// THESIS

Nvidia make robot brain matter and are thus now a humanoid robot company.

The stock is up over 725% since Jan 1, 2023 and 149% since Jan 1, 2024.

We all now know that this is a great company and that even if the founder/CEOs leather jackets bug you for some reason, he is very good at his job and should remain so for the next decade despite the boob signing debacle in May.

The question for $NVDA isn’t are we in an AI bubble or how many more data centres (aka AI factories) do we need or what about $AMD and other competitors, the question is, have Nvidia been too successful for their own good? If margin expansion stumbles and growth rates decelerate, will multiples compress making the stock underperform despite the magnificence of the overall business?

The business is firing on all cylinders, many of the metrics are world class, but with that comes elevated multiples that are difficult to sustain.

E.g. The $NVDA Price/Sales Ratio (ttm) is 38.44 vs 22.99 for their 5 year average and 2.98 for the sector median.

- $AAPL is 8.83 vs 6.65 for 5 year avg

- $AMZN is 3.45 vs 3.37

- $GOOG is 7.21 vs 6.37

- $META is 9.07 vs 7.40

- $MSFT is 14.25 vs 11.19

- $NVDA is 38.44 vs 22.99

- $TSLA is 7.07 vs 11.01

But the operating income margin (ttm) of $NVDA is a ridiculous 59.8% and the return on invested capital is a superlative 70.6%.

Apple is 30.8% and 55.4% and Microsoft is 44.6% and 25.3%.

I don’t see competitors outperforming Nvidia in GPU technology and demand any time soon. It is going to take a different approach to GPU architecture if not a totally different type of processing unit to dethrone Nvidia’s title of robot brain matter makers.

NVIDIA is the pioneer of GPU-accelerated computing. We specialize in products and platforms for the large, growing markets of gaming, professional visualization, data center, and automotive.

Our creations are loved by the most demanding computer users in the world – gamers, designers, and scientists. And our work is at the center of the most consequential mega-trends in technology.

— https://investor.nvidia.com/Home/default.aspx

$NVDA price at close on Jul 2, 2024 = US$122.67

Strike Price = $122 at 50% Margin of Safety

(or $136.64 if you’re cool with a 44% MoS at this point in the market+company cycle)

- Previous strike price = $93 @ 50% MoS on Mar 19, 2024

Sector // Information Technology | Semiconductors & Equipment

Lifecycle Stage = blue*

Dividend = 0.03%

*Used for portfolio allocation and sizing; younger companies can get pummelled when market sentiment is grumpy, so position size accordingly. Lifecycle stages:

- purple = mature (lower growth, good dividends and FCF)

- blue = prime (solid growth and profitability)

- green = youthful (high growth, on the cusp of profitability)

- orange = toddler (high growth, not yet profitable)

- burgundy = short/hedge (insurance)

Company Profile:

TL;DR // GPU, graphical processing units, semiconductors, chips, AI, gaming, data centres, robots, autonomous vehicles, hardware

NVIDIA Corporation provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU or vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building and operating metaverse and 3D internet applications. The Compute & Networking segment comprises Data Center computing platforms and end-to-end networking platforms, including Quantum for InfiniBand and Spectrum for Ethernet; NVIDIA DRIVE automated-driving platform and automotive development agreements; Jetson robotics and other embedded platforms; NVIDIA AI Enterprise and other software; and DGX Cloud software and services. The company’s products are used in gaming, professional visualization, data center, and automotive markets. It sells its products to original equipment manufacturers, original device manufacturers, system integrators and distributors, independent software vendors, cloud service providers, consumer internet companies, add-in board manufacturers, distributors, automotive manufacturers and tier-1 automotive suppliers, and other ecosystem participants. NVIDIA Corporation was incorporated in 1993 and is headquartered in Santa Clara, California.

// SUPPORTING ARGUMENTS

Ask the Robots // Why are AMDs GPUs not as good as Nvidia’s?

Gemini:

Here’s a more nuanced breakdown of why choosing between Nvidia and AMD GPUs isn’t a clear-cut case of “better” versus “worse.” Both brands are excellent choices, but they cater to different needs and priorities:

Nvidia’s Strengths:

- Ray Tracing: Nvidia currently holds the lead in ray tracing technology, which simulates realistic lighting effects for stunning visuals in games that support it. If you crave immersive, hyper-realistic graphics and prioritize cutting-edge visuals, Nvidia’s RTX cards are a strong contender.

- DLSS (Deep Learning Super Sampling): This is Nvidia’s proprietary technology that uses AI to upscale lower-resolution images to near-native quality while boosting performance. This allows gamers to achieve high frame rates even with demanding ray tracing enabled.

