GreenPower Motor » GP // Industrials Sector // Strike Price = $xx {subscribe}

// 🍑 〰️

GreenPower builds clean sheet designed battery electric shuttle buses, cargo vans and school buses. They will also sell you a Cab+Chassis so you can customize your own. City and intra-city buses are also in the pipeline.

Electrifying commercial fleets should be low hanging fruit for governments and businesses wanting to contribute to decarbonization. The US federal gov is doing their part with the Clean Bus Program, etc. There are 480,000 school buses in the US needing to be replaced by EVs. Not having kids huff diesel on their way to school everyday seems like a no-brainer. And as a bonus, EVs are cheaper systems for their administrators to maintain and operate.

Secular tailwinds a plenty.

GP is a young company but they now have two factories in the US, one for the shuttles and vans and one for buses. They are Built in America compliant. We estimate their current capacity to be about 2000 vehicles per year and they delivered 299 in their past fiscal year (a 130% increase over the 93 deliveries the previous year).

They are growing rapidly and in 2024 we should start to see their EPS go from negative to positive.

The problem is scaling production is difficult and it takes cashola to make it happen. In the most recent earnings call they claimed to be reducing SG&A expenses, improving inventory management efficiencies (better use of their financial resources) and having access to capital if required ($9.5 million at the end of last week, said the CEO).

They also claimed the past quarter to be record setting with 123 EVs delivered and $15.3 million in revenue. At this point every quarter had better be record setting!!

Apparently they have 42 active orders and 141 purchase orders for EV Stars (shuttles, vans, etc) and this doesn’t include Cab+Chassis partnership orders from Workhorse ($WKHS). They also have 63 active orders for Nano BEAST and BEAST school buses plus additional purchase orders.

The future of transport is electric. We expect them to be a player in it.

// SOME FINANCIAL NUMBERS & ANALYSIS

- 5 year CAGR = 7.1%

- Jul 17, 2021 to 2023 || $16.66 -> $5.02 || high of $34.45 in Jan 2021

- 200% above 52 week low of $1.67

- Short Interest = 3.8%

The market has had a tumultuous relationship with GP since they graduated from the Canadian Venture Exchange to the Nasdaq in August 2020 at $22 a share. But that’s what ya get with big potential but tiny numbers companies hungry for cash as they scale production in a ferocious interest rate hiking cycle. We expect the next 5 year CAGR to outperform the previous but hopefully without the tumultuousness.

- Future Growth Rate Estimate: xx% {subscribe}

- Previous 5 year EPS = 3.2023 -> ($0.64) ($0.69) ($0.43) ($0.34) ($0.34) -> 3.2019

- Previous 5 year Revenue = $6.1M to $39.7M for 551% growth

- Next 5 year estimates EPS = NA (but 3.2024 is ($0.25) and 3.2025 is $0.27)

- Next 5 year estimates Revenue = NA (but 3.2024 is $83.2M and 3.2025 is $129.8M for 56% growth)

Numbers to focus on here is in Mar 2024 their EPS is estimated at ($0.25) but a year later the estimate is for $0.27. If that plays out and profitability appears sustainable, even if the macro sucks, this should positively re-rate the stock price.

- 5 year Price Target = $xx {subscribe}

- Price to Sales/Revenue multiple = xx {subscribe}

- Sector median P/S (ttm) = 1.4

- currently 3.3

The target seems high but we kept the P/S multiple low despite the high growth rate. We also tempered the target by including 25% dilution in case they need to raise equity. If they can directionally achieve their goals the upside is significant. No guarantees though, this is far from a mature company but they do have secular tailwinds behind them.

- Price to Free Cash Flow per Share = -7.8 😢

- Operating Margin = -34% 😢(but it was -13% Aug 2022)

- Return on Invested Capital = -34.6% 😢 (but it was -51% Mar 2019)

- Long Term Debt to Total Assets = 1% 😀

- Cash & Equivalents to Total Operating Expense = 2.9% 🤔

Besides the lack of long term debt these numbers are kinda brutal. We expect them to improve significantly in the next 2 years and in the last earnings call they seemed confident about their cash flow, inventory management improvements and access to capital but at 2.9% Cash to OpEx they don’t have much margin for error. High reward potential but still a high risk profile.

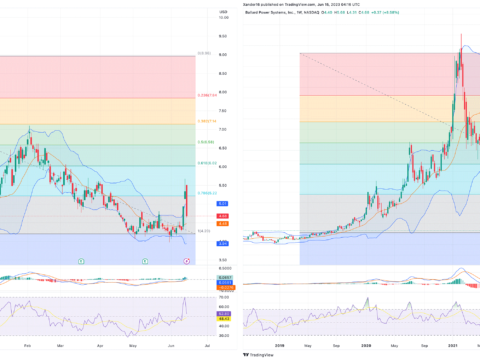

// THE CHART

Golden cross on the 1 year chart was in early June. We may see a pull back after this latest run, but in general the chart says this puppy has some open space to run wild should the macro cooperate with that sentiment.

