1.5 years ago, after Putin decided to pummel his neighbours, I researched some stocks in the nuclear space. The Rick Rule’s of the world were talking it up and It seemed like nuclear energy had some green cred and the bad parts were overblown, at least for the modern era. There was a quick price spike in March 2022 and then the rally fizzled.

In July RethinkX released a video: Why we shouldn’t build nuclear power.

“Nuclear power makes no economic sense. It really is that simple. We can get clean energy for a small fraction of the cost – and with negligible risk – from solar, wind and batteries. In this episode of ‘Brighter’, Adam tackles some of the FAQs and busts some of the myths about nuclear power.”

It’s expensive to build and operate and thus has a high cost per kWh, and it uses tonnes of water; enough to significantly change the temperature of nearby rivers

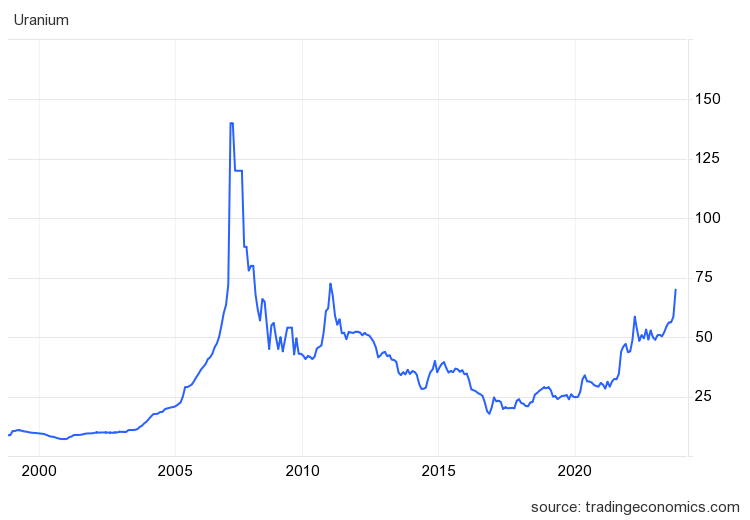

In the past couple months I have seen a plethora of articles and tweets bestowing the virtues of nuclear energy and the spot price of uranium has finally had a decent spike going from $55 to $70. It hasn’t seen that level since just before Fukushima in early 2011. For various reasons, including a busted pipe, it had a crazy price spike in 2007 and hit $140.

See chart above.

It seems like a lot of people disagree with RethinkX. They shouldn’t, but like fossil fuels, there is profits to be made from industries that utilize our resources. Renewables aren’t inherently profitable as abundance brings the price to the marginal cost of production. It’s free to harvest sunlight and wind and batteries will be a mostly closed loop system as recycling ratchets up.

I actually think nuclear will be the power of the 22nd century and solar+wind+battery are the power of this century.

But perhaps I am wrong and nuclear power will have a place in the near future. The AI robots are extremely energy intensive and all the supercomputers being built on their behalf will need to get their juice from somewhere.

According to Marin Katusa in his latest email about Uranium Royalty Corp:

“Bill Gates, Peter Thiel, and Sam Altman, tech giants of Silicon Valley, have heavily invested in nuclear energy, a departure from their tech backgrounds. Companies like Oklo, Helion, and TerraPower are pioneering small nuclear reactors specifically designed to power these supercomputers.

Since 2010, the amount of computing power needed to train AI systems has been doubling every six months, driving an unprecedented energy need.”

Marin has written four articles in the past month about uranium and a special report on UROY. He may come across as sales-y, but he knows commodities.

Some of the factors supporting the nuclear/uranium bull case:

- Lack of supply: globally we are consuming 50 million pounds more than is being produced.

- New mines are only incentivized by high prices.

- Uranium is a national security concern for the US Gov and they are working on the Nuclear Fuel Security Act of 2023. 1 in 5 US homes get electricity from nuclear power but the US gets 50% of its uranium from Russia, Kazakhstan and Uzbekistan.

