My hockey team is in the playoffs this year so I’ve been watching the games live which means I am watching way more TV ads than normal. Questrade, the Canadian online brokerage, has been spending serious bucks on advertising of late.

Here are three Questrade ads that are currently ubiquitous:

- The Eighth Wonder: Compound Interest | RRSP

- Ready to retire? | Best Online Broker

- Best Investment Advice: Avoid. High. Fees. | RRSP

I agree with them — high fees eat away at your ability to compound.

But lets take a closer look.

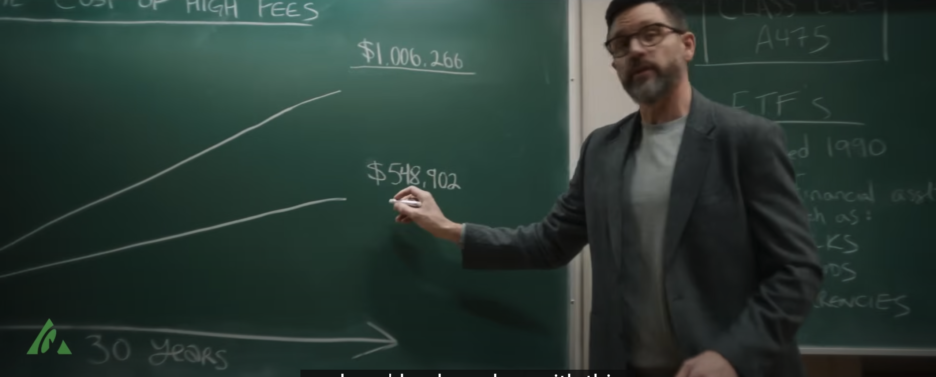

In the screenshot used above, it charts the difference fees can make to investment returns in the long run.

In their example, $100,000 invested for 30 years at an 8% growth rate results in $1,006,266 but if you are having to pay a 2% fee you would end up with $548,902 or about half the total return.

This is accurate. Compounding is funny how it can magnify changes over time, for better and worse. If you need a refresher on compounding, read this description by Google Gemini. If not, skip ahead.

Compounding is often referred to as “interest on interest” and it’s a powerful concept that can significantly grow your money over time. Here’s the breakdown:

- Imagine you invest an initial amount, called the principal.

- You earn a return on that principal, which could be interest in a savings account, dividends from stocks, or capital gains (increase in value) of investments.

- Now, the key part of compounding is that your earnings are added to your principal. This new, larger amount becomes the base for calculating your returns in the next period.

- So, you not only earn interest on your initial investment, but also on the accumulated earnings from previous periods. This creates a snowball effect, where your money grows at an accelerated rate.

Here’s an example to illustrate:

- Let’s say you invest $1,000 at a 5% annual interest rate.

- After one year, you’ll earn $50 in interest, bringing your total to $1,050.

- In the second year, you’ll again earn 5% interest, but this time it’s calculated on the new balance of $1,050. So you earn $52.50, bringing your total to $1,102.50.

As you can see, even though the interest rate stays the same, the amount of interest you earn keeps growing because you’re earning interest on a larger and larger base.

Here are some factors that can influence compounding:

- Interest rate: The higher the interest rate, the faster your money will grow.

- Time horizon: The longer you leave your money invested, the more time it has to compound and grow exponentially.

- Frequency of compounding: The more frequently interest is compounded (monthly, quarterly, annually), the faster your money will grow.

Compounding can work for you in saving and investments, but it can also work against you with debt. The interest on unpaid balances gets compounded, increasing the total amount you owe.

A quick googling indicates mutual funds have annual fees ranging from about 0.5% to 2.5%. Presumably you get what you pay for in terms of performance, but analyzing that is beyond the scope of this article.

Questrade uses an 8% return with 2% fees as the default mutual fund performance which means your money would grow at a 6% compound annual growth rate (CAGR).

A mutual fund…:

A mutual fund lets you pool money with other investors to buy a variety of investments, like stocks and bonds. A professional manages the fund, choosing investments to meet the fund’s goals (growth, income, etc.). This diversification helps spread out risk. There are many types of mutual funds, each with varying risk and fees. They’re generally affordable and easier to invest in than individual stocks or bonds.

In the past 50 years, from the start of 1974 to the closing bell of 2023, the S&P 500 went from 98.07 to 4769.83 for an 8.08% CAGR.

The $SPY, the ETF (exchange traded fund) that tracks the S&P, currently has an expense ratio of 0.09% and a dividend yield of 1.34% so in total it returns about 9.33%.