// OFFICIAL PROFILE

GreenPower Motor Company Inc. designs, manufactures, and distributes electric vehicles for commercial markets in the United States and Canada. The company offers commercial vehicles for delivery, public transit, schools, vanpools, micro-transit, shuttles, and other; and passenger, student, low floor transit, and cargo transportation. It leases its vehicles to customers. GreenPower Motor Company Inc. was founded in 2010 and is headquartered in Vancouver, Canada.

// SOME BITS TO CONSIDER

Latest quarter revenue of $15.3M (+255% YoY) beats by $1.11M after delivering 123 vehicles (combo of shuttle buses, cargo vans, Type A school buses and cab+chassis platforms).

For the full year ended March 31, the company’s revenue was $39.7 million with a gross profit of $7.3 million.

Working capital improved to $27.7 million at the end of the quarter compared to $25.6 million at the end of the previous quarter.

GP is an OEM of Class 4 – 8 commercial bus chassis and related products for battery powered all-electric buses ranging in length from 25 – 45 feet.

GP uses various Asian contract manufacturers in Asia for sub-components and assembles buses in its Porterville, California facility and as of September 2022, school buses in South Charleston, West Virginia.

GP are battery agnostic:

“Where some other electric vehicle manufacturers build their own battery packs we purchase the batteries in a plug-and-play pack for our designs. This provides us with the flexibility to use different cell manufacturers with different battery chemistries. We believe that the underlying battery cells are a commodity and consequently have designed our products to take full advantage of the best batteries that are available at the time we manufacture our products.”

Their primary product is the EV Star which can be a shuttle bus or cargo van, etc. They describe it as:

“The EV Star is a multi-purpose, zero-emission, min-E Bus. It has a range of up to 150 miles and offers dual charging capabilities as a standard feature. The EV Star can be used for para-transit, employee shuttles, micro-transit, and vanpool service. The seating layout is customizable to an operator’s needs with multiple configurations and ADA positions. The EV Star is the only Buy America compliant and Altoona tested vehicle in its class with the highest score of 92.2. The EV Star chassis is the base chassis for the entire EV Star product line.”

Management is focused on the EV Star, as it ‘can produce the EV Star in the shortest time compared to any of our other products and given the ease with which we can deploy an EV Star…’

They also produce two sizes of school buses (Beast and Nano Beast), two city buses and an inter-city bus.

“Although the EV star has been driving the growth in vehicle sales at GP I expect to see the school bus sales grow significantly over the next few years and perhaps see them reaching 1,000 unit sales per year.”

For a good time, watch this promo video 🙂

California intends to phase out purchases of nonelectric buses by major transit agencies starting in 2029. Dude, hurry up already!!

School bus pilot project according to the President in the most recent earnings call:

“Yesterday, at the Transportation Network Conference in Reno that I had mentioned previously, that goes on in Nevada every year at this time, we presented the results of our school bus pilot project in West Virginia. This is where four of our battery electric school buses were operated at different school properties throughout the state on a rotating basis. The pilot project has proven to be so wildly successful, actually the most wildly successful pilot project I’ve ever been involved with on the EV space.

And this product shows that our BEAST and our Nano BEAST can perform in all different types of terrain, weather and operating environments. And again, it proves that you can operate GreenPower BEVs or battery electric vehicles, without changing the way a school district performs their existing operation.”

Path to profitability. CFOin the most recent earnings call:

“Selling, general and administrative costs as a percentage of revenues have declined from 133% in the first quarter to 36% in the fourth quarter. This demonstrates the improving operational leverage in our business model as revenues have steadily increased.”

Also improving inventory management for more efficient use of their financial resources:

“Inventory at March 31, 2023, was $41.6 million, which was 3.2 times our fourth quarter cost of goods sold. This was a significant improvement over the prior year, as inventory at March 31, 2022, was $32.3 million or 8.7 times our quarterly cost of goods sold for the quarter ended March 31, 2022. As inventory represents the largest single financial asset of the company, increasing inventory turnover allows us to more efficiently utilize our financial resources. More efficient use of our inventory remains a key focus area for management.”

Competitors include:

- Proterra

- BYD Motors

- New Flyer of America

- Blue Bird (BLBD)

- The Blue Bird electric uses a Cummins powertrain with a Sumo motor giving it a smaller range (120 miles v 150 miles) and fewer seats (84 v 91) than the GP competitor.

- Nova Bus

- The Lion Electric Co

- Thomas Built Buses

- Collins Bus Corp.

- Trans Tech

CEO owned over 10% of the company stock pre-IPO (Aug 23, 2020). According to Yahoo Finance, no insider transactions since Mar 2022 and 26.6% of all shares held by insiders.