- By 2030, low investment in new mines is projected to cut the uranium supply in half.

- The World Nuclear Association is predicting nearly a 100% increase in uranium demand by 2040 and this doesn’t include any demand from SMRs (small modular reactors). According to Katusa: “SMR demand is real and expect the independent SMR developers to do to the WNA nuclear developers what Tesla did to the traditional car manufacturers: kick their asses.”

- Russia is the #1 uranium enricher in the world. US expected to sanction Rosatom to end the reliance.

- Kazakhstan’s uranium resources are being locked up by Russia and China.

- Renewables are unreliable. In the long run, I disagree, but until they are built out to full capacity there is merit to this argument.

- If one ignores the water and toxic waste issue, nuclear energy is carbon free and doesn’t pollute like fossil fuels.

- Nuclear is expensive compared to other energy sources but if the techies can scale the SMRs they are working on, this should bring the costs down.

Uranium according to Rick Rule last June. The easy money may have been made,

“And yet the medium to long term outlook for the nuclear fuel remains extremely positive, says Rick Rule, in a recent interview with Stockhead’s Oriel Morrison.

“The incentive price for new production of uranium with inflation in the supply chain is $US75/lb,” Rule says.

“Given [the world is] using 180 million pounds and producing 120 million pounds – meaning that there is a 60 million pound per year shortfall – it’s pretty simple to figure out that over the five-year time frame that the price of uranium needs to go through the incentive price of $US75.

“Either that, or the lights go out. Those are the only two choices.

“Which of those happens? I suspect that the price of uranium goes up.””