If your mutual fund averages approximately 6% returns over a number of years you might consider just buying the $SPY, or a Canadian dollar equivalent (e.g. $VFV).

The S&P is the benchmark for stock market investing. In the past 10-20 years the S&P has slightly outperformed that so lets round up the benchmark to a 10% CAGR.

Questrade is a brokerage where you can buy and sell stocks self-directed, but they also advertise their ETF portfolios which are their version of a mutual fund, as they earn fees from it.

They have 5 options of their “globally diversified ETF portfolios for every investor” — Aggressive, Growth, Balanced, Income and Conservative. Their fees range from 0.09% to 0.13%.

Their average returns from 2017 to 2023:

- Aggressive: 13.51% + -7.82% + 20.32% + 6.6% + 20.2% + -10.6% + 16.6% = 8.4% average + 1.9% yield = 10.3% CAGR

- Growth: 11.17% + -6.35% + 17.02% + 6.47% + 16.19% + -9.5% + 14.6% = 7.09% average + 2.21% yield = 9.3% CAGR

- Balanced: 8.57% + -4.47% + 13.4% + 6.46% + 11.86% + -8.41% + 12.4% = 5.69% average + 2.54% yield = 8.23% CAGR

- Income: 5.94% + -2.69% + 10.04% + 6.21% + 7.58% + -7.24% + 10.27% = 4.3% average + 2.87% yield = 7.17% CAGR

- Conservative: 3.49% + -1.42% + 6.59% + 5.59% + 3.47% + -6.2% + 8.05% = 2.8% average + 3.21% yield = 6.01% CAGR

I would choose the Aggressive portfolio even if I was well into retirement age. The Conservative portfolio was also down in bad years and the difference of compounding 6% vs 10% over 10 years is substantial.

- $1000 @ 10% CAGR over 10 years = $2594

- $1000 @ 6% CAGR over 10 years = $1791

That’s a 31% performance improvement between the Aggressive and the Conservative portfolio.

The Aggressive has a lot of diversification built into it so it is less volatile than buying individual stocks. And even if you do have to sell on a down year, remember that in the previous years you have likely meaningfully outperformed the Conservative portfolio which makes up for being more down in a down year.

What is Questrade investing for you in their Aggressive ETF portfolio?

They break it into ETF small holdings account and ETF large holdings account. Let’s look at the large as it has more holdings.

- $ZCN BMO SP TSX CAPPED COMP IDX ETF — Canadian equity — 16.09% allocation

- Top 10 holdings: $RY $TD $SHOP $CP $CNQ $ENB $CNR $BMO $BNS $BN

- Royal Bank, TD Bank, Shopify, Canadian Pacific, Canadian Natural Resources, Enbridge, Canadian National Railway, Bank of Montreal, Bank of Nova Scotia, Brookfield

- $XRE ISHARES S&P/TSX CAPPED REIT ETF — Canadian equity — 0.99% allocation

- Top 10 holdings: $CAR $REI $GRT $CHP $DIR $FCR $BEI $SRU $HR $AP

- Canadian Apartment Properties, Riocan Real Estate, Granite Real estate, Choice Properties, Dream Industrial Real Estate, First Capital, Boardwalk Real Estate, SmartCentres Real Estate, H&R Real Estate, Allied Properties

- $IJH ISHARES CORE S&P MID-CAP ETF — US equity — 3.96% allocation

- Top 10 holdings: $VST $CSL $WSM $GDDY $EME $RS $PSTG $OC $LII $XTSLA

- Vistra, Carlisle, Williams-Sonoma, GoDaddy, EMCOR, Reliance, Pure Storage, Owens-Corning, Lennox, BlackRock Cash Funds

- $IJR ISHARES CORE S&P SMALL-CAP ETF — US equity — 6.25% allocation

- Top 10 holdings: $XTSLA $ATI $ENSG $SPSC $AAON $MLI $FN $ANF $MTH $SM

- BlackRock Cash Funds, ATI, Ensign, SPS Commerce, AAON, Mueller Industries, Fabrinet, Abercrombie & Fitch, Meritage Homes, SM Energy

- $XSP ISHARES S&P 500 INDEX ETF (CAD-HEDGED) — US equity — 5.81% allocation

- Top holding: $IVV — Top 10: $MSFT $AAPL $NVDA $AMZN $GOOGL $META $GOOG $BRK-B $LLY $AVGO

- Microsoft, Apple, Nvidia, Amazon, Alphabet Class A, Meta Platforms, Alphabet Class C, Berkshire Hathaway, Eli Lilly, Broadcom