// SOME STATS

- South Charleston capacity, 600 – 700 plus school buses per year

- “The Environmental Protection Agency’s (EPA) Clean School Bus Program as passed in the Bipartisan Infrastructure Law provides five billion dollars over five years (FY 2022-2026) to replace existing school buses with clean and zero-emission models to help bring healthier transportation solutions to students around the country. As part of EPA’s current program offering, GreenPower’s all-electric school buses are eligible for rebates for the Type D BEAST of up to $375,000 and up to $285,000 for the Type A Nano BEAST all-electric school bus. GreenPower’s innovative technologies will help school districts drive down fuel costs and minimize maintenance costs while delivering outstanding reliability and efficiency.”

- The state is providing $3.5 million in employment incentives and has agreed to purchase $15 million of vehicles manufactured at the site. The lease-purchase agreement does not require any money upfront, gives the first year rent-free, and all lease payments will be applied to the property’s purchase price.

- More than 8,000 type A school buses are sold each year in the US and there are 480,000 school buses in operation in the US

- In 2020, there were 821 BEV school buses, and by 2021 this had grown to 11,000.

- Electric buses have an annual cost of only 50% of the comparable diesel bus.

// HIGHLIGHTS FROM THE LATEST INVESTOR PRESENTATION

February 2023

- Track record of deliveries including more than 400 EV Stars, low floor transit buses and school buses

- EV Star Platform: GreenPower has developed its own purpose-built, all-electric cab and chassis that is the platform for GreenPower’s EV Star product line and supports a diverse range of offerings to customers.

- 7,000 pound payload capacity

- Range of up to 150 miles, 118 KW of batteries

- EV Star CC (Cab and Chassis)

- EV Star (up to 19 passengers)

- EV Star+ (up to 24 passengers)

- EV Star Cargo (over 6,000 pound payload)

- EV Star Cargo+ (up to 836 cubic feet cargo space)

- Nano Beast Type A School Bus (built on EV Star Platform)

- Beast Type D School Bus (up to 90 passengers with 194 KW batteries)

- EV 250 (30 foot low floor)

- EV 350 (40 foot low floor)

- Buy America compliant vehicles (tax credit friendly)

- GreenPower established an At-the-Market equity program in September 2022, under which it can raise up to $20 million, and has raised gross proceeds of $4.6 million as of February 10, 2023.

- As of December 31, 2022 GreenPower has an operating demand loan for up to $8 million to fund working capital investments and interest bearing debt of $4.7 million with maturities ranging from within 12 months to May 2050.

// NEWS, REVIEWS & COMMENTS

Seeking Alpha, last 10 articles:

- Strong Buy: 1 (second most recent article)

- Buy: 2

- Hold: 4

- Sell: 1

- Strong Sell: 1 (oldest article)

All 10 articles written since Sep 23, 2020.

Jan 25, 2023

SA // buy: GreenPower Motor Ramps Up Deliveries With Large Backlog 🔗

“Over the trailing twelve months, free cash used was $19.4 million, of which capital expenditures accounted for only $600,000. The company paid a hefty $6.8 million in stock-based compensation. …

Overall, the company’s prospects are looking up with the increased school bus subsidies from federal and state sources.

In January 2023, the firm provided a delivery update for Q4 2022 [101 vehicles, inc. the first Nano Beast] that was apparently a catalyst for a sharp stock increase, as it also indicated a strong delivery cadence for the beginning of 2023.

Given the firm’s backlog of over 2,000 vehicles and ‘almost all of these are supported by firm contracts or federal and state funding,’ for investors that can accept the potential for a bumpy ride, my outlook on GreenPower is a Buy at around $3.50 per share.”

// GGI 💬

Cash = scaling production = cash = scaling production = profit = stock price increase

Jan 17, 2023

SA // strong buy: Sales Surge, Capacity Grows, I Am Buying 🔗

“GreenPower Motor appears to be a low-cost gross profit generating business; they are focused on their products and have significant sales contracts in place. They have reported an explosion in sales that could well solve their cash issues and put them on a shortcut to profitability.

They have guided to 100 vehicles in the quarter ending Dec 2022; however, the detail of this article suggests that they could be at 100 vehicles per month by the middle of 2023. That would represent a growth of 500% from June 2022 to June 2023.

They have positive gross profit and low costs, this growth in vehicle sales will quickly drive them to bottom-line profit, and as a result, the share price will move significantly higher.

Management is developing two manufacturing sites that will eventually become owned by the company adding to its net worth without depleting cash reserves.”

// GGI 💬

Cash = scaling production = cash = scaling production = profit = stock price increase

Green Garage Investing offers a semi-DIY subscription service to help long term oriented investors outperform the stock market index.

- Strike Price List: https://www.patreon.com/greengarage ( < 🍺 per month )

- Newsletter: https://greengarageinvesting.com/newsletter/ ( free weekly )