Uranium ETFs

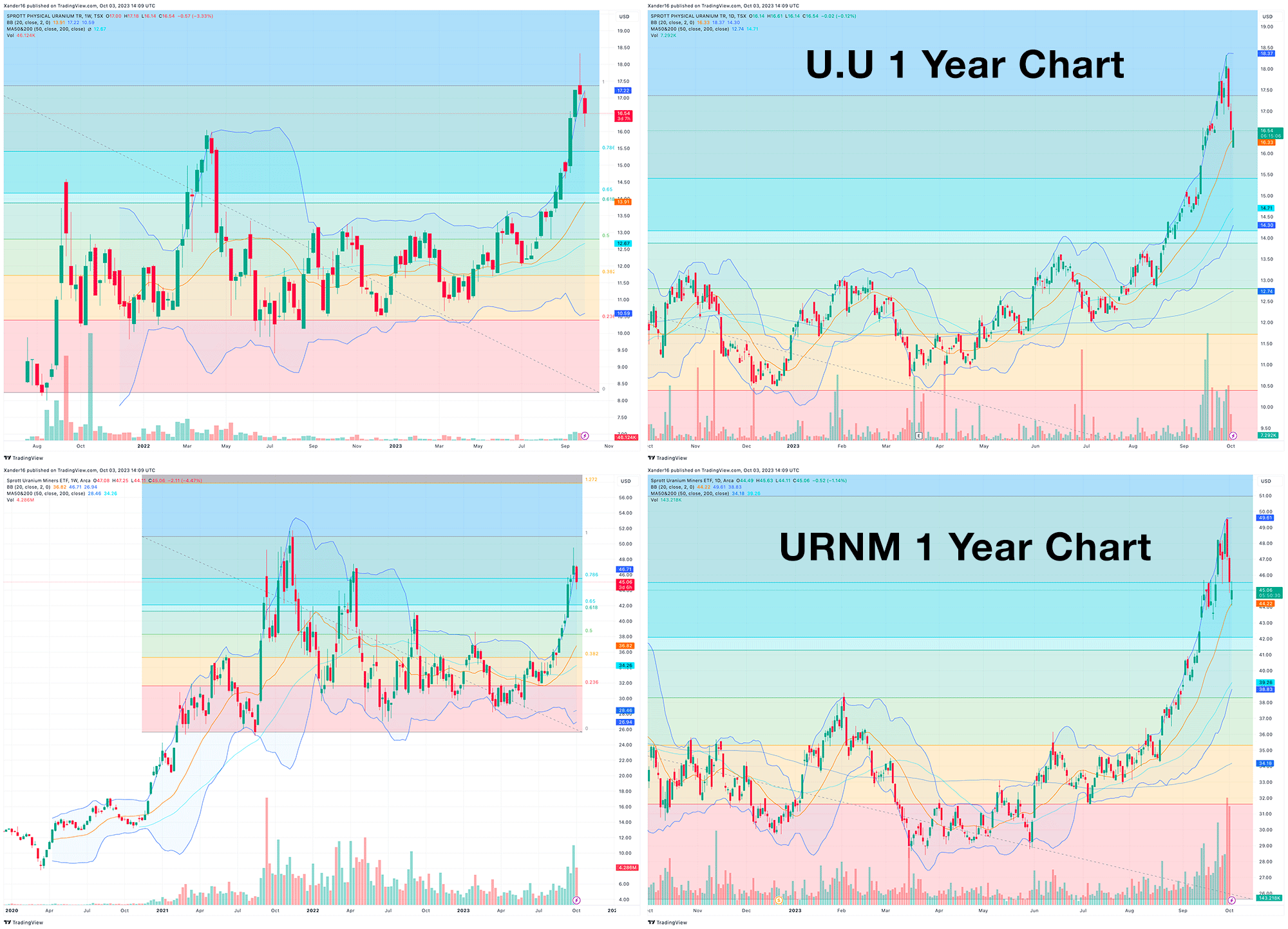

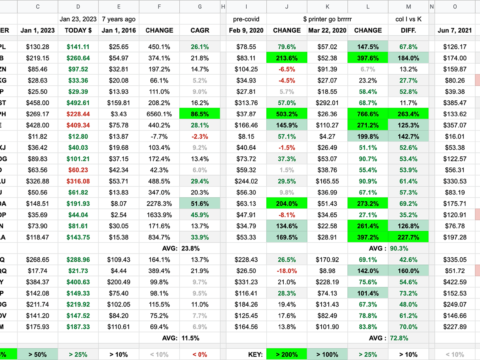

I updated my Strike Prices of the Sprott Uranium Miners ETF (URNM) and the Sprott Physical Uranium Trust Fund (U.U or U.UN*). They are slightly above Strike after the run up. It looks to me like they have a gap to fill before they can continue their upward trend. To paraphrase Jared Dillian, don’t buy when their are too many assholes in the trade, that’s the time to sell.

If I had to choose one it would likely be U.U as it is more of a pure play on uranium prices. It has a slightly lower expense ratio (0.72 vs 0.83) and more assets under management but much less trading volume. Neither have a dividend. URNM has 12% of its holdings in U.U, it’s second largest holding just behind Cameco (CCJ), the largest uranium producer in North America.

Then again, junior miners tend to have the most upside in a bull market, but also the reverse if the bear returns.

Here’s a good article on URNM for those interested: The Latest Rally Has Been Vicious. And an article on U.U: Radiating Opportunites: Yellow Cake and Sprott Physical Uranium Trust.

https://www.tradingview.com/symbols/TSX-U.U/

https://www.tradingview.com/symbols/AMEX-URNM/

* Some exchanges etc use U-U or U-UN instead. U.U is CA$ and U.UN is US$. Both trade on the TSX. URNM trades on the NYSE.

There is also the Global X Uranium ETF (URA) that has a different mix than URNM. It’s not in my Strike Price List but it’s a viable option for those interested.

