Bloom Energy » BE // Industrials Sector // Strike Price = $xx {subscribe}

// THESIS

Like price, a name says a lot and Founder CEO Sridhar chose the name of his company well. His original concept of having a Bloom Box in every home was not as astute. Wind/solar/battery (WSB) are a superior solution. He has since pivoted to a Bloom Energy Server in every large building (e.g. data center, manufacturing facility, etc). Bloom’s solid oxide fuel cells for on-site power generation enable building operators to be somewhat energy independent. Not WSB independent, but at least not reliant on The Grid. A tangible fuel source is required.

Fuel cells are more efficient than the ICE generators they are looking to replace. Fuel cells burn hydrogen. The waste product is water.

However, getting the hydrogen can be … problematic.

Bloom Energy Servers can use natural gas, methane, biogas and hydrogen as a fuel source. Ex-biogas and hydrogen, there are still CO2 emissions, but Bloom does filter out the sulfur and other chemicals so their system can utilize the fuel and turn it into hydrogen. It isn’t clean and renewable like wind and solar but it is an improvement on legacy systems and a better way to use that legacy fuel source. It puts large building operators, who are unable to fully utilize WSB for their purposes, on a better path (independence, efficiency, emissions) than legacy systems provide.

Bloom estimates a 30-35% revenue growth trajectory, going from $1.2B in 2022 to $15-20B in 2031 as they expand from on-site power generation to include decarbonizing technologies and marine power.

Catalysts:

Inflation Reduction Act: a $370B bill includes significant investments in climate spending that benefit Bloom. Opportunities for Bloom:

- Bloom Energy Server

- Drives demand for 0n-site power

- Broader micro-grid adoption

- Carbon capture more economic

- Strengthens domestic business

- Accelerates Bloom Electrolyzer growth

- Expansion of Bloom’s Manufacturing

- Improves supply of Project Financing

Data centers need significant power; constantly and absolutely without interruption. Data centers are a growth industry.

Europe is natural resource constrained and half of it is northerly and rainy or snowy. WSB may not be as large a part of their energy mix as some places. Hydrogen fuel cells are likely to play a significant part of their energy infrastructure.

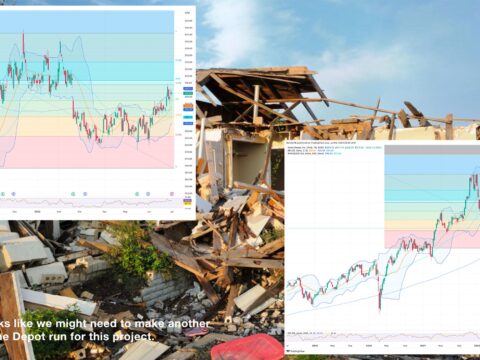

Risks:

Debt is higher than desired. Expect some share dilution as they raise cash for their CapEx. Cash funds new growth opportunities, but investors can easily tire of that practice. The market decides this product ain’t a winner due to better tech elsewhere or costs don’t make it viable. In 2020 Forbes wrote, “Without subsidies, they generate power at a cost of roughly 13.5 cents per kilowatt hour versus 10 cents per kwh for grid power nationally.”

Conclusion:

Our research on Bloom started out looking for a hydrogen play, but this appears to be an on-site power generation play that includes hydrogen. Ultimately it is a clean but not renewable energy play with a large dose of energy independence and micro-grids.

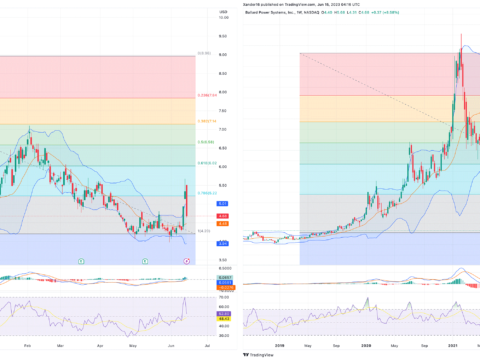

Bloom’s era of profitability is expected to finally start in 2024. There are risks yet, especially until profitability proves the market approves of their product and they can build, install and service that product with positive margins. They have secular tailwinds and government incentives at their back.

This is an opportunity for long-term investors to get in on the ground floor. If things go basically as planned, and they stop share dilution and some cash makes it into the FCF category of their financial statement, this stock will get re-rated.

The large TAM they are attacking is very enticing. For the most part WSB are better, but for industrial purposes where vast amounts of energy are required or redundant reliability is necessary, fuel cells have an important role to play. To borrow a Bitcoiner expression, fix the energy, fix the world.

…

Subscribe to the Strike Price List for the Full Report:

Green Garage Investing offers a semi-DIY subscription service to help investors busy with real life outperform the stock market index. Less risk, more CAGR.

- Strike Price List: https://www.patreon.com/greengarage ( < 🍺 per month )

If you prefer to follow along for free at the moment, we have Twitter and a Newsletter: https://linktr.ee/greengarageinvesting

Abide The Strike Price // Outperform // Generate Resilient Wealth