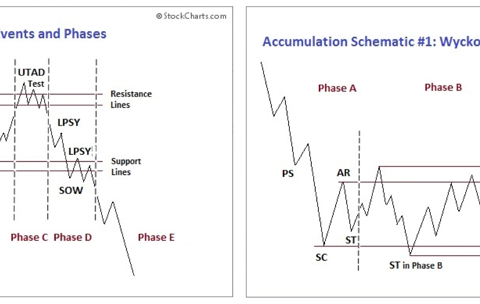

Scary or enticing? If you find it enticing you may want to have the RSI pull back and let it come back to the middle of the Bollinger Band. If you look at a 1 year chart you will find the 50 day moving average crossed the 200 for good in late May. Dips happen but as long as the company executes and something cataclysmic doesn’t happen to Bitcoin, the stock price should climb the Fibonacci ladder. Could it get as far as 1.618? Yes, but this company ain’t no Apple or Microsoft blue-chipper. Invest accordingly.

// OFFICIAL PROFILE

Hut 8 Mining Corp. operates as a cryptocurrency mining company in North America. It provides computing power to the mining pools in exchange for digital assets. The company serve commercial customers across various industries, including financial, healthcare, government, and those in the growing digital asset, Blockchain, gaming, virtual effects, and Web 3.0 space. Hut 8 Mining Corp. was incorporated in 2011 and is headquartered in Toronto, Canada.

// SOME BITS TO CONSIDER

Month-end balances: RIOT MARA HUT BITF CLSK CIFR

December 2022: 6,952 12,232 9,086 405 228 394

May 2023: 7,190 12,259 9,233 510 451 407

YTD Change: 238 27 147 105 223 13

%: 3.4% 0.2% 1.6% 25.9% 97.8% 3.3%

Hut 8 is moving away from being just a bitcoin miner to be more of a diversified technology business, offering High Performance Computing to various industries (see profile above).

But it’s all about the price of Bitcoin: “Despite aspirations for a more diverse business, the elephant in the room is Hut 8’s market capitalization has become more dependent on the price of Bitcoin than anything else. … Given the production declines, cash depletion, and questions about future business questions, I tend to agree with the market that HUT’s valuation should come more from its BTC than other companies in the mining space, but 64% is probably too much.”

Hut 8 is one of the few bitcoin miners that uses the HODL approach to corporate balance sheet management; choosing not to sell any of the Bitcoin they mine. They did sell some recently to fund the merger with USBTC.

In August 2022 Hut 8 produced 375 BTC but only 161 in December, a 57% reduction.

Part of this is for some of their operations they were using GPUs to mine ETH which they would convert to BTC. The Ethereum Merge was Sept 15, 2022. Mining for ETH was no longer required as it went to a Proof-of-Stake system.

They also had a disagreement with their power supplier in Ontario. They say the bill was paid. They had a 25 megawatt operation in North Bay and they have 100 megawatts in Alberta. They also intentionally reduced operation due to high energy prices.

1000 of the mining rigs were sent to Alberta but 7,800 are in storage. Yeesh.

Merger with USBTC:

Boosts Hut 8’s mining capacity from 2.7 to 5.6 EH/s (exahashes or 1 quintillion hashes … Hashes are a type of mathematical function that takes in data of any size and produces a fixed-size output, often represented as a string of characters.) (Note: The 5.6 is now upped to 7.5 in their latest investor presentation.)

Following the merger, “New Hut” shareholders will split the equity 50/50 between current HUT shareholders and US Bitcoin Corp equity owners. There will be a 5-1 reverse split of current HUT shares. Seems dilutive to current Hut 8 shareholders as we don’t yet know what the USBTC balance sheet looks like but it might not be great as they had to forfeit a facility in Texas to a lender.

“In addition to US Bitcoin Corp giving up property to satisfy debt obligations, the deal isn’t even done yet and US Bitcoin Corp is getting cash from Hut 8 up front through a bridge loan. I think we can safely assume US Bitcoin Corp is bringing some financial baggage with that EH/s capacity and probably not a lot of BTC.” Update: “As of December 31st, USBTC had just $6.7 million in cash, $750k in BTC, and $265 million in total liabilities.”

Misery loves company; USBTC needs cash and Hut 8 needs to scale EH/s to stack as many sats as possible before The Halving in April 2024.

“HUT’s operating cost per BTC (excluding depreciation) in Q2 2022 is $20,200, up from Q1’s $13,800. This implies that HUT was operating at a loss when Bitcoin traded below $20,000. Hence, there is significant risk of halting operation should operating loss (mainly cash expenses) eat into its cash position faster than cash raised through issuing new shares (dilution).” Bitcoin was below $20K at various times from June thru December 2022.

Video: Hut 8 CEO on Securing Up to $50M in Loans From Coinbase, State of Bitcoin Mining

Interview with the CEO about securing funding from CoinBase Credit to fund its operations and how they are expanding into the data centre business and origins of the name Hut 8.

“Hut 8 was the name of the building at Bletchley Park where Alan Turing created the Bombe, a machine that could quickly crack the Enigma code and intercept enemy communications during World War II.”