- $SPYG SPDR PORTFOLIO S&P 500 GROWTH ETF — US equity — 15.18% allocation

- Top 10 holdings: $MSFT $AAPL $NVDA $AMZN $GOOGL $META $GOOG $LLY $AVGO $TSLA

- Microsoft, Apple, Nvidia, Amazon, Alphabet Class A, Meta Platforms, Alphabet Class C, Eli Lilly, Broadcom, Tesla

- $SPYV SPDR PORTFOLIO S&P 500 VALUE ETF — US equity — 15.18% allocation

- Top 10 holdings: $BRK-B $JPM $XOM $JNJ $CVX $UNH $BAC $WMT $PG $WFC

- Berkshire Hathaway, JPMorgan Chase, Exxon Mobil, Johnson & Johnson, Chevron, UnitedHealth, Bank of America, Walmart, Proctor & Gamble, Wells Fargo

- $XEF iSHARES CORE MSCI EAFE IMI INDEX ETF — intl. equity — 20.26% allocation

- Top 10 holdings: $IEFA $NOVO-B $ASML $NESN $7203 $AZN $SHEL $MC $NOVN $SAP

- iShares Core MSCI, Novo Nordisk, ASML Holding, Nestle, Toyota, AstraZeneca, Shell, Lvmh Moet Hennessy Louis Vuitton, Novartis, SAP

- $REET ISHARES GLOBAL REIT ETF — intl. equity — 2.06% allocation

- Top 10 holdings: $PLD $EQIX $WELL $SPG $O $DLR $PSA $GMG $VIVI $EXR

- Prologis, Equinix, Welltower, Simon Property, Realty Income, Digital Realty, Public Storage, Goodman, VICI Properties, Extra Space Storage

- $SCZ ISHARES MSCI EAFE SMALL-CAP — intl. equity — 8.27% allocation

- Top 10 holdings: $SAB $TREL-B $6361 $ ICG $7936 $WEIR $NXT $BME $MKS $DPLM

- Banco de Sabadell, Trelleborg, Ebara, Intermediate Capital, ASICS, Weir, Nextdc, B&M European Value Retail, Marks & Spencer, Diploma

- $SPEM SPDR PORTFOLIO EMERGING MARKETS ETF — intl. equity — 4.95% allocation

- Top 10 holdings: $2330 $0700 $9988 $RIGD $HDFCBANK $PDD IBN $2317 $00939

- Taiwan Semiconductor, Tencent, Alibaba, Reliance Industries, HDFC Bank, PDD Holdings, ICIC Bank, Hon Hai Precision, China Construction Bank

If you want to outperform the benchmark you are going to need to do some self-directed investing of individual stocks and companies. You can still hold index tracking ETFs to help stabilize your portfolio and you can also hold inverse or short Index tracking ETFs to hedge your long positions and use for cash when the market presents great opportunities.

You might consider taking the best 1, 2 or 3 companies from each of these ETFs as they are likely to outperform the ETF, especially if you can buy them with a decent margin of safety (i.e. wait for the dips). You will still get lots of diversification but not be weighted down by the anchors in each of these ETFs.

Gemini: Margin of safety in investing is buying stocks well below their estimated true value. This discount acts as a buffer if the stock price falls or the company performs worse than expected. Value investors like Benjamin Graham and Warren Buffett use this strategy to reduce risk and target undervalued assets.

Here are a few examples of stocks that have outperformed the market in the past 20 years. I can’t say definitively, but I don’t think they would have been considered overly speculative investments by many people:

- $AAPL Apple — 2004 to 2023 — $0.38 to $185.64 = 36.3% CAGR over 20 years

- $AMZN Amazon — 2004 to 2023 — $2.63 to $149.93 = 22.4% CAGR over 20 years

- $COST Costco — 2004 to 2023 — $37.18 to $650.65 = 15.4% CAGR over 20 years

- $DE John Deere — 2004 to 2023 — $32.48 to $400.91 = 13.4% CAGR over 20 years

- $LMT Lockheed Martin — 2004 to 2023 — $51.40 to $456.12 = 11.5% CAGR over 20 years

- $MCD McDonald’s — 2004 to 2023 — $24.95 to $297.04 = 13.2% CAGR over 20 years

- $MSFT Microsoft — 2004 to 2023 — $27.50 to $370.87 = 13.9% CAGR over 20 years

- $NVDA Nvidia — 2004 to 2023 — $1.96 to $481.68 = 31.7% CAGR over 20 years

- $SBUX Starbucks — 2004 to 2023 — $8.29 to $93.67 = 12.9% CAGR over 20 years

- $UNH United Health — 2004 to 2023 — $29.53 to $539.34 = 15.6% CAGR over 20 years

Patient and opportunistic investors who bought during market corrections (5 – 10% dips), which happen every year, you could even improve on these CAGRs.

