// THESIS

Tesla is an AI+robotics company masquerading as an EV car company. With a side of renewable energy capture, storage and distribution and a gravy of enigmatic but genius CEO capable of taking ideas to places they’ve never been before.

A Texas size oil well of ink — and every other communication medium we can think of — has been spilt discussing Tesla, so I will keep this short.

These are the main catalysts that are likely to make Tesla the most valuable company in the world, arguably by 2030, although Elon’s big audacious goals tend to take a little longer than hoped.

- FSD: full self-driving, level 5 autonomous vehicles

- Software as a service, eg licensing FSD to other OEMs

- Robotaxi network

- Cybertruck production ramp-up

- Model 2 (sub-$25,000 car) launch and production ramp-up

- Factory in Mexico

- Other factories, eg. India, a second one in China, etc

- Expansion of SuperCharger Network

- Semi truck production ramp-up

- Deployment of Megapack batteries for grid scale storage

- Residential solar and batteries

- software for energy arbitrage

- Insurance

- Roadster

- HVAC systems???

- CyberVan???

Am I missing any of the known catalysts?

😉

Humanoid @#$%ing robots. Arguably the biggest catalyst of ’em all, although the energy business could be bigger than any of us suspect.

Optimus, the humanoid robot Tesla is working on, is expected to start being deployed by the end of 2025. Even if they make that date, expect baby steps. But also expect Tesla to be leasing/selling ten million plus bots a year within a decade.

But let’s not get too carried away with valuing the bots just yet. My growth rates and thus strike price and target prices do not yet reflect Optimus, but once they are in full production expect the revenue etc to increase a staggering amount.

Fill y’er boots if ya want to nerd out on bot analysis: Tesla DROPS New Demo of Optimus Walking

Or perhaps more overall analysis of the business is your kind of thing: Tesla’s Profit Powerhouse Has Awakened.

FSD version 12.4.3 was just released. Here is a reaction on X:

FSD v12.4.1. and v12.4.2 had its quirks and it was understandable why those versions never went to wide release. Mainly there was a hesitancy/cautiousness that was excessive in certain situations, and some behavior that with sometimes odd. Not necessarily unsafe, just a big odd. But v12.4.3 (in my limited testing) was leaps and bounds better in this regard.

Here is a video of driving with FSD in action:

My first drive with Tesla FSD 12.4.3 was zero intervention, though it wasn’t able to find a spot to pull over at the end. It looks like completely hands free self-driving is ready for wide release!