// SOME STATS

- 120 Bitcoin mined in June (46.2 BTC/EH)

- 217 Bitcoin – 100% of Bitcoin produced in May and 70 Bitcoin produced in June – were sold during the month for proceeds totalling $7.9 million

- 3,568 Bitcoin mined throughout 2022 (avg of 297.3 per month)

- 100% of Bitcoin mined added to balance sheet, increasing reserves by 65% in 2022 to 9,086 BTC

// HIGHLIGHTS FROM THE LATEST INVESTOR PRESENTATION

https://hut8.io/wp-content/uploads/2023/06/230613_USBTC_Project_Union_Merger_Deck_v26.pdf

- Strategic Merger of Hut 8 Mining and US Bitcoin Corp: Creating a leading energy and infrastructure platform of the future

- Hut 8 Mining Corp. (“Hut 8”) and U.S. Data Mining Group, Inc. dba US Bitcoin Corp (“USBTC”) to combine in an all-stock merger of equals transaction

- 0.2000 share of New Hut common stock per Hut 8 common share and 0.6716 share of New Hut common stock per USBTC capital stock

- Proposed Transaction is currently expected to close in early Q3 2023

- 6 mining sites across NA with 7.5 EH/s installed self-mining capacity and 825 MW total installed capacity under management

- USBTC’s portfolio of owned and managed sites significantly accelerates Hut 8’s growth trajectory

- Digital Asset Mining Sites in Alberta (x2), New York, Nebraska and Texas (x2)

- High Performance Computing Data Centres in BC (x3) and Ontario (x2)

- USBTC is expected to strengthenNew Hut’s energy strategy and commitment to leveraging low-cost, renewable energy sources with:

- An in-house energy origination and management team

- A disciplined, technical approach to energy sourcing and management

- A diversified mix of hydro, wind, and nuclear energy sources powering the expanded site portfolio

- USBTC’s purpose-built operating technology is expected to optimize site returns, powered by:

- Operator, an asset management platform that enables precise diagnosis of environmental and infrastructural issues that affect miner efficiency

- Reactor, an algorithmic energy curtailment platform with miner-level granularity

// NEWS, REVIEWS & COMMENTS

Seeking Alpha, last 10 articles:

- Strong Buy: 0

- Buy: 1

- Hold: 9

- Sell: 0

All 10 articles written since Jul 15, 2022.

Jun 20, 2023

SA // hold: Starting To Get Answers 🔗

“Hut 8 currently has one of the largest BTC treasury balances in the entire public equity market. To me, that’s the only real reason to consider longing HUT shares at this point. We don’t have all of our answers yet on Hut 8 Mining. But we’re starting to get some of them. USBTC’s balance sheet isn’t terribly surprising. Going forward, I would like to see some clarity on how much revenue the company expects from the recently announced HPC deal.

If nothing else, New Hut should have a better diversified revenue segment breakout following the merger. The exahash growth and new revenue segments are coming with a price; namely quite a bit more debt. Since there are other miners that will have cleaner balance sheets and solid production capacity, I still think it’s wise to wait on HUT for now.”

// GGI 💬

Yup.

Jun 14, 2023

SA // hold: Energy Woes And Upcoming Merger 🔗

“HUT’s merger with US Bitcoin Corp does provide a slither of hope to address these issues [energy and growth]…

HUT’s pre-merger primary attraction was derived from its massive Bitcoin reserves. Unfortunately, this attraction will be diminished because HUT will no longer trade below adjusted net asset value post-merger. At the same time, HUT will be joining the billion-dollar valuation club with one of the smallest mining capacities.”

// GGI 💬

His model suggests that BTC has to trade above $62K to justify HUT’s $1B post-merger valuation. It will get there and then some and theoretically should stay mostly above that in the next halving cycle trough.

Apr 24, 2023

SA // hold: The Bitcoin Miners Are Flying, But Where Is Hut 8 Going? 🔗

“I cannot invest in Hut 8 stock yet; there are too many unknowns, and the next earnings call will be very important.

I like the high-performance computing business but have no idea what the plan is, and so far, management has declined to give forward guidance.

I like the look of Bitcoin Mining in 2023, but I am unclear about the capacity Hut will have and, as a result, can not make any projections about income.

I might like the facilities management business, but Hut must give me some figures to work with.”

// GGI 💬

That stinks if he’s correct about the 7,800 mining rigs in storage.

Feb 16, 2023

SA // hold: Even More Questions Now 🔗

“Without knowing how much debt New Hut is about to carry, I’ve sold off about half of my “HUT HODL.”

I could certainly become more excited about HUT again if US Bitcoin Corp’s balance sheet isn’t actually as bad as I anticipate it probably is. Until then, HUT is still a great trade when BTC is going up and probably a big sell when BTC is going down. For now, we don’t have enough information to make a great fundamental case for Hut either way.”

// GGI 💬

At this point, to put it politely, Hut 8 is a cyclical business and one would Take Profit When The Market Giveth.

Jan 11, 2023

SA // hold: More Questions Than Answers 🔗

- “December marked the third decline in the last four months for Hut 8’s monthly BTC production.

- The company likely needs to raise cash soon to continue funding mining operations. Meanwhile, the company is transitioning to an HPC business.

- HUT is a tough business to value with so many lingering questions, but the BTC on the balance sheet provides a massive valuation backstop.”

// GGI 💬

As the business is valued mostly based on the Bitcoin on its balance sheet they should do well in the bull market but how can they outgrow that and give us a reason to invest in the company instead of just buying Bitcoin or a spot ETF?

Green Garage Investing offers a semi-DIY subscription service to help long term oriented investors outperform the stock market index.

- Strike Price List: https://www.patreon.com/greengarage ( < 🍺 per month )

- Newsletter: https://greengarageinvesting.com/newsletter/ ( free weekly )