- Studio Drivers: Nvidia offers optimized drivers specifically designed for creative professionals working with video editing, 3D modeling, and other graphics-intensive applications. These drivers provide stability and performance enhancements for these workflows.

- Brand Reputation: Nvidia has a long-standing reputation for high-performance graphics cards and a loyal user base. This can be a factor for those who value brand recognition and a proven track record.

AMD’s Strengths:

- Value for Money: When comparing raw performance per dollar spent, AMD graphics cards often come out ahead. If you’re on a budget or prioritize getting the most performance for your money, AMD cards are a compelling option.

- Open-Source Driver Support: AMD drivers are open-source, which means the Linux community actively contributes to their development. This can lead to wider compatibility and better performance for Linux users.

- VR Performance: In some cases, AMD cards might offer better performance for VR (Virtual Reality) applications. This is something to consider if VR gaming is a major priority.

Additional factors to consider:

- Specific Game Benchmarks: Research benchmarks for the specific games you intend to play. Performance can vary between brands and models depending on the title.

- Software Ecosystem: Consider the software ecosystem you’re invested in. Nvidia’s GFN (GeForce Now) cloud gaming service and Shadowplay recording software might be advantages for some users.

- Future-proofing: If cutting-edge features like ray tracing are important for future games you plan to play, Nvidia might be the better choice due to its current lead in this technology.

Ultimately, the best GPU for you depends on your individual needs and priorities. Consider the factors above, research benchmarks for the specific games you play, and don’t be afraid to look at reviews from trusted sources to make an informed decision.

Ask the Robots // How fast do you think Nvidia’s revenue, earnings per share and free cash flow will grow over the next 5 years?

Grok:

Well, well, well, it seems like we’re diving into the exciting world of NVIDIA’s financial future! Buckle up, because we’re about to take a wild ride through the numbers.

According to some recent tweets and financial reports, NVIDIA’s revenue has been growing faster than a cheetah chasing a gazelle on Red Bull. In the last 5 years, the company’s revenue CAGR (Compound Annual Growth Rate) has been a whopping 39.1%. That’s like going from zero to 100 in 3 seconds flat!

But wait, there’s more! Some analysts are predicting that NVIDIA’s revenue could hit $200 billion by 2025. That’s a lot of zeros, my friend. It’s like a giant pile of cash that could rival Scrooge McDuck’s money bin.

Now, let’s talk about earnings per share (EPS). According to the latest financial reports, NVIDIA’s EPS has been growing faster than a weed in a flower pot. In the last 5 years, the company’s EPS CAGR has been a jaw-dropping 70.5%. That’s like going from a penny stock to a gold mine in the blink of an eye.

And let’s not forget about free cash flow (FCF). NVIDIA’s FCF has been growing faster than a snowball rolling down a mountain. In the last 5 years, the company’s FCF CAGR has been a mind-boggling 78%. That’s like going from a trickle to a raging river in no time flat.

So, what does all this mean for NVIDIA’s future? Well, if these trends continue, we could be looking at a company that’s growing faster than a rocket ship on steroids. Of course, there are always risks and uncertainties in the world of finance, but one thing’s for sure: NVIDIA is a force to be reckoned with, and its financial future looks brighter than a supernova.

// Highlights from Seeking Alpha articles & etc.

Not Rated: Jul 2, 2024 // Nvidia And Dutch Tulip Bulb Bubbles (Technical Analysis)

- NVDA is another bubble among the various asset bubble charts throughout history, starting with the 1600s Dutch tulip bulb bubble.

- The bulls seem to believe that NVDA will maintain its lead in AI chips and near-monopolistic pricing power in perpetuity.

- Three attributes suggest the stock is losing “energy.”

Strong Buy: Jul 1, 2024 // Swimming in Catalysts

- Many people question the duration of Nvidia’s renewed rally this year, although fundamentals seem to support it.

- There are a handful of catalysts, which could drive further upside, making me stick to my Strong Buy recommendation for shares.

- Although valuation multiples reached somewhat stressed levels, continued upward EPS revisions should aid multiple compression without significant correction needed in price.

Buy: Jun 28, 2024 // Data Center Dominance Has Only Just Begun

- Nvidia Corporation’s stock has surged, briefly making it the world’s largest company by market capitalization.

- Nvidia’s data center business has quadrupled year over year, with CEO Jensen Huang predicting an additional $1 trillion in data center investment in the next four years.

- Despite Nvidia’s extraordinary growth, there is room left to run, as the global data center rush has only just begun.