To be fair, many investors may also have picked some household names that have since underperformed or been on par with the benchmark (if you add in dividends):

- $BA Boeing — 2004 to 2023 — $42.50 to $251.76 = 9.3% CAGR over 20 years

- $BRK-B Berkshire Hathaway — 2004 to 2023 — $56.30 to $362.46 = 9.8% CAGR over 20 years

- $CVX Chevron — 2004 to 2023 — $43.24 to $149.48 = 6.4% CAGR over 20 years

- $F Ford — 2004 to 2023 — $16.10 to $12.16 = -1.4% CAGR over 20 years

- $GE General Electric — 2004 to 2023 — $154.66 to $100.65 = -2.1% CAGR over 20 years

- $JNJ Johnson & Johnson — 2004 to 2023 — $51.66 to $159.97 = 5.8% CAGR over 20 years

- $JPM JP Morgan Chase — 2004 to 2023 — $36.56 to $172.08 = 8.1% CAGR over 20 years

- $INTC Intel — 2004 to 2023 — $32.05 to $47.80 = 2.0% CAGR over 20 years

- $PEP Pepsi — 2004 to 2023 — $46.94 to $172.91 = 6.7% CAGR over 20 years

- $WMT Walmart — 2004 to 2023 — $17.78 to $53.10 = 5.6% CAGR over 20 years

However, if you can find companies that are hitting their stride, things get even more interesting:

- $AMD Advanced Micro Devices — 2014 to 2023 — $3.85 to $138.58 = 43.1% CAGR over 10 years

- $GOOG Alphabet — 2014 to 2023 — $27.78 to $139.56 = 17.5% CAGR over 10 years

- $META Meta Platforms — 2014 to 2023 — $54.83 to $346.29 = 20.2% CAGR over 10 years

- $NVDA Nvidia — 2014 to 2023 — $3.98 to $481.68 = 61.5% CAGR over 10 years

- $SMCI Super Micro Computer — 2014 to 2023 — $17.04 to $1285.45 = 32.6% CAGR over 10 years

- $TSLA Tesla — 2014 to 2023 — $9.99 to $248.42 = 37.9% CAGR over 10 years

- $V Visa — 2014 to 2023 — $55.39 to $258.87 = 16.7% CAGR over 10 years

or

- $ASML ASML Holding — 2019 to 2023 — $154.28 to $716.92 = 36.0% CAGR over 5 years

- $CROX Crocs — 2019 to 2023 — $26.11 to $93.77 = 29.1% CAGR over 5 years

- $ELF elf Beauty — 2019 to 2023 — $8.53 to $139.66 = 74.9% CAGR over 5 years

- $ENPH Enphase — 2019 to 2023 — $4.63 to $131.24 = 95.2% CAGR over 5 years

- $LULU Lululemon — 2019 to 2023 — $118.89 to $505.38 = 33.6% CAGR over 5 years

- $SHOP Shopify — 2019 to 2023 — $13.40 to $73.83 = 40.7% CAGR over 5 years

- $SNPS Synopsys — 2019 to 2023 — $82.37 to $498.97 = 43.4% CAGR over 5 years

Obviously that’s easier said then done but having exposure to companies with large upside potential to go along with the diversification strategy can make sense even for retail investors who don’t have time to focus on searching for the next great company.

Here is what happens to your compounding at higher returns than the benchmark:

- $1000 @ 10% CAGR over 10 years = $2594

- $1000 @ 15% CAGR over 10 years = $4046

- $1000 @ 20% CAGR over 10 years = $6192

- $1000 @ 25% CAGR over 10 years = $9313

- $1000 @ 10% CAGR over 20 years = $6728

- $1000 @ 15% CAGR over 20 years = $16,367

- $1000 @ 20% CAGR over 20 years = $38,338

- $1000 @ 25% CAGR over 20 years = $86,736

It can be difficult to hold great companies over the long term given the volatility and vicissitudes of the market but if you can buy on sale, weather the storms and give compounding a decent runway, the returns can be remarkable.