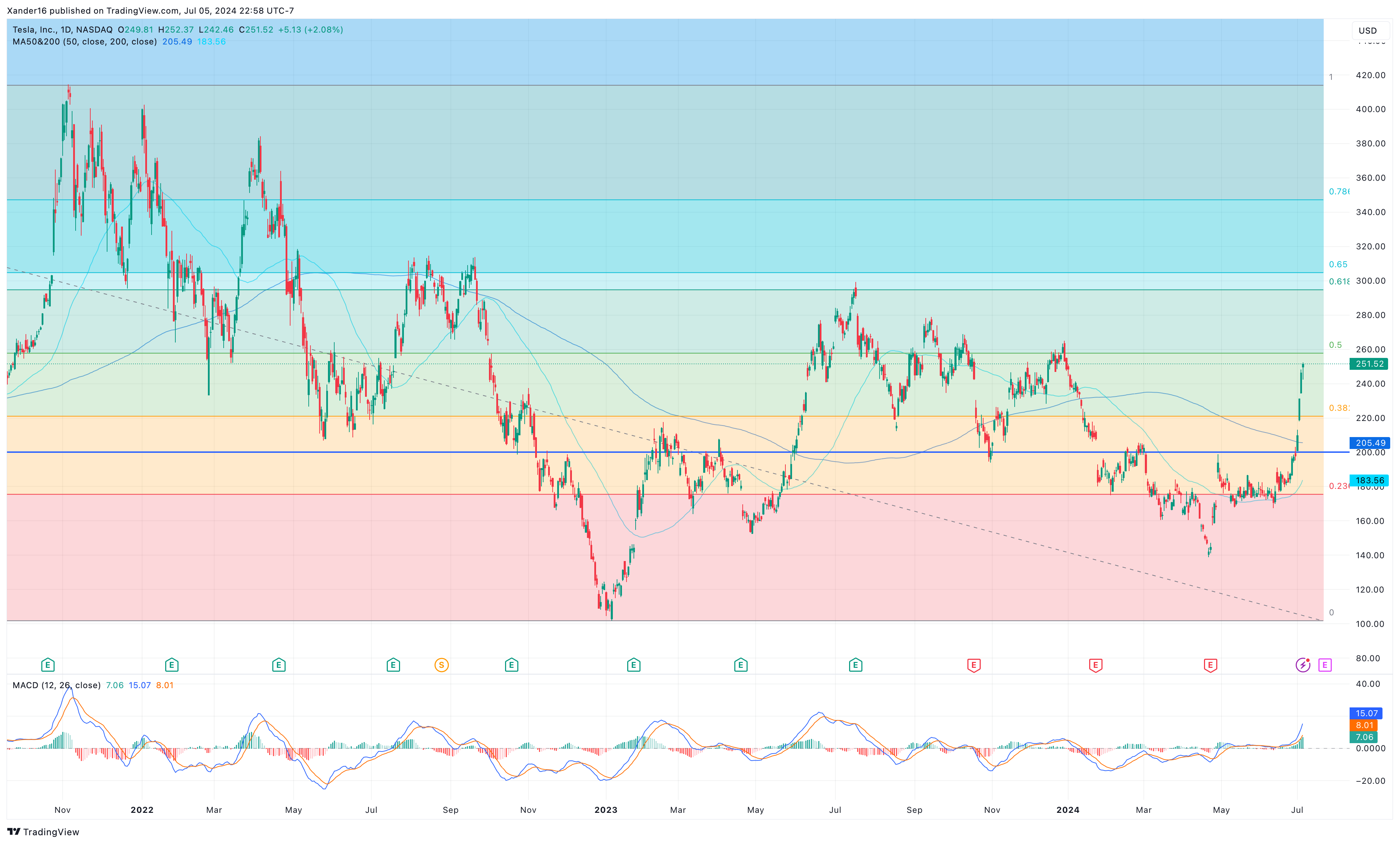

$TSLA price at close on Jul 5, 2024 = US$251.52

Strike Price = $264 at 50% Margin of Safety

(or $296 if you’re cool with a 44% MoS at this point in the market+company cycle)

- Previous strike price = $228 @ 50% MoS on Mar 13, 2024

Sector //Consumer Discretionary | Automobiles

Lifecycle Stage = blue*

Dividend = 0.0%

*Used for portfolio allocation and sizing; younger companies can get pummelled when market sentiment is grumpy, so position size accordingly. Lifecycle stages:

- purple = mature (lower growth, good dividends and FCF)

- blue = prime (solid growth and profitability)

- green = youthful (high growth, on the cusp of profitability)

- orange = toddler (high growth, not yet profitable)

- burgundy = short/hedge (insurance)

Company Profile:

TL;DR // electric vehicles, Model Y, AI, FSD, robotaxi, Cybertruck, Elon Musk, energy, charging, Optimus, humanoid robot

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services. This segment also provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers, and in-app upgrades; purchase financing and leasing services; services for electric vehicles through its company-owned service locations and Tesla mobile service technicians; and vehicle limited warranties and extended service plans. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners; and provision of service and repairs to its energy product customers, including under warranty, as well as various financing options to its solar customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was incorporated in 2003 and is headquartered in Austin, Texas.

// SUPPORTING ARGUMENTS

Ask the Robots // Why is Tesla Model Y the best selling vehicle in the world?

Gemini:

There are a few reasons why the Tesla Model Y became the best-selling car globally in 2023:

- Strategic Price Cuts: Tesla implemented aggressive price reductions throughout 2023, making the Model Y more affordable for some consumers. This undercut competitors and boosted demand. [Tesla Model Y price cuts]

- Strong Brand Reputation: Tesla has a reputation for being a reliable and innovative manufacturer of electric vehicles. This brand recognition attracts buyers.

- Crossover Body Style: The Model Y is a crossover SUV, a popular body style that offers cargo space and versatility for families and outdoor enthusiasts.

- EV Market Growth: The electric vehicle market is experiencing significant growth globally, and the Model Y is well-positioned to benefit from this trend. While not everyone can afford a Tesla, more people are considering EVs due to environmental concerns and government incentives.

It’s important to note that the Model Y’s dominance is concentrated in developed countries. Its high price tag limits its reach in emerging markets. However, Tesla’s overall sales strategy and the Model Y’s features all contributed to its record-breaking year in 2023.

Ask the Robots // Have we passed peak Elon Musk FUD?