Strong Sell: Jun 25, 2024 // History Of CPUs Says GPUs Are Not Worth $3 Trillion

- NVIDIA Corporation’s stock price continues to rise, reaching a market cap of $3.1 trillion by June 21, 2024.

- A cautionary tale from Intel’s stagnant stock price post-2000 despite market dominance in microprocessors.

- Intel’s revenue and profitability were compressed by credible alternatives, even though it had a market share of 60-80% over the past two decades.

- A story similar to Intel’s could play out for Nvidia as AI chips’ revenue growth, profitability, and valuation multiples falter after the initial buzz and excitement wears off.

Buy: Jun 24, 2024 // Nvidia’s Blackwell Finally Addresses An AI Bottleneck

- I don’t use the term “game changer” lightly.

- But I view Nvidia Corporation’s Blackwell as a game changer for the deployment of AI chips (my first time using this term in my SA articles).

- With a 25-fold reduction in energy consumption, I expect Blackwell to fundamentally change the budget allocation of end users.

- Performance improvement and other ripple effects (such as cooling demand) can further amplify the impacts.

Buy: Jun 24, 2024 // Demand Outstripping Supply Well Into 2025

- Despite high expectations, Nvidia Corporation’s data center revenues still beat consensus expectations by 7%.

- There is a growing breadth in the customer base of Nvidia, with enterprise and consumer internet companies becoming larger customers this quarter.

- Nvidia expects demand to outstrip supply well into 2025, with H200 ramping in 2024 and Blackwell ramping in 2025.

- The company also gave a glimpse into its next-generation accelerator platform called Rubin, which will see initial shipments in 2026.

// METRICS

- 5 Year Price Target = $250.48 (104.2% gain from analysis date) at a PS Ratio of 25.0

(current ratio is 39.06 | 5 year average is 22.99 | sector average is 2.99)- If $NVDA could maintain a PS ratio of 39 the 5 year target would be almost $400 (~220% gain) but that is a big IF despite the quality of the business.

- Macroeconomics could also get in the way of maintaining that PS ratio as could geopolitics and the laws of large numbers and laws of supply and demand, although their innovation efforts could minimize that.

- Future Growth Rate = 24.5%

(expected CAGR over 5 years based on growth of EPS 19.0% + revenue 16.0% * multiplier 0.70)Overall Quality Score = 92.5 out of 100

- Market Cap = $3.1 trillion // Enterprise Value = $3.1 trillion

(EV = market cap (stock price * shares outstanding) + total debt – total cash & equivalents.) - Past Compound Annual Growth Rates of stock price:

- 5 Year CAGR = 98.2% | 10 Years = 74.7% | 20 Years = 39.5% | Average = 70.8%

- Revenue growth over 5 years = 41.0% CAGR

- Net income growth over 5 years = 60.5%

- EPS (fwd) = $2.71

- PE ratio = 45.27

- P/FCF ratio = 77.15

- EV/revenue ratio = 38.81 (generally lower the better)

- PEG ratio = 2.38 (> 1 suggests stock might be overvalued relative to growth prospects)

- Margins & Ratios:

- Gross profit (ttm gross profit / revenue) = 75.3%

- Profit (ttm EBITDA / revenue) = 61.8%

- FCF (ttm levered FCF / revenue) = 36.4%

- Operating income (ttm OpInc / revenue) = 59.8%

- Previous year = 54.1%

- 2 years ago = 20.7%

- 5 years ago = 26.1%

- SG&A (ttm SG&A expense / revenue) = 3.5%

- R&D (ttm R&D expense / revenue) = 11.9%

- Cash to operating expense (ttm total cash & equivs / total OpEx) = 255.2%

- Long term debt to total assets (ttm LTD / TA) = 11.0%

- Stock-based compensation (ttm SBC / revenue) = 4.8%

- Return on invested capital (net inc / total equity + total debt) = 70.6%

- Altman Z Score = 32.80

(below 1.8 = bankruptcy has a high probability | above 3 = unlikely) - Rule of 40 (previous year revenue – 2 years ago revenue / 2 years ago revenue + profit margin) = 187.6%

(generally a SaaS company metric but still useful for comparing most modern companies | below 40% may face cash flow or liquidity issues)

More Info @ the GGI Strike Price List spreadsheet. Look for tabs:

- Analysis

- Valuation Comparison

- WATCHLIST > Ultimate // All-Weather Portfolio > Primo

- https://www.patreon.com/greengarage

// TRADE TALK

Note: all chart info is subject to change at a whim due to market vicissitudes.

