Nuvei » NVEI // Financials Sector // Strike Price = $xx {subscribe}

// 🍑 〰️

Ryan Reynolds may be a famous actor, handsome, witty, whimsical AND Canadian, but that doesn’t mean you should mimic his Nuvei investment. (Although he has done well with Mint Mobile, Aviator Gin, WealthSimple and presumably his growing stable of sporting franchises.)

As far as our own investments go, for now, Nuvei goes in what Charlie and Warren call the too hard pile. But we provide a Strike Price for those who are interested.

There is a lot to be intrigued about, but also things to be concerned about.

They provide a payment solutions platform with over 600 “alternative payment methods” and global operations. They have customers in online gaming, sports betting, ecommerce, crypto and presumably porn. For a while they did very well with huge revenue growth. But volatility reigns in the fields they play in.

They recently more than doubled their debt and bought a US based competitor, Paya, whose clients are more – dignified; healthcare, utilities and B2Bs. This should stabilize growth somewhat, but the pace of Paya isn’t exactly exponential.

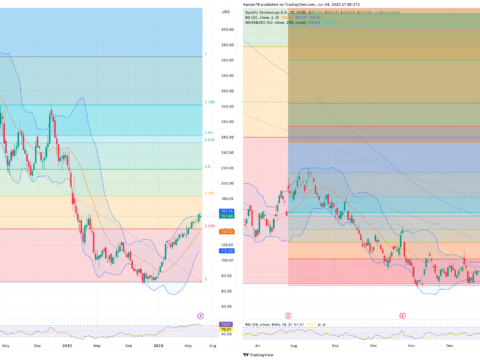

Organic revenue growth rates are a primary concern at the moment. Is this still a growth stock?

Nuvei has been EPS positive since 2021 and FCF positive since 2019. This is impressive since the inflation+interest rate story became rather – exciting – in 2022.

Then there is the issue of stock based compensation, primarily for the Big 3 in the C-suite and not the developer talent, while simultaneously doing share buybacks and taking on debt. Not a great look.

The amount of Margin of Safety required to become an investor (traders do your thang, the crypto bull could re-accelerate the Nuvei growth story) goes up as does the risk caused by debt, growth issues and questionable management.

Does Nuvei have a moat? Definitely not. Competition ranges from credit card behemoths to crypto exchanges to fellow payment solutions providers like StoneCo, Adyen, PayPal and the IPO everyone is waiting for, Stripe. And there are probably a bunch more competitors if you look from a global perspective. They’re going to need to crush more Paya’s to build a moat in this fintech field. Or maybe they can turn Ryan into Super Nuvei Riche and create a movie franchise to build a brand moat around.

Let’s check back in a couple quarters to see if they have cleaned up any of the messiness. If growth resumes, given where the EPS is at, the Strike Price could be moved up substantially.

…

Subscribe to the Strike Price List for the Full Report:

Green Garage Investing offers a semi-DIY subscription service to help investors busy with real life outperform the stock market index. Less risk, more CAGR.

- Strike Price List: https://www.patreon.com/greengarage ( < 🍺 per month )

If you prefer to follow along for free at the moment, we have Twitter and a Newsletter: https://linktr.ee/greengarageinvesting

Abide The Strike Price // Outperform // Generate Resilient Wealth