List of publicly traded in the US and Canada companies involved with uranium:

- Boss Energy » BQSSF

- Explores for, develops and produces uranium deposits

- Operations in Australia

- Market cap US$17.1B // Yield 0.24% // EPS 0.53 // PE 71.5 // PS 21.2

- Junior miner, revenue expected in 2024

- Past 10 articles on Seeking Alpha: NA

- Cameco » CCJ / CCO

- Exploration, mining, milling and sale of uranium concentrate

- Refining, conversion services, reactor components

- Operations in Australia, Canada, Kazakhstan and USA

- Market cap US$1.1B // Yield 0% // EPS 0.02 // PE 132.6 // PS 10.1

- Top company in the industry in a friendly jurisdiction

- Past 10 articles on Seeking Alpha: 5 Buy, 5 Hold

- Denison Mines » DNN / DML

- Exploration and development

- Operations in Saskatchewan

- Market cap US$1.4B // Yield 0% // EPS (0.03) // PE NA // PS 163

- Junior miner, revenue of about $10M

- Past 10 articles on Seeking Alpha: 2 Strong Buy, 8 Buy

- Centrus Energy » LEU

- Supplies nuclear fuel and services for nuclear power industry

- Operations in Europe, Japan, USA

- Market cap US$881M // Yield 0% // EPS 1.94 // PE 28.3 // PS 2.5

- Nuclear power services, revenue of about $300M

- Past 10 articles on Seeking Alpha: 1 Strong Buy, 8 Buy, 1 Hold

- Energy Fuels » UUUU

- Exploration, extraction and processing or uranium, vanadium and rare earths

- Operations in Brazil, USA

- Market cap US$1.3B // Yield 0% // EPS 0.24 // PE 32 // PS 40.9

- Revenue turning back up after a terrible few years

- Past 10 articles on Seeking Alpha: 7 Buy, 3 Hold

- Paladin Energy » PALAF

- Explores for, develops and operates uranium mines

- Operations in Australia, Canada, Namibia

- Market cap US$2.1B // Yield 0% // EPS (0.004) // PE NA // PS 767

- Flagship project in Namibia, revenue of $91M expected by June 2024

- Past 10 articles on Seeking Alpha: 6 Buy, 2 Hold, 2 Sell

- UR-Energy » URG

- Explores for, develops and operates uranium mineral properties

- Operations in USA

- Market cap US$399.1M // Yield 0% // EPS (0.02) // PE NA // PS NA

- Revenue returns in 2023

- Past 10 articles on Seeking Alpha: 6 Buy, 1 Hold, 2 Sell, 1 Strong Sell

- Uranium Energy » UEC

- Exploration, extraction and processing uranium and titanium concentrates

- Operations in Canada, Paraguay, USA

- Market cap US$2B // Yield 0% // EPS (0.04) // PE NA // PS 10.8

- Revenue of over $100M but from existing supply, needs to start producing

- Past 10 articles on Seeking Alpha: 6 Strong Buy, 1 Hold, 3 Sell

- Uranium Royalty » UROY / URC

- Pure play uranium royalty company (invest in projects and collect royalties)

- Interests in Canada, Namibia, USA

- Market cap US$283M // Yield 0% // EPS 0.04 // PE 76.7 // PS 26.5

- TTM Revenue of $10.5M starting in 2023

- Past 10 articles on Seeking Alpha: 7 Hold, 3 Sell

- Katusa pumping it. The last royalty company he publicly pumped was GROY – gold – and it has gone nowhere fast with only $2.6M in TTM revenue after starting in 2021.

- Yellow Cake » YLLXF

- Involved in the purchase and holding of uranium oxide concentrates

- HQ in Saint Helier, Jersey, UK

- Market cap US$1.5B // Yield 0% // EPS (0.56) // PE NA // PS NA

- I have seen $0 revenue companies but never negative revenue – ($97M)

- Past 10 articles on Seeking Alpha: 4 Strong Buy, 3 Buy, 3 Hold

- Azincourt Energy » AZURF / AAZ

- Junior explorer, no revenue, market cap of $8M

- Fission Uranium » FCUUF / FCU

- Revenue not expected until 2028

- F3 Uranium » FUUFF / FUU

- Revenue expectations unknown

- Global Atomic » GLATF / GLO

- Exploration and development in Niger

- GoviEx Uranium » GVXXF / GXU

- Exploration and development in Africa with revenue expectations in 2025

Are there any companies you would like me to do a deeper dive on?