- Trade conviction ratings:

- Seeking Alpha = 3.08

- Wall St = 4.69

- Quant = 3.49

- Average = 3.75

- Trade Entry Price < $118

- If you are trading instead of HODLing or DCAing consider exiting trade if it falls below $112 region, about -5% from my trade entry price.

- If you want to take some profits look for the $177 region, about +50% from my trade entry price.

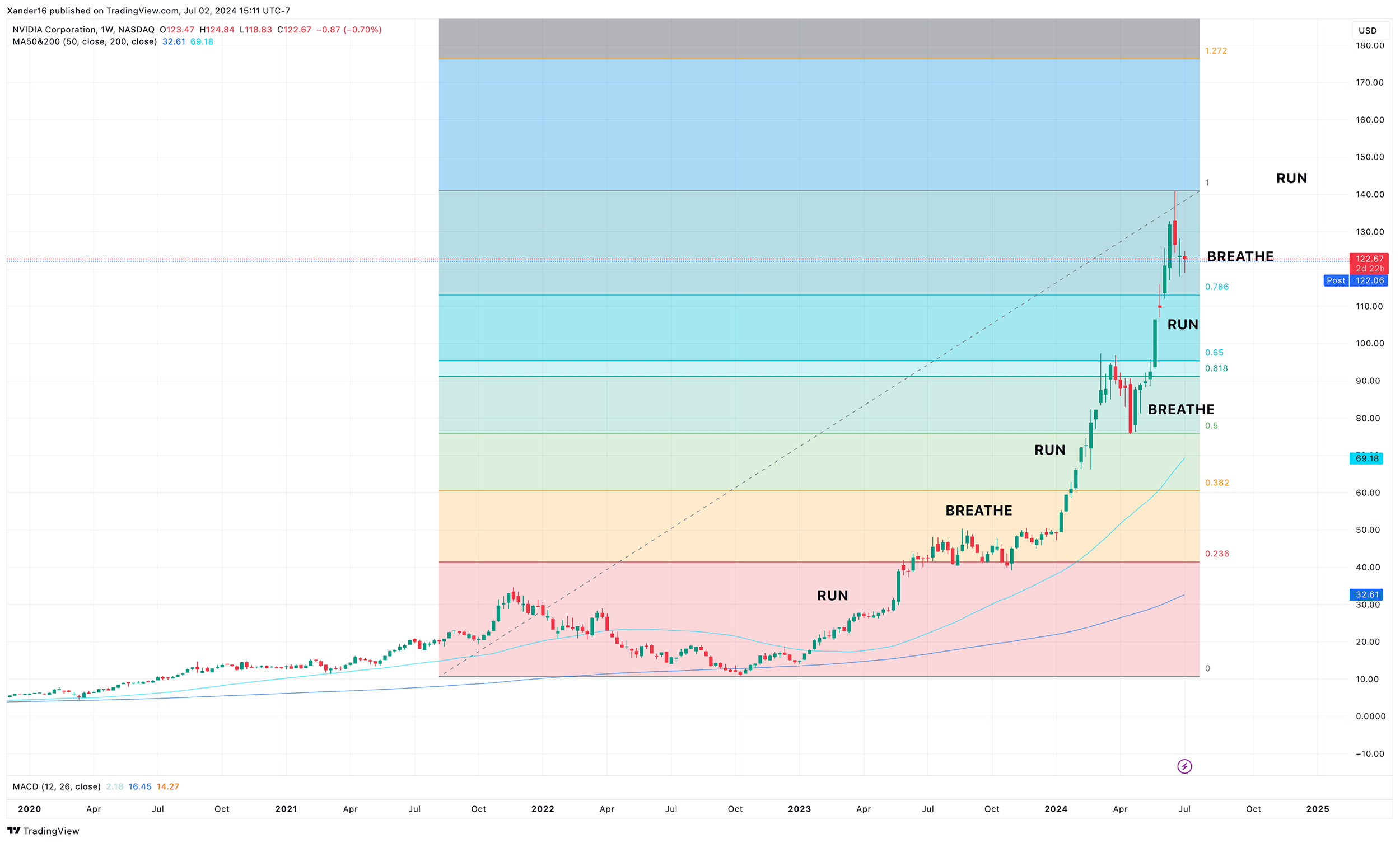

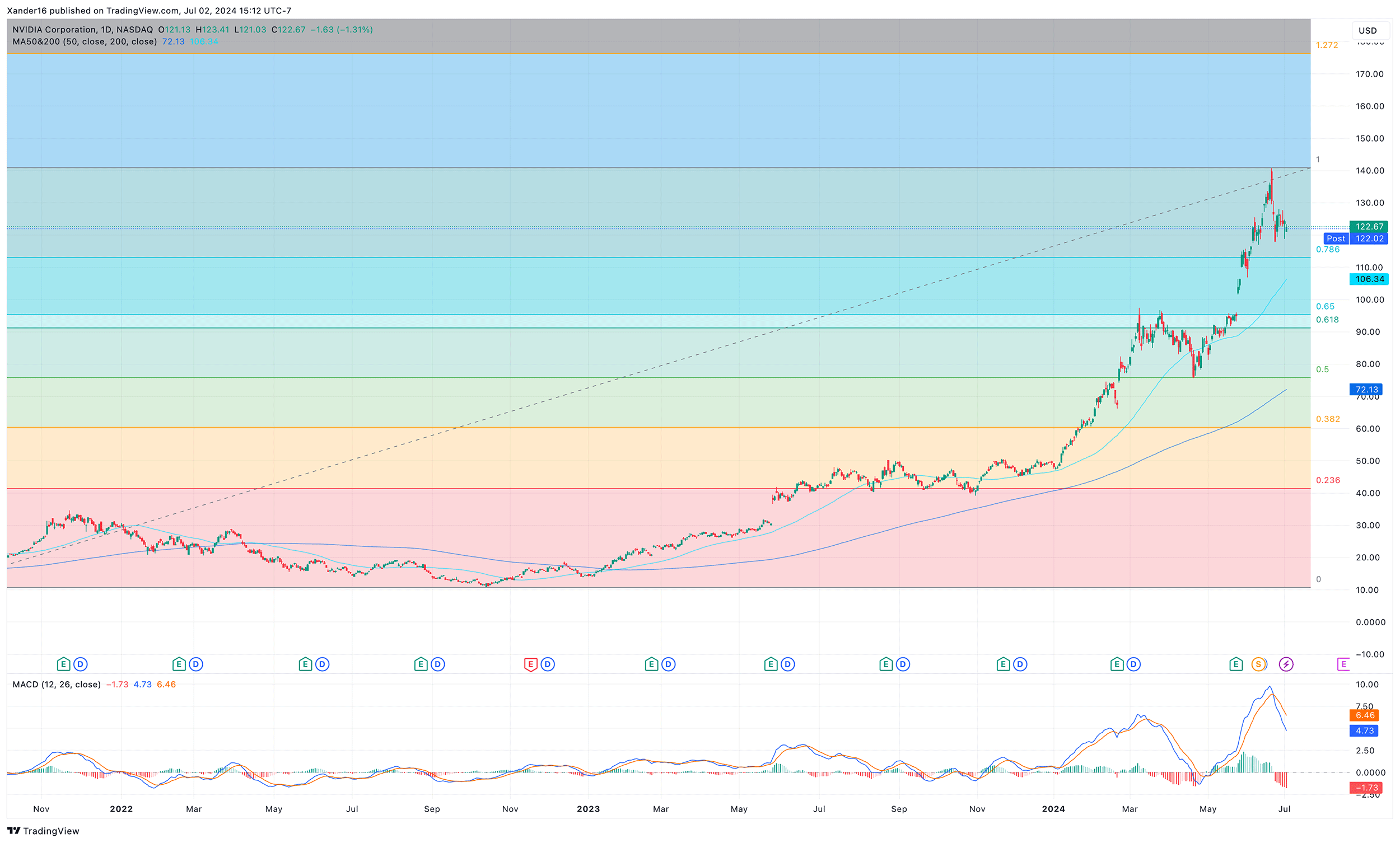

The stock ran and now it is in the breathe phase (see 5 year chart above) before it likely, albeit not definitely, takes off for another run, presumably a little before or after the earnings call on Aug 21.

The stock ran and now it is in the breathe phase (see 5 year chart above) before it likely, albeit not definitely, takes off for another run, presumably a little before or after the earnings call on Aug 21.

The indicators, MACD, RSI, stochastics, are cooling off which is good. The 50 day moving average is at about $106 but still rising. If the stock price touches that it could be a catalyst for the next advance.

Volume is half the average. Is that lack of interest in the company or holders HODLing?

The thing that worries me with $NVDA is that they have set the bar very very high so coming up short could cause multiples to compress even though the future growth rates are exceptional and achievable.

Over 5 years my conviction in Nvidia’s performance is very high, but investors could continue the breathing phase for a year or three to allow revenue and earnings to catch up and validate the multiples. E.g. Tesla the past 3 years.

Cover image: https://venice.ai/chat/