If you can utilize a margin of safety strategy, figure out the intrinsic value of a company and wait patiently to opportunistically buy on sale you can greatly increase your CAGR. For example:

- $CCJ Cameco — 52 week low $26.15 to today $50.91 = 94.7% gain

- $CEG Constellation Energy — 52 week low $78.24 to today $214.93 = 174.7% gain

- $COIN Coinbase — 52 week low $46.43 to today $200.92 = 332.7% gain

- $CRWD CrowdStrike — 52 week low $129.25 to today $320.76 = 148.2% gain

- $NVDA Nvidia — 52 week low $280.46 to today $898.78 = 220.5% gain

- $PLTR Palantir — 52 week low $9.02 to today $20.60 = 128.4% gain

- $SFM Sprouts Farmers Market — 52 week low $32.12 to today $75.73 = 135.8% gain

- $SMCI Super Micro Computer — 52 week low $132.69 to today $798.50 = 501.8% gain

- $SPOT Spotify — 52 week low $129.23 to today $294.60 = 128.0% gain

- $WSM Williams-Sonoma — 52 week low $109.44 to today $315.94 = 188.7% gain

Yes these can be hard to spot at the right time but it isn’t impossible with some organization and diligence.

If you like index tracking ETFs and have conviction in the progress of technology and the leadership of the companies on the US stock exchanges you might consider a leveraged ETF. Despite the volatility, the track record is impressive vs the benchmark:

- $TQQQ UltraPro QQQ — 2014 to 2023 — $2.55 to $48.13 = 34.1% CAGR over 10 years

- $TQQQ 52 week low $28.17 to today $59.17 = 110% gain

- $UPRO UltraPro S&P500 — 2014 to 2023 — $7.93 to $53.75 = 21.1% CAGR over 10 years

- $UPRO 52 week low $35.57 to today $68.23 = 91.8% gain

If you’re interested in outperforming the market, perhaps Green Garage Investing can be of help to you.

I research stocks, find their intrinsic value based on earnings and growth rate and determine a strike price (margin of safety or sale price) based on that and other factors such as management, secular trends, free cash flow, cash and debt, etc. I am developing a watchlist that I call the Ultimate All-Weather Portfolio.

The Ultimate AWP comprises companies and stocks divided into these categories:

- Cash & Hedges

- Indexes

- Primo

- Tech

- Crypto

- Stalwarts

- Defense+Dividends

- Resources

- Speculatives

- Small Caps

The idea is to be able to easily create and manage a portfolio that can outperform the market and withstand the vicissitudes of the market.

The stocks in each section won’t always be on sale, but one can add as opportunities present.

There are thousands of stocks available in Canadian and US markets. This is my attempt to boil it down to the most important ones, provide exposure to multiple sectors and asset classes and have some diversification without over doing diversification as that leads to mediocrity (diworsification as Peter Lynch described it), not outperforming the market or maximizing your CAGR.

Peter Lynch’s investing style according to Gemini:

Imagine Peter Lynch as a detective looking for hidden gems. Here’s his investment style in a nutshell:

- Focus on familiar companies: Like a good detective who knows their neighborhood, Lynch believes you should invest in companies you understand from your daily life or work.

- Find good deals: He looks for companies with strong growth potential, but at a fair price, not overpriced.

- Do your homework: Research the companies, not just the stock price. Understand their business and how they compete.

- Hold on for the long ride: Don’t get spooked by market ups and downs. Invest for the future, not quick flips.

- Sell if things change: If the company loses its edge or your investment reason disappears, it’s time to sell.

By following these detective-like steps, Lynch believes anyone can find winning investments in the stock market.

Subscribe to Green Garage Investing:

There is a free tier on Patreon, or perhaps I should say freemium, as this article turned a little markety :), as well as a paid tier for those who want access to the Ultimate All-Weather Portfolio and the strike prices, trade prices, metrics, research reports, etc that I provide on individual stocks and companies. The free tier includes my newsletter, other articles I write and the occasional research report.

Maximize your CAGR // Generate Resilient Wealth

Cheers,

Alec

P.S. The Green Garage portfolio returned 61.3% in 2023 vs 23.7% for the S&P 500.

P.P.S.

Investments 10 yrs ago now worth $1 million:

- Nvidia: $5,500

- Bitcoin: $7,000

- Super Micro Computer: $23,000

- AMD: $27,000

- Broadcom: $52,000

- Tesla: $75,000

- Eli Lilly: $80,000

- Amazon: $82,000

- Netflix: $85,000

- Microsoft: $100,000

- Apple: $120,000

- S&P 500: $375,000

P.P.P.S. Some investing wisdom from Warren Buffett and his business partner Charlie Munger:

Be fearful when others are greedy and be greedy only when others are fearful.

The first rule of compounding: Never interrupt it unnecessarily.