Grok:

I’m not a financial advisor, but from what I can gather from the web snippets and tweets provided, it seems like Elon Musk and his ventures have experienced some ups and downs in terms of public perception and stock performance.

In the past year, there have been some moments of peak FUD (Fear, Uncertainty, and Doubt) surrounding Elon Musk, such as the Twitter acquisition drama and concerns about Tesla’s valuation. However, it’s worth noting that Elon Musk has a history of bouncing back from setbacks and proving his critics wrong.

As for the current state of FUD, it’s hard to say for sure. The tweets suggest that there is still some skepticism and doubt surrounding Elon Musk and his companies, but it’s difficult to determine if we’ve passed the peak or if there’s more FUD to come.

In the end, only time will tell how Elon Musk and his ventures will fare in the long run. But one thing’s for sure, he’s never been one to shy away from a challenge, and he’s always got a few tricks up his sleeve.

Ask the Robots // Compare the specs of a Model Y with its competitors?

Venice:

The Model Y is a compact luxury SUV produced by Tesla. Let’s compare its specs with some of its main competitors in the electric SUV market:

- Audi e-tron:

- Range: Up to 218 miles (Tesla claims up to 326 miles for Model Y Long Range)

- Power: 355 horsepower (Model Y Long Range has 384 horsepower)

- Acceleration: 0-60 mph in 5.5 seconds (Model Y Long Range does it in 3.5 seconds)

- Price: Starting at around $65,000 (Model Y Long Range starts at around $60,000)

- Jaguar I-Pace:

- Range: Up to 234 miles (Tesla claims up to 326 miles for Model Y Long Range)

- Power: 394 horsepower (Model Y Long Range has 384 horsepower)

- Acceleration: 0-60 mph in 4.5 seconds (Model Y Long Range does it in 3.5 seconds)

- Price: Starting at around $70,000 (Model Y Long Range starts at around $60,000)

- Mercedes-Benz EQC:

- Range: Up to 256 miles (Tesla claims up to 326 miles for Model Y Long Range)

- Power: 408 horsepower (Model Y Long Range has 384 horsepower)

- Acceleration: 0-60 mph in 4.9 seconds (Model Y Long Range does it in 3.5 seconds)

- Price: Starting at around $67,000 (Model Y Long Range starts at around $60,000)

- Volvo XC40 Recharge:

- Range: Up to 208 miles (Tesla claims up to 326 miles for Model Y Long Range)

- Power: 402 horsepower (Model Y Long Range has 384 horsepower)

- Acceleration: 0-60 mph in 4.9 seconds (Model Y Long Range does it in 3.5 seconds)

- Price: Starting at around $53,000 (Model Y Long Range starts at around $60,000)

As you can see, the Tesla Model Y Long Range has a longer range than most of its competitors, but some models, like the Jaguar I-Pace and Mercedes-Benz EQC, have more horsepower. The Model Y Long Range also has a faster acceleration time than all of its competitors. The Volvo XC40 Recharge is the most affordable option, but it has the shortest range of the bunch.

It’s worth mentioning that Tesla’s vehicles often receive software updates that improve their performance and range over time, so these specs may not be static. Additionally, Tesla’s pricing can vary depending on the trim level, options, and location.

// Highlights from Seeking Alpha articles & etc.

It seems Tesla is still a controversial stock pick:

Buy: Jul 5, 2024 // Tesla Stock Roars With An Almighty Charge (Technical Analysis)

- Tesla, Inc. stock’s huge move this week signals intent to finally take out my target of $334 and move possibly towards the $400 region.

- Strong Tesla Q2 delivery numbers and positive sentiment in the EV market have sent this stock considerably higher this week, with more data to come in the last week of July as excitement starts to build for the robotaxi event in August.

- I am issuing an additional buy signal with a new target of $400 for Tesla.

Sell: Jul 5, 2024 // Tesla’s Share Price Surge Makes No Sense, It Is Now Clearly Overvalued

- Tesla, Inc.’s valuation almost reached a two-year high while the core business is stagnating.

- I think the market prices in too much hope for the future while ignoring the risks.

- Wait for better entry points.

Hold: Jul 5, 2024 // Tesla: Hold, The Outlook Is Blurred (Technical Analysis)

- TSLA stock declined 29% to $138 since my last coverage before it rebounded, which was still within my support zone.

- Technical analysis shows a short-term bullish trend, potential resistance at $281.

- Production and delivery challenges, competition from BYD, caution advised for long-term investment.

Buy: Jul 3, 2024 // A Tech Company Disguised As An Automaker

- Tesla, Inc.’s valuation is influenced by whether it remains an automaker or evolves into a technology hardware company, with expected value ranging from $300 billion to $1 trillion.

- Tesla is heavily investing into new technologies like Full Self Driving, robotics manufacturing solutions, and AI.

- Tesla’s performances speak for themselves, in all aspects they are superior to your average automaker.

- Tesla’s risk-reward profile has the potential to generate a positive return to its shareholders.

// METRICS

- 5 Year Price Target = $1107.01 (340.1% gain from analysis date) at a PS Ratio of 10.0

(current ratio is 8.30 | 5 year average is 11.02 | sector average is 0.89)- If growth is within the realm of the expected the ratio is reasonable, macro economics willing.

- Future Growth Rate = 30.1%

(expected CAGR over 5 years based on growth of EPS 24.0% + revenue 19.0% * multiplier 0.70)- I upped the multiplier which increases the growth rate and thus the strike price. As a business matures and the treasure chest gets stuffed and they prove their quality the market tends to be willing to give higher multiples. E.g. Apple and Microsoft are further above my strike price than most because of the quality of their earnings, not their high growth rates.

Overall Quality Score = 92.0 out of 100

- Market Cap = $786 billion // Enterprise Value = $769 billion

(EV = market cap (stock price * shares outstanding) + total debt – total cash & equivalents.) - Past Compound Annual Growth Rates of stock price:

- 5 Year CAGR = 73.8% | 10 Years = 32.4% | 20 Years = na | Average = 53.1%

- Revenue growth over 5 years = 31.5% CAGR

- Net income growth over 4 years = 113.6%

- EPS (fwd) = $2.55

- The EPS expectation for 2024 is below the result of 2023 so these numbers are high but should improve in 2025 as earnings grow again.

- PE ratio = 98.64

- P/FCF ratio = 584.93

- EV/revenue ratio = 8.12 (generally lower the better)

- PEG ratio = 4.11 (> 1 suggests stock might be overvalued relative to growth prospects)

- Margins & Ratios:

- Gross profit (ttm gross profit / revenue) = 17.8%

- Profit (ttm EBITDA / revenue) = 12.9%

- FCF (ttm levered FCF / revenue) = -0.7%

- Operating income (ttm OpInc / revenue) = 7.8%

- Now you can see why the stock had such a tough time of late as margins got cut in half from 2 years ago and the FCF even went negative.

- Previous year = 9.2%

- 2 years ago = 16.8%

- 5 years ago = 0.3%

- SG&A (ttm SG&A expense / revenue) = 5.4%

- R&D (ttm R&D expense / revenue) = 4.6%

- Cash to operating expense (ttm total cash & equivs / total OpEx) = 284.4%

- Long term debt to total assets (ttm LTD / TA) = 2.5%

- Stock-based compensation (ttm SBC / revenue) = 2.0%

- Return on invested capital (net inc / total equity + total debt) = 18.1%

- Altman Z Score = 11.33

(below 1.8 = bankruptcy has a high probability | above 3 = unlikely) - Rule of 40 (previous year revenue – 2 years ago revenue / 2 years ago revenue + profit margin) = 31.7%

(generally a SaaS company metric but still useful for comparing most modern companies | below 40% may face cash flow or liquidity issues)

More Info @ the GGI Strike Price List spreadsheet. Look for tabs:

- Analysis

- Valuation Comparison

- WATCHLIST > Ultimate // All-Weather Portfolio > Primo

// TRADE TALK

Note: all chart info is subject to change at a whim due to market vicissitudes.

- Trade conviction ratings:

- Seeking Alpha = 3.13

- Wall St = 3.41

- Quant = 3.36

- Average = 3.30

- Trade Entry Price < $235

- If you are trading instead of HODLing or DCAing consider exiting trade if it falls below $221 region, about -6% below my trade entry price.

- If you want to take some profits look for the $352 region, about +50% above my trade entry price.

The stock had a massive week, up 26%. The indicators are running a wee bit hot now. Some consolidation before the earnings call on July 23rd is a possibility but we seem to have passed peak Elon FUD and Robotaxi release in the next year or so is quite possible as is the first deployment of humanoid robots. We should also get some significant Model 2 news at the event on August 8th this year.

That 50 day moving average is really starting to curl up nicely. A golden cross appears imminent.

Cover image: https://venice.